Texas has been a top destination for people wanting affordable living and below-average home prices. The state has recently experienced the largest population growth and a significant real estate boom.

Since 2021, median house prices in the Lone Star State have surged by 9%, thanks to the continuous influx of people moving to Texas, particularly in cities like Austin, Houston, Dallas-Fort Worth, and San Antonio. The population in these cities has increased by 48.8% in the last ten years 👀.

Even though the Texas real estate market is expected to become more buyer-friendly in 2023, there is still a significant demand for homes in the state. This means that sellers have an opportunity to make good profits.

However, many first-time homebuyers in Texas make the mistake of paying too much in realtor fees and cutting their profits. Understanding realtor fees and understanding common mistakes can help you grab the best deal.

Let’s explore how realtor fees work in Texas and how they work out. We will also discuss tips on negotiating a lower fee to maximize profits.

Key Takeaways

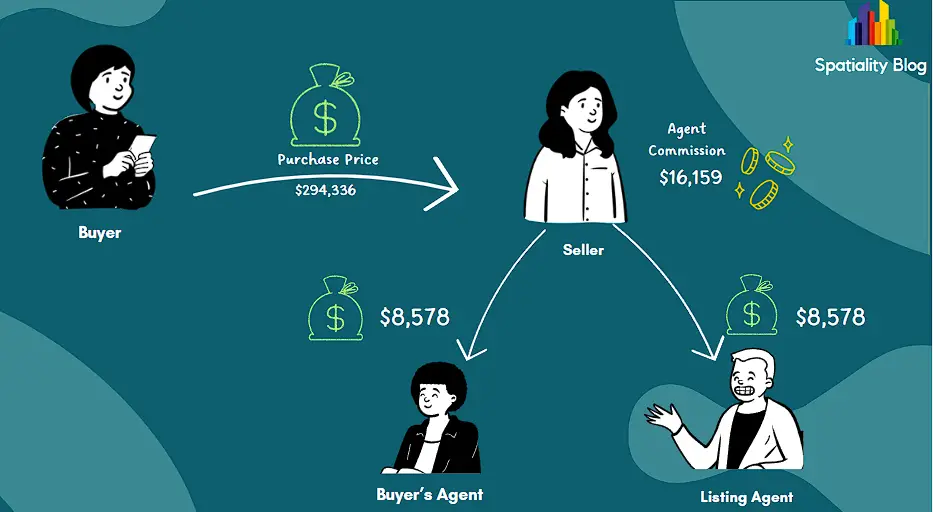

- Realtors can earn an average fee of $16,159 on a typical home with a sale price of $294,336.

- The realtor fee in Texas is higher than the national average, especially because of the state’s booming real estate market. However, the percentage has been declining over the years to balance out the rising home prices.

- Realtor fees are not tax-deductible in Texas

1. Understanding Realtor Fees in Texas

Realtor fees will be your biggest expense when selling your home. It alone accounts for 5-6% of the home price, costing sellers as much as $30,000 in Texas.

Suppose you are selling a home worth $500,000 in Texas, and if your agent charges you 6% in realtor fee, you will have to pay a commission of (drumrolls please🥁) $30,000. 🤯 Here’s how the math works out in that case.

Here’s how much does a realtor make on a $500,000 sale:

Commission = Home price X Commission %

= $500,000 X 6%

= $30,000

Note: As of 2022, over 89% of sellers hire a real estate agent for their services and expertise, so these costs are inevitable.

The Realtor Fee in Texas is not fixed. It depends on multiple factors, including what your property is worth, who you are working with, the current market conditions, micro-market trends, etc.

1.1 How does the Texas Real Estate Commission work?

Sellers hire listing agents to help them find a suitable buyer in Texas. Hiring an agent also ensures that the selling process is hassle-free and all the documentation is handled. In exchange for these services, agents charge sellers a commission on the final sale price, which we all know as a realtor commission or a realtor fee.

The commission is a percentage of the home price payable at closing. It covers both the listing agent’s and buyer agent’s commissions.

The seller and the listing agent (or seller’s agent) negotiate and decide on this commission before signing the listing agreement. So, technically, the buyer or his agent has no say in it.

Once the negotiation between the listing agent and the seller is concluded and the agreement is signed, the agent completes the paperwork and lists the house on the local MLS (Multiple Listing Service) for buyer agents to see.

If a buyer is interested in a property, the typical real estate process follows: showing, offering, counter-offer, and closing.

2. How Much Is the Realtor Fee in Texas?

Texas Real Estate Commission can vary depending on where you are and who you work with.

But if you’re looking to buy or sell a home in Texas, the average realtor fee is currently around 5.49% of the sale price. So, on a typical home with a sale price of $294,336, you’re looking at an average fee of around $16,159.

Remember that this fee is usually split between the buyer’s and seller’s agents. Some real estate agents might charge a flat fee instead of a commission based on the sale price. It really depends on the agent and their specific services.

The average realtor commission in Texas is 5.49%, higher than the national average of 5.37% and way above the commission of neighboring areas.

Additional Info:

Here is how we calculated the average realtor fee in Texas. Note that this is against the average home price in Texas, i.e., $294,336, and agent commission of 5.49%.

Average realtor fee in Texas = Average home price X Average commission percentage

= $294,336X 5.49%

= $16,159

Now, if the buyer and seller agents decide to share the commission equally,

Each agent gets = Total commission ➗ 2

= $17,516 ➗ 2

= $8,578

Note: The realtor fee in Texas is higher than the national average, especially because of the state’s booming real estate market. However, the percentage has been declining over the years to offset rising home prices.

2.1 How Much Is Realtor Fee in Texas Compared to Other States?

Here is the list of realtor commissions in Texas and its neighboring states.

On average, home sellers in Texas pay slightly more in commission fees. As Texas is located near states with slight realtor commissions, such as Florida and Virginia, their prices influence commission fees in Texas.

| 📖 Also read: Paperwork for selling land in Texas |

2.2 How Much Does Realtor Fee Vary in Texas?

The realtor fee is directly proportional to the home price and agent commission. So, it will vary if there are any fluctuations in these two factors.

Here’s a table showing the possible realtor fees for various home prices.

| Home price range | 5% Realtor fee | 5.49% Realtor fee | 6% Realtor fee |

| $225,000 to $275,000 | $11,250 – $13,750 | $12,352 – $15,097 | $13,500 – $16,500 |

| $300,000 to $350,000 | $15,000 – $17,500 | $16,470 – $19,215 | $18,000 – $21,000 |

| $375,000 to $425,000 | $18,750 – $21,250 | $20,587- $23,332 | $22,500 – $25,500 |

2.3 How Much Does the Realtor Fee Vary in the Different Counties of Texas?

Realtor fees even vary in the different counties of Texas. Here is the average realtor fee in the top 20 counties of Texas

| County | Median home price | Average realtor fee 5% | Average realtor fee 5.49% | Average realtor fee 6% |

| Collin | $563,121 | $28,156 | $30,915 | $33,787 |

| Fort Bend | $394,770 | $19,739 | $21,673 | $23,686 |

| Travis | $652,748 | $32,637 | $35,836 | $39,165 |

| Denton | $495,475 | $24,774 | $27,202 | $29,729 |

| Williamson | $550,064 | $27,503 | $30,199 | $33,004 |

| Montgomery | $371,636 | $18,582 | $20,403 | $22,298 |

| Rockwall | $467,163 | $23,358 | $25,647 | $28,030 |

| Lubbock | $206,981 | $10,349 | $11,363 | $12,419 |

| Brewster | $254,628 | $12,731 | $13,979 | $15,278 |

| Comal | $515,520 | $25,776 | $28,302 | $30,931 |

| Brazos | $283,607 | $14,180 | $15,570 | $17,016 |

| Galveston | $330,359 | $16,518 | $18,137 | $19,822 |

| Randall | $241,570 | $12,079 | $13,262 | $14,494 |

| Kendall | $622,848 | $31,142 | $34,194 | $37,371 |

| Brazoria | $313,856 | $15,693 | $17,231 | $18,831 |

| Tarrant | $351,650 | $17,583 | $19,306 | $21,099 |

| Harris | $285,136 | $14,257 | $15,654 | $17,108 |

| Dallas | $336,895 | $16,845 | $18,496 | $20,214 |

| Taylor | $192,595 | $9,630 | $10,573 | $11,556 |

| Bexar | $306,442 | $15,322 | $16,824 | $18,387 |

The above table shows that the state’s average realtor fee of 5.59% varies in the top 20 counties, from a low of $10,766 in Taylor County to a high of $36,489 in Travis County. Now, that is a considerable variance of more than $25,000.

| 📖 Also read: Is it safe to live in Texas? |

3. Who Pays Realtor Fees in Texas 🤔?

In Texas, the seller typically pays the realtor commission, which is typically a percentage of the home’s sale price. However, since the commission is included in the home’s asking price, some argue that the buyer ultimately pays it.

Realtors can be a valuable resource for determining the asking price of your home. They can conduct comparative market research by looking at recently sold properties and other comparable homes for sale in your area.

Comparing your home’s features to other properties can help you price your home accurately. This is crucial because if you overprice your home, it may not attract potential buyers, and if you underprice it, you could lose thousands of dollars.

4. What services are included in the realtor fee?

Why do you need a realtor when their commission typically costs you a ton? Well, that’s because the commission covers all the services you need to complete the sale, from listing your home to closing the deal. It also covers the buyer agent commission in Texas.

Unless otherwise stated, signing an agreement with the realtor means you agree to all their services.

It’s important to understand the range of services that full-service agents typically provide, as it can help you negotiate the commission and make informed decisions about the home-selling process. Here’s a list of some of the services that full-service agents commonly offer:

Realtors may also offer additional services beyond what’s listed here, such as virtual home tours or assistance with relocating to a new area.

When you’re choosing a realtor, it’s always a good idea to discuss your specific needs and expectations with them upfront so that you can ensure they’re providing the services you require.

4.1 Listing the House

Although putting a property up for sale on the internet seems simple, real estate agents do much more than just slapping a description over your property and putting it up for sale.

4.1.1 Figuring Out the Fair Market Value of Your Home

The price you set for your house actually sets the tone for sale. Pricing your home too low might raise questions about your home’s condition; however, you might risk losing clients if you price your home too high.

That’s why it’s beneficial to seek the help of expert real estate professionals to find the perfect balance in pricing. Your agent can help you determine the right asking price for your property based on comparative market research and the condition of your home.

This part is crucial as it decides how long your property will sit on the market and the returns you will receive at the end of the deal.

5.1.2 Taking Professional Photographs and Making the House Presentable

With professional photographs and drone shots, agents ensure that your property looks appealing to a wide audience. They know exactly what features to highlight in these photographs to attract prospective buyers and make your home stand out.

A good real estate agent will also suggest cosmetic repairs to help you sell your home quickly. This may include recommendations for window washing, carpet cleaning, minor repairs, or even painting the home. They can also hire a professional stager to make your home look its best for the photos and showings.

In addition, your agent will help you write an appealing description for your property. While photos and videos may be the first things buyers see, the description is crucial in making a strong impression and generating interest.

4.1.3 Listing on MLS

is also covered by your realtor’s fee.

MLS, or Multiple Listing Service, is a database that Realtors use to search or list a property. Only real estate agents, brokers, and realtors can access this database.

Listing your property on MLS is crucial as even websites like Zillow and Realtor.com access MLS, pull relevant data, and showcase it on their platforms.

Note: If you choose to sell your home For Sale By Owner (FSBO), you can still hire an agent specifically to list your property on the MLS. These agents are known as fee-for-service agents and charge a flat fee based on the services you require.

4.2 Marketing the House

Once your house is listed, agents also ensure that your property gets maximum exposure. Agents know precisely where they can reach out to prospective buyers. For example, they could put up a ‘For Sale’ sign in your yard, distribute fliers in the locality, advertise in the local newspapers or magazines, and put your listing on social media and other relevant listing websites.

Not only do they advertise your property, but they also ensure timely follow-ups with prospective clients and schedule showings for you.

When a potential buyer shows interest in your property, the agent will communicate with them to negotiate the price and other terms of the sale. This can be crucial in getting the best deal possible for your property.

| 📖 Also read: Living in Texas vs California |

4.3 Organizing Open Houses and Walk-Throughs

Agents will also help you with showings and organize open houses and walk-throughs.

Open houses are home-showing events where multiple buyers can come to see the house in scheduled time slots.

The agent will also ensure they show the best aspects of the house and deliver all the relevant information to the client, such as any accidents, remodeling, or repairs.

4.4 Helping With the Paperwork

Your agent will also assist you in getting all your documents in place as per state and local guidelines.

Having everything with you before you negotiate with a buyer will ensure that there are no unpleasant surprises during the processing of the sale.

Note: Hiring a local agent always gives you an edge. Such agents keep themselves updated about law changes or specific requirements in your neighborhood, making the selling process smooth sailing for you.

4.5 Screening Prospective Buyers

Screening potential buyers is a crucial step in the home-selling process, and it’s included in the realtor fee. Agents carefully vet prospective buyers based on various criteria, such as their financial history, background, income, and pre-approval status.

By screening buyers, agents help ensure that you don’t waste time and money on deals that are unlikely to go through. They will alert you if they find any red flags in a buyer’s background so you can make informed decisions and protect yourself as a seller.

4.6 Negotiating With the Buyer (Sending Counteroffer)

Your agent will also handle the negotiation process and send out counteroffers to clients against their offers. They will do this on your behalf while keeping your best interests in mind and ensuring that they negotiate the best deal possible with the buyer’s agent.

For example, if you are not okay with making significant repairs to the home or redoing the painting, your agent will effectively communicate this to prospective buyers. Your agent will handle all essential clarifications and negotiations, and you will only be involved in the final negotiations or approval.

5. Is the Realtor Commission Negotiable in Texas?

Realtor fees or commissions are always negotiable. Although brokers will tell you that the fee is non-negotiable, you can do your research and find out how to reduce the fees. There are many options you can look at.

Since there is no standard rule for a fixed amount or rate of commission, it all depends on the parties involved and different factors. So, if you think your deal qualifies for a lower commission, you can bring the agent to the negotiating table. Here are some tips to handle the negotiation and things to know before you get down to brass tacks

5.1 How and When to Negotiate Realtor Commission

Knowing how and when to negotiate is the key to saving money on realtor commissions.

While there is no guarantee that your agent will be open to negotiations, there are a few scenarios where you can bring down the commission. You must research and determine whether these situations are valid for your home and area to leverage them.

5.1.1 You have a premium property

If you are dealing with an upscale property, your agent might negotiate the commission with you. The commission is also much above average in high-ticket real estate. In such cases, negotiating a lower commission will be easier, as the agent would spend roughly the same time and effort on a lower-priced home.

5.1.2 You are selling your home off-season

Selling during the off-season period will get you a better deal because business is slow for agents, and they are more willing to negotiate on the commission at this stage as they need the company.

5.1.3 You are reducing the agent’s work

If you only require a set of services from the agent, then there is a good chance that your agent might work on a discounted commission.

That’s because, in this case, you are reducing the agent’s time and effort on a deal.

For example, suppose you already have a buyer in mind and need an agent only to assist with the paperwork and legal proceedings.

Having a buyer in place will save considerable time and effort on the agent’s end. Plus, he will get to close deals faster. As a result, he may agree to negotiate the agent commission.

5.2 How To Negotiate Commission With A Real Estate Agent (Home Seller’s Masterclass)

5.2.1 Your property has the potential to sell quickly

If you are sure that your property is easy to sell because of its location and condition, you can point this out to the agent and get them to lower the commission.

As your property will be off the market quickly, helping the agent make money fast, there is a good chance that you might get a good deal from your agent.

Note: Rely on appraisal reports and market data to determine whether your house is easy to sell or not.

5.2.2 You’re offering more business

If you plan to buy another house soon, you can offer your agent the contract for both. As it would translate to more money for the agents, they would be willing to cut the commission to get your business.

Another way you can negotiate a commission is by promising to refer the agent to your friends and family.

5.2.3 Your agent is new

A new realtor looking out for clients would be more than ready to negotiate the commission.

New agents constantly look for clients to build their reputation, so they might agree to work at a pay cut.

| 📖 Also read: Buying Land in Texas – A Guide |

5.3 Do’s and Don’ts of Negotiating Agent Commission.

5.3.1 Don’t be unreasonable

Keep your demands reasonable. To find out how much you can negotiate, look at the average commission rate in your area and then offer a commission slightly below this percentage.

Also, explain to the agent why you expect a lower commission. Be ready with your reasons. Only if you are convincing enough will you get your discount.

5.3.2 Do your research

Know everything possible to know about your market. Agents are expert negotiators; if you falter or don’t know the facts, they will immediately get the better of you.

To succeed in your attempt to negotiate, you need to be well-educated on the current situation in the market.

So talk to people, go online, browse properties in your area, and see which homes have been sold and at what price; getting an overview of your situation will always help you go a long way.

5.3.3 Reduce the agent’s expenses

Let the agent know you are not looking at expensive drone photography or being driven around in an expensive car. If you reduce the agent’s expenses on the deal, they will be willing to charge you a lower commission.

5.3.4 Talk to multiple agents

Don’t restrict yourself to talking to a single agent. Instead, be in talks with multiple agents and understand how to get the best deal possible.

In addition, if you let agents know that you are talking to other agents, there is a good chance they will offer you a lower commission to get your business and gain a competitive edge.

You can watch this video to understand such situations better.

5.4 How to Reduce the Real Estate Commission Without Negotiating

Sometimes, you do not have the time to negotiate or are simply not inclined to haggle.

If you feel negotiating for the commission is not an option, there are still ways to pay a lower commission or realtor fee. Here are some options you can look at in this case.

5.4.1 Agent-Matching Services

There are many agent-matching services out there that have already negotiated a discounted realtor fee with a whole network of agents.

UpNest and Clever Real Estate are two examples. You could use these services to find your agent. Registering for their services is free; they work with experienced real estate professionals.

Services like Clever and UpNest match you with top-rated local real estate agents who have already agreed to offer their customers full service for a fraction of their typical cost.

There is also no obligation to sign with their agent if you dislike their terms. They will give you a list of agents you can talk to and another list if you are unhappy with the first one.

5.4.2 For Sale by Owner (FSBO)

If you feel that you can do all the paperwork and running around that an agent does, you might want to consider the FSBO (For Sale by Owner) route. In this case, you can push the deal through without an agent and save almost 3% of the commission.

If you can find a buyer who is not availing of the services of an agent, you will save the remaining 3%.

That would be a considerable saving. However, be aware that this would entail handling the entire sale yourself. Only do it if you know all the legalities involved and have plenty of time on your hands. Otherwise, you could end up getting into legal trouble.

| Also Read: Cost and Stress of Selling a House |

5.4.2.1 Flat-fee MLS Company

If you are selling your home via FSBO, agents might warn you that you cannot take advantage of the local MLS listing service used by real estate agents. This is the primary platform all agents use to list and find properties for their clients. But this is not the case today.

Instead, you can sign up with a flat-fee MLS company that will list your home on this platform for a nominal fee.

Once listed on the MLS, websites like Realtor.com and Zillow will automatically pull the listing onto their platforms, ensuring that your ad reaches a broad audience.

5.4.3 Fee-for-Service Companies

Fee-for-service realtor companies provide only the required services and charge you a la carte.

So, for example, if you only need the agent to make the contract and already have a buyer in place, they will charge you a nominal fee to do this. Or, if you only need the agent to visit a few homes, they could charge you only for that service.

5.4.4 Discount Brokers

Discount brokers are another option you can look at to avail yourself of a lower commission percentage when you are selling your home. These discount brokers have a team of in-house agents who work with multiple clients simultaneously and offer the same services as a full-service real estate agent.

Make sure you can make do with the list of services before you sign on. Discount brokers tend to cover up the lower commission fees they charge you through the volume of business they do.

Unfortunately, due to their many clients, their agents are often spread too thin, and the quality of service suffers.

6.4.5 Sell to an Investor

Often, the seller could be in a hurry to conclude the deal due to adverse circumstances such as urgent relocation required for a job, a sale due to divorce, or you don’t have the time to go through the normal process.

Also, the seller may be unable to do up the home and make it presentable before selling. In such a case, some companies or investors are willing to take the property off your hands at a reduced price.

The only saving grace is that you will conclude the deal quickly and be paid promptly. The downside is that you may get a significantly lower price – maybe even 40-50% lower.

5.4.6 Sell to an iBuyer

iBuyers leverage technology to make an offer on homes. These companies have strict criteria for the kind of homes they are willing to buy.

However, if your home qualifies, you will get fair value for your home. In addition, you could close the deal in 7 days or take up to 90 days to conclude if required. So, if your home qualifies, you will get an offer quickly, sometimes within a day.

| Also Read: Buyer Rebate in Texas |

6. What Is Dual Agency?

When a single agent represents the buyer and seller, this is termed a dual agency. This is usually done to save on commission, as the agent will be getting a double commission and will be more willing to reduce the fees.

Dual agency is not generally advised as it is almost impossible for one agent to act simultaneously in both parties’ interests. There is a conflict of interest, which is why the dual agency is banned in some states.

Even where it is allowed, there are strict rules governing dual agency. The agent needs to get written approval from the buyer and seller and inform all the parties involved in the transaction about the dual agency.

6.1 Is dual agency legal in Texas?

Dual agency is illegal in Texas. Under the revisions to TRELA (Texas Real Estate Act), a single agent cannot represent the buyer and seller simultaneously. If such a situation arises by accident—for example, if the buyer contacts the agent directly—the agent can only act as an intermediary and immediately inform the parties that they will be representing only one party.

In addition to Texas, dual agency is illegal in Alaska, Colorado, Florida, Kansas, Maryland, Vermont, and Wyoming.

7. Are Realtor Fees Tax-Deductible in Texas?

No realtor fees are not tax-deductible in Texas. However, you can minus any costs associated with selling your home. This is because the IRS only considers the sale basis of your home while calculating your profit.

The sale basis is the price of the home minus all related costs such as real estate commissions, legal fees, escrow fees, home staging fees, and advertising costs. Although you cannot deduct these costs the same way as mortgage interest, you can directly subtract them from your home’s sale price, reducing your capital gains tax.

Capital gain is the profit on the sale of the house. For example, if you purchased the property for $400,000 and sold it for $500,000, your capital gain would be $100,000.

Capital gain = Sale price – Purchase price

= $500,000 – $400,000

= $100,000

Paying a realtor fee will bring down the sale basis of your house. The sale basis is the home price minus all related expenses mentioned above.

If you sell a house for $500,000 and do not pay any commission, your sale basis, or the sale price, according to the IRS, will be $500,000.

However, if you pay a realtor fee of $50,000, your sale basis comes down by that much.

Sale basis = Home price – Realtor commission = $500,000 – $50,000

= $450,000

So your capital gain would be = Sale basis – Purchase price

= $450,000 – $400,000

= $50,000

So, in the second case, you would end up paying a lower tax since the capital gain is only $50,000, as compared to a capital gain of $100,000 when there is no realtor commission.

8. FAQs

8.1 Do Realtors Earn Thousands of Dollars in a Single Deal?

The answer is both yes and no. Realtors do earn thousands of dollars in commission; however, they have to split this amount further.

Real estate agents cannot work independently. US laws say they cannot accept commissions directly from sellers (or buyers).

So, your agents work under a broker—an individual or company with a higher license. Brokers advise and guide agents and often provide them with the infrastructure from which they can operate.

For this, they charge a percentage of the commission – this sharing ratio is called a commission split. The broker accepts the commission from the seller on the agent’s behalf, keeps the agreed-upon share, and transfers the rest to the agent.

For example, if the two brokers and their agents in the transaction agree to a commission split of 50/50 when the agent receives $50,000 from a deal,

Each agent/broker will get = Total commission ➗ 4

= $50,000 ➗ 4

= $12,500

The agent’s share of the commission split usually increases as the agent gains more experience. For example, you may also see splits such as 60/40, 70/30, or even 80/20 in an experienced agent’s favor.

Here is a video that will help you better understand this dynamic.

Also, let’s look at how much the split works out in these cases.

| Total commission | Split | Buyer/Seller agent’s share | Buyer/Seller broker’s share |

| $50,000 | 50:50 | $25,000 ($12,500 each) | $25,000 ($12,500 each) |

| $50,000 | 60:40 | $30,000 ($15,000 each) | $20,000 ($10,000 each) |

| $50,000 | 70:30 | $35,000 ($17,500 each) | $15,000 ($7,500 each) |

| $50,000 | 80:20 | $40,000 ($20,000 each) | $10,000 ($5,000 each) |

8.2 What Does “Op” or “No Fee” Mean?

When advertising a rental property, if you see the words “OP” or “No Fee”, this means the owner pays (OP) the commission. “No Fee” means that the owner or landlord will pay the commission. This is usually seen in markets such as New York or Boston, where the tenant pays the commission.

8.3 What Happens to the Commission if the Buyer Does Not Have an Agent?

If the buyer does not have an agent, the entire commission will go to the listing agent. This is because the commission has been decided between the seller and the listing agent at the outset. If required, the listing agent will share the commission with a buyer’s agent. However, that is at the listing agent’s discretion.

If the buyer has no agent, they may request the seller to reduce the home price. The seller can discuss this with the listing agent, and if both are agreeable, they can reduce the price of the home to

accommodate the buyer.

8.4 Who Pays the Commission for a Rental Property?

There is no hard-set rule in rental markets. The split, the percentage rate, and whether the renter or the owner pays the commission are all flexible. Let’s look at some of the scenarios that might arise in case of rental commission

8.4.1 The owner pays the commission

Usually, in the case of a rental property, the owner pays the agents’ commissions. The seller sets the rent, and since he pays the entire commission, ensure this is adjusted in the rent.

So, technically, both the buyer and seller would indirectly pay the commission. In the same way, during a home sale, the agent splits the commission with the tenant’s agent.

The owner’s agent will market, screen, and lease the property. Most agents specialize in their niche area—for example, some realtors work with leases, while others handle only high-end leases.

The tenant pays the commission in some locations, like New York and Boston. It all depends on who is in a stronger position—the landlord or the tenant. If there are few houses for rent and many renters, the landlord is in a better position, so the tenant has to pay the commission.

However, if there are many houses for rent and few renters, the tenant is in a stronger position, and the landlord pays the rent.

8.4.2 Tenant pays a flat fee

Sometimes, the tenant may hire an agent and pay the agent a flat fee for finding a place to live in Texas. This fee is often a cut from the first month’s rent. In this case, the tenant pays the agent directly rather than the landlord.

8.4.3 Property Management Companies

The landlord sometimes hires a property management company. The property management company will handle the repairs, maintenance, and letting out. In addition, they will search for a tenant on behalf of the landlord.

They usually charge the landlord 10% of the annual rent for all these services. In this case, the tenant does not pay a commission.

8.5 How Much Is the Rental Commission in Texas?

The average rent in Texas is $1,043 and is relatively more affordable than in other states. The realtor commission differs from deal to deal and location to location. Let’s look at some of the ways commission is paid in Texas.

8.5.1 First month’s rent as realtor fee

In many instances, the real estate agent will get a cut of rental payment for finding a tenant from the landlord, which is out of the first month’s rent and security deposit. This is usually one month’s rent and is paid before the tenant moves in.

8.5.2 Percentage of the annual rent

Sometimes, tenants sign an agreement for a longer period, and in such cases, the commission could be a percentage of the annual rent.

For example, suppose the rent is $1000 per month, then the annual rent would be $12,000. If the commission percentage is 10%, then the homeowner would give $1,200 as a commission.

Commission = Annual rent X 10%

= $12,000 X 10%

= $1,200

8.5.3 Extended Lease Agreements

Sometimes, tenants sign an agreement for an extended period; in such cases, the commission could be a percentage of the annual rent. For example, suppose the rent is $1000 per month, and the yearly rent is $12,000. If the commission percentage is 10%, then the homeowner would give $1,200 as a commission.

8.6 who pays the broker fee when buying a house in Texas?

The seller pays the broker fee. Although this amount is baked into the final purchase price, you do not have to pay something explicitly when buying a house in Texas.

8.7 how much do real estate agents charge to do paperwork only

Real estate agents in Texas typically don’t charge a separate fee just for paperwork completion. Their commission, which averages around 5.73% of the final sale price, encompasses the entire transaction process, including:

- Filling out and handling real estate paperwork

- Marketing and listing the property (for sellers)

- Showing the property to potential buyers

- Negotiating the sale price

- Coordinating inspections and appraisals

- Facilitating communication between buyer and seller

- Ensuring a smooth closing process

However, there might be a few scenarios where you could pay a separate fee for paperwork help:

- Limited service representation: Some agents offer limited service, handling specific tasks like paperwork completion for a flat fee. Depending on the complexity, this could cost you $500-$2000. They can even charge you hourly ($75 -$150 per hour).

Here’s what you might consider if you’re looking for help with just the paperwork (this can cost you somewhere between $750 and $2,000)

- Real estate attorney: An attorney can review and complete real estate paperwork for a fee. This can be a good option if the transaction is complex or you have concerns.

- Online legal services: Online legal services offer document preparation for real estate transactions. This can be a more affordable option than hiring an attorney, but it’s important to ensure the service is reputable and meets your specific needs.