Are you at a place where selling your land feels like the right move, and you’re inspired by the idea of doing this independently, without a realtor’s assistance?

The trend of independent land sales in Texas has been growing steadily in recent years. Many landowners have recognized the benefits of cutting out intermediaries, such as real estate agents, and opting for a more hands-on approach.

But to be honest, taking the plunge to sell your land in Texas independently can seem difficult, considering the complexity of paperwork and legal formalities.

From legal agreements to disclosure forms, each document serves a specific purpose and plays a crucial role in the home buying process and in safeguarding your interests as a landowner. However, with the right guidance and resources, this journey can be navigated efficiently and confidently.

Here are all the documents you need to sell your home without a realtor.

An overview of documents needed to sell land by Owner in Texas

Here is a list of basic documents required to get you started with the land sale process:

1.1 Deed

The deed officially transfers ownership of the land from the seller to the buyer.

It contains a detailed and accurate legal description of the property, which is essential for defining the boundaries and identifying the parcel of land being conveyed. To ensure its validity, the deed must be properly executed and notarized according to state laws.

1.2 Purchase Agreement

The purchase agreement is a comprehensive contract that outlines all the terms and conditions of the land sale.

It includes crucial information such as the agreed-upon purchase price, any financing arrangements or contingencies, and the scheduled closing date.

This legally binding document provides both the buyer and seller with clear guidelines and expectations throughout the transaction, ensuring a smooth and transparent process.

1.3 Property Disclosure Form

This form serves to disclose any known material defects or issues with the property.

By doing so, sellers ensure transparency, allowing potential buyers to make informed decisions.

The Property Disclosure Form helps protect the buyer from unforeseen problems that may arise after the sale, creating a fair and honest transaction.

1.4 Title Report

This report confirms the legal ownership of the land and reveals any potential liens, encumbrances, or restrictions that could affect the sale.

By obtaining a title report, the buyer gains peace of mind, knowing that they are acquiring clear and marketable title to the property. Additionally, the title report serves as a protective measure against future claims or disputes that may arise related to the property’s ownership.

1.5 Survey

Before finalizing the land sale, it’s essential to conduct a land survey. A professional surveyor will determine the exact boundaries, dimensions, and any potential easements or encroachments affecting the property. This detailed information enables the buyer to fully understand the physical characteristics of the land they are purchasing, helping them make informed decisions about the property’s use and potential development.

1.6 HOA Documents

If the land is part of a homeowners association (HOA), providing the buyer with relevant HOA documents is necessary. These documents include the HOA’s bylaws, rules, and regulations, outlining the obligations and restrictions associated with the property.

The buyer needs to be aware of any HOA-related responsibilities and potential limitations on property usage, ensuring a smooth transition into the community and fostering a positive relationship with the homeowners association.

2. Land Title

When selling land in Texas, one crucial document takes center stage—the land title. It serves as irrefutable evidence of ownership and holds the power to transfer property from one owner to another.

A land title, also known as a property title or deed, is a legal document that establishes and confirms ownership rights and interests in a specific piece of land. It serves as tangible evidence of your ownership and a crucial link between you and your property. The land title contains essential information such as the legal description, boundaries, and any restrictions or encumbrances associated with the land.

The importance of a land title cannot be overstated, as it serves multiple crucial purposes:

- Proof of Ownership: The land title provides irrefutable proof that you are the rightful owner of the property. It establishes your legal rights to possess, use, and transfer the land, giving you the authority to sell or convey it to another party.

- Legal Protection: A valid and clear land title offers legal protection to both the buyer and the seller. It ensures that the property sale is legitimate, protects against fraudulent activities, and mitigates the risk of potential disputes or competing claims.

- Marketable Title: Having a marketable title makes your property more attractive to potential buyers. A marketable title implies that there are no significant defects, liens, or encumbrances that could impede the transfer of ownership. It enhances the value and marketability of your land.

- Financing and Investment: Lenders typically require a clear and marketable land title as a prerequisite for providing financing. A solid title assures the lender that their investment is secure and reduces the risk associated with the transaction

To obtain a land title in Texas, you’ll need to follow a systematic process that involves several steps:

1. Preliminary Title Search

Before finalizing the land sale, it is essential to conduct a preliminary title search. You can either undertake this task yourself or hire a reputable title company to perform a comprehensive investigation.

The purpose of this search is to uncover any potential issues or defects associated with the property’s title. This includes identifying any existing liens, easements, or unresolved legal disputes that might affect the property’s ownership and use.

By conducting a thorough preliminary title search, you can address any problems before they become obstacles during the sale process.

2. Title Examination

To ensure a smooth and secure land sale, hire a qualified title examiner or an experienced real estate attorney.

These professionals will meticulously examine the property’s records, including deeds, surveys, and public documents, to verify the accuracy of the legal description and confirm ownership.

The title examination process aims to identify any existing or potential title defects that may not have been detected during the preliminary title search.

By undergoing a rigorous title examination, you can gain a comprehensive understanding of the property’s title status and resolve any issues proactively.

3. Title Insurance

Title insurance is a vital safeguard for you, as the seller, and the buyer. It offers protection against any unforeseen title-related issues that may arise after the sale is complete.

You can protect yourself and the buyer from potential financial losses resulting from defects in the title.

Title insurance policies provide coverage for losses arising from defects in the title that may emerge after the sale.

4. Title Transfer

Once the title examination has been completed, and any potential title issues have been addressed, you can proceed with the title transfer process. This involves preparing a new deed that clearly outlines the transfer of ownership from you, as the seller, to the buyer.

The deed must contain an accurate legal description of the property and be properly executed, notarized, and filed with the county clerk’s office where the property is located.

Completing the title transfer in accordance with legal requirements finalizes the land sale and officially transfers ownership to the buyer, completing a successful and secure transaction.

It is worth noting that the process of obtaining a land title can be complex, and it is advisable to seek professional assistance from title companies, real estate attorneys, or experienced real estate agents. They can guide you through the intricacies of the process, ensure compliance with legal requirements, and help you address any title-related challenges that may arise.

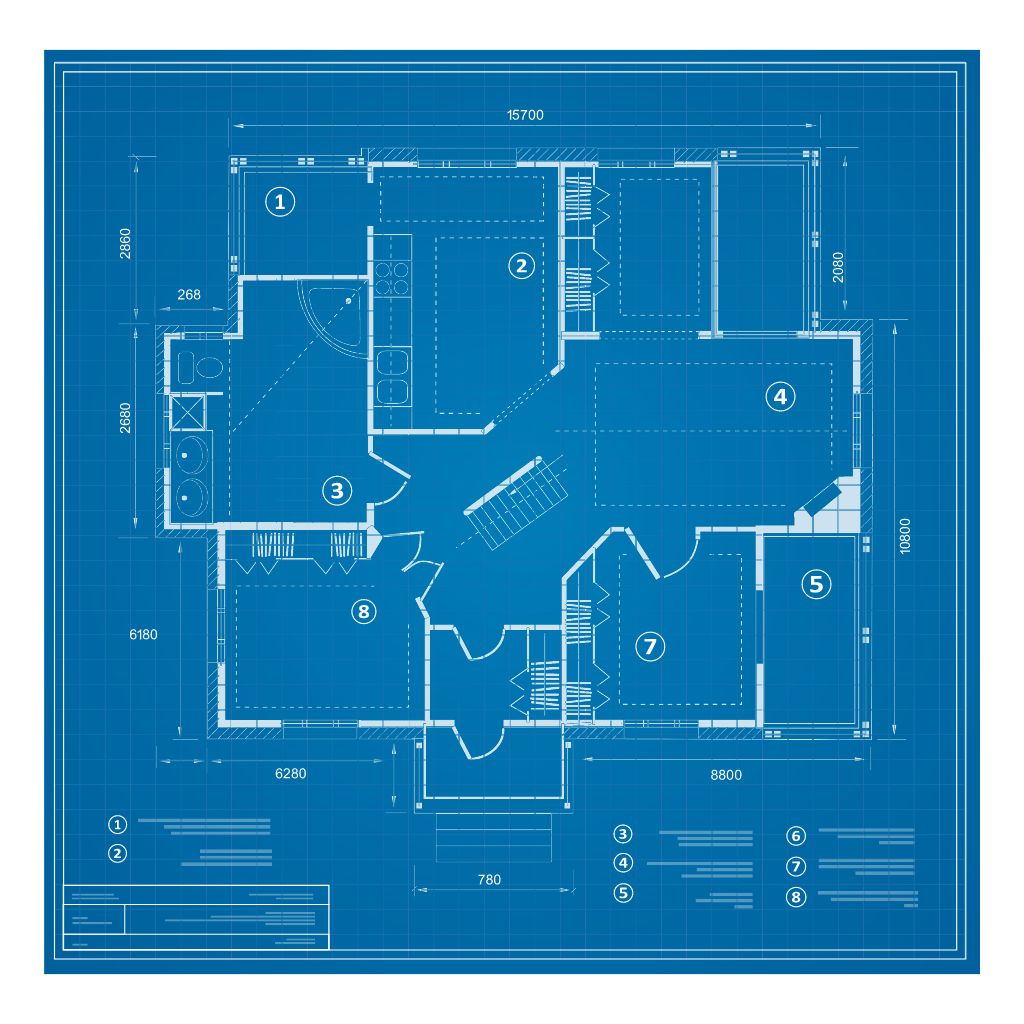

3. Property map

Imagine having a visual blueprint of your land, outlining its boundaries and showcasing essential features such as trees, fences, and buildings.

That’s precisely what a property map provides—a detailed depiction of your property’s layout and surrounding elements.

This document plays a crucial role in understanding the physical characteristics of your land, making it an invaluable tool for both buyers and sellers.

The importance of a property map cannot be overstated, as it serves several significant purposes:

- Boundary Identification: It helps you understand the exact extent of your property, ensuring you have a comprehensive view of what you own. This knowledge is essential during negotiations and can prevent potential boundary disputes or encroachments.

- Visual Representation: It helps prospective buyers or real estate agents visualize the land’s potential, assess its suitability for specific purposes, and plan accordingly. Moreover, it allows sellers to showcase the unique aspects of their land, making it more appealing to potential buyers.

- Property Development and Planning: For buyers, a property map aids in evaluating the land’s suitability for development projects or other endeavors. It helps assess factors such as proximity to utilities, access roads, or neighboring properties. Likewise, sellers can use the map to highlight any advantageous features that make their land stand out in the market.

To obtain a property map, you can follow these steps:

- County Assessor’s Office: Visit your local county assessor’s office or access their website to obtain property maps. County offices maintain detailed records of land parcels within their jurisdiction and often provide maps or access to online mapping systems.

- Online Mapping Resources: Utilize online mapping platforms like TexasFile or Regrid, which offer comprehensive property mapping services. These platforms allow you to search for your property by parcel number or address and provide detailed maps with accurate boundary information.

- Survey or Topographical Map: These specialized maps provide precise details about elevation changes, contours, and other physical features of the land, making them valuable for specific purposes such as construction or land development.

A property map is an indispensable tool for landowners and prospective buyers alike. With its ability to clearly outline boundaries and showcase important features, it facilitates accurate property assessments and informed decision-making.

4. Property Contract Information

When it comes to buying or selling land, it’s essential to have a comprehensive understanding of property contracts. These legal agreements govern the rights and obligations of parties involved in real estate transactions.

In this section, we’ll explore three common types of property contracts—leases, easements, and licenses—and shed light on their purposes, significance, and key elements.

4.1 Easements

An easement is a legal right granted to an individual or entity to use a portion of another person’s land for a specific purpose. Easements are often created to provide access to a landlocked property, allow utility companies to install infrastructure, or facilitate shared usage of common areas. Key elements of an easement include:

- Scope of Use: The easement document defines the specific purpose and extent of the granted use. For example, it may allow a neighboring property owner to access their land through a designated pathway.

- Duration: Easements can be temporary or permanent, depending on the terms specified in the agreement. Permanent easements may be established for utility lines or conservation purposes.

- Maintenance Responsibilities: The easement agreement typically outlines the responsibilities of the grantee and grantor concerning maintenance, repairs, and any associated costs.

4.2 Licenses

A license is a more informal and revocable permission granted by a landowner to an individual or entity to engage in a specific activity on their property. Unlike leases and easements, licenses do not create a property interest but simply confer a personal right to access or use the land. Key considerations for licenses include:

- Limited Permission: A license allows the licensee to engage in a particular activity or use the land for a specific purpose. For example, granting someone permission to fish in a private pond.

- Revocability: Licenses can be revoked by the landowner at any time, typically without the need for legal proceedings.

- Informal Nature: License agreements can be oral or written, but they are generally less formal than leases or easements.

5. Texas real estate commission Contracts for selling Land

The Texas Real Estate Commission (TREC) provides standardized contract forms specifically designed for various types of land sales.

We will explore two important TREC contract forms for selling land— the Unimproved Property Contract and the Farm and Ranch Contract—and highlight their significance in facilitating a smooth land sale process.

5.1 Unimproved Property Contract

The Unimproved Property Contract is a TREC form specifically tailored for the sale of vacant or undeveloped land. It is suitable for transactions involving land that does not have any structures or improvements on it.

This contract form covers important aspects such as the purchase price, closing date, title matters, and special provisions relevant to unimproved properties. It provides a comprehensive framework to protect the interests of both the buyer and the seller.

5.2 Farm and Ranch Contract

For those selling agricultural or rural land, the Farm and Ranch Contract is the ideal TREC form. This contract is specifically designed to address the unique considerations involved in the sale of farm and ranch properties.

It covers various aspects related to these types of properties, including mineral rights, water rights, livestock, crops, and agricultural exemptions. The Farm and Ranch Contract ensures that all critical elements pertaining to agricultural land sales are addressed in a clear and comprehensive manner.

Using TREC contracts for selling land offers several advantages for both real estate agents and sellers:

- Standardization: TREC contracts provide a standardized and recognized framework that is widely accepted within the Texas real estate community. Using these contracts ensures consistency and familiarity, reducing the potential for confusion or disputes during the transaction.

- Legal Compliance: TREC contracts are created and regularly updated by legal experts, ensuring that they comply with relevant Texas real estate laws and regulations. This provides confidence to both parties that the contract is legally sound and offers the necessary protections.

- Clarity and Protection: TREC contracts include specific provisions that address critical details relevant to land sales, protecting the interests of both buyers and sellers. These provisions cover essential aspects such as purchase price, financing, property conditions, title matters, and contingencies, providing clarity and minimizing potential risks.

- Accessing TREC Contracts: To access TREC contracts, you can visit the official Texas Real Estate Commission website. There, you will find a wide range of standardized contract forms, including the Unimproved Property Contract and the Farm and Ranch Contract. These forms can be downloaded, filled out, and utilized for your land sale transaction, ensuring compliance with TREC guidelines and Texas real estate laws.

6. Disclosure Document

When selling land in Texas, it’s essential to prioritize transparency and provide potential buyers with all the necessary information to make informed decisions.

One crucial document that promotes transparency is the disclosure document. Let’s understand the significance of the disclosure document, why it’s required, and what key information it should include to ensure a transparent and successful land sale.

What is a Disclosure Document?

A disclosure document is a legal document that sellers provide to potential buyers, outlining important information about the property being sold. Its purpose is to disclose any known defects, issues, or pertinent facts that may affect the buyer’s decision or their use and enjoyment of the land.

In land sales, transparency is key to fostering trust between sellers and buyers. A crucial document that ensures transparency and provides peace of mind for both parties involved is the disclosure document.

Let’s understand the significance of the disclosure document, its purpose, and highlight the different aspects it covers to facilitate a transparent and successful land sale transaction.

Why is a Disclosure Document Required?

The requirement of a disclosure document is based on the principle of full disclosure in real estate transactions. The main reasons it is required are:

- Legal Obligation: Texas law mandates that sellers disclose any known material defects or conditions that may adversely impact the value or desirability of the property. Failure to disclose material information could lead to legal consequences and financial liabilities for the seller.

- Informed Decision-Making: Buyers have the right to be fully informed about the property they are considering purchasing. The disclosure document enables them to assess the condition, potential risks, and any other relevant factors associated with the land, empowering them to make educated decisions.

6.1 What Information Should a Disclosure Document Include?

While the specific requirements may vary, a disclosure document should typically include the following information:

- Property Condition

- Legal Matters

- Previous Repairs or Renovations

- HOA and Community Rules

6.3 The Significance of a Disclosure Document

The disclosure document serves as a vital tool in land sales, offering several important benefits:

- Promoting Transparency: The disclosure document allows sellers to provide potential buyers with comprehensive information about the property, enabling them to make informed decisions. It establishes an atmosphere of transparency by disclosing any known material facts, defects, or issues related to the land.

- Mitigating Legal Risks: By providing a disclosure document, sellers can minimize potential legal risks. Disclosing relevant information upfront protects sellers from future disputes and potential lawsuits, as it demonstrates their commitment to honesty and transparency.

- Building Trust: Buyers appreciate sellers who proactively disclose relevant information. The disclosure document builds trust between sellers and buyers, fostering a positive relationship throughout the land sale process.

6.4 Key Aspects Covered in a Disclosure Document:

When preparing a disclosure document, it is important to cover various aspects to ensure a comprehensive overview of the property. Some key aspects to consider include:

- Property Condition: Disclose any known material defects or issues related to the property’s condition. This may include structural concerns, plumbing or electrical problems, pests, or any other issues that may impact the property’s value or functionality.

- Environmental Factors: Provide information about any environmental factors that may affect the property, such as flood zones, soil contamination, or proximity to environmentally sensitive areas.

- Legal Matters: Disclose any legal matters associated with the property, such as easements, encroachments, zoning restrictions, or pending litigation. Ensure that buyers are aware of any potential legal implications or restrictions that may impact their intended use of the land.

- Title Information: Include relevant information about the property’s title, such as liens, encumbrances, or restrictions that may affect the buyer’s ownership rights.

- Property History: Consider including details about the property’s history, such as previous renovations, repairs, or insurance claims. This information provides buyers with insights into the property’s past and helps them make informed decisions.

- HOA and Community Rules: Inform buyers about any homeowners’ association (HOA) rules, community restrictions, or other obligations they need to be aware of.

In the land sales process, a disclosure document plays a crucial role in promoting transparency, mitigating legal risks, and building trust between sellers and buyers.

By encompassing key aspects such as property condition, environmental factors, legal matters, title information, and property history, the disclosure document provides potential buyers with essential information to make informed decisions.

As a seller or real estate agent, taking the time to prepare a thorough and accurate disclosure document demonstrates your commitment to transparency and contributes to a successful and harmonious land sale.

7. Purchase Agreement or Purchase Contract

A purchase agreement includes:

- Buyer and seller information

- Property details

- Pricing and financing details

- Closing and date of possession

- Earnest money, deposit amount due

- Closing costs and the party responsible for paying

- Contract contingencies

- Conditions under which the contract can be terminated

A purchase contract, also known as a purchase agreement or sales contract, is a legally binding agreement between a buyer and a seller. It outlines the terms and conditions of the land sale, ensuring that both parties are on the same page regarding the purchase price, contingencies, closing date, and other important details. The purchase contract serves as a roadmap for the transaction, providing clarity and protecting the interests of both the buyer and the seller.

7.1 The Purpose of a Purchase Agreement:

A purchase agreement serves as a crucial document in the land sale process, offering several important benefits:

7.1.1 Establishing Mutual Understanding

The purchase agreement ensures that both the buyer and the seller are on the same page regarding the terms and conditions of the sale. It establishes a mutual understanding and minimizes the potential for misunderstandings or disputes.

7.1.2 Defining the Terms and Conditions

The purchase agreement clearly outlines important details such as buyer and seller information, property details, pricing, financing terms, closing and possession dates, earnest money, deposit amounts, closing costs, and any contract contingencies. This comprehensive overview ensures that all parties involved are aware of their rights, obligations, and expectations.

7.1.3 Ensuring Legal Protection

By having a purchase agreement in place, both the buyer and the seller are legally protected. The agreement provides a framework to address potential issues, contingencies, and conditions under which the contract can be terminated. It safeguards the interests of all parties involved and offers a level of security throughout the transaction.

7.1.4 Contingencies and Due Diligence

One of the significant advantages of a purchase contract is the ability to include contingencies. These provisions allow the buyer to conduct inspections, surveys, or other necessary due diligence on the property before finalizing the sale.

Contingencies offer protection to the buyer, as they can renegotiate or even withdraw from the contract if certain conditions are not met or if unforeseen issues are discovered during their investigation. This ensures that the buyer can make an informed decision and proceed with confidence.

7.1.5 Legally Binding Agreement

Upon the mutual acceptance and signing of the purchase contract, it becomes a legally binding agreement between the buyer and the seller. This legally enforceable document holds both parties accountable for fulfilling their obligations as outlined in the contract. The assurance of a legally binding agreement gives both the buyer and the seller peace of mind, knowing that their interests are protected, and the terms of the sale will be honored.

7.2 Key Components of a Purchase Agreement:

A well-crafted purchase agreement should include the following key components:

7.2.1 Buyer and Seller Information

The agreement should clearly state the legal names and contact information of both the buyer and the seller.

7.2.2 Property Details

The purchase agreement should provide a detailed description of the property being sold, including its legal description, address, and any relevant features or improvements.

7.2.3 Pricing and Financing Details

The agreement should specify the purchase price, payment terms, financing arrangements, and any contingencies related to the buyer’s ability to secure financing.

7.2.4 Closing and Date of Possession

The agreement should outline the agreed-upon closing date, which signifies the transfer of ownership, as well as the date of possession when the buyer can take possession of the property.

7.2.5 Earnest Money and Deposit Amount Due

The agreement should state the amount of earnest money or deposit required from the buyer and outline the conditions under which it may be forfeited.

7.2.6. Closing Costs and Responsibilities

The agreement should define the allocation of closing costs between the buyer and the seller, specifying which party is responsible for paying each cost.

7.2.7 Contract Contingencies

The agreement should address any contingencies or conditions that must be met for the sale to proceed, such as satisfactory inspections, title clearance, or resolution of any outstanding issues.

7.2.8 Title and Legal Description

The purchase agreement should explicitly state that the seller possesses a clear and marketable title to the property. It should include a legally accurate description of the property, including its boundaries, lot numbers, and any relevant easements. This ensures that the buyer is aware of the exact property they are purchasing and helps prevent disputes over the land’s boundaries in the future.

7.2.9 Inspections and Disclosures

The purchase agreement should address the issue of property inspections and disclosures. It should specify which inspections the buyer has the right to conduct and outline the seller’s obligation to disclose any known material defects or issues with the property.

By doing so, the agreement promotes transparency and empowers the buyer to make an informed decision about the purchase.

7.2.10 Default and Remedies

In the event of a default by either party, the purchase agreement should outline the remedies available to the non-defaulting party.

This may include the right to terminate the contract, the return of earnest money, or the ability to pursue legal action for specific performance or damages.

Clearly defining the consequences of default helps protect the interests of both parties and ensures that the agreement is taken seriously.

7.2.11 Prorations and Adjustments

The purchase agreement should address prorations and adjustments for expenses such as property taxes, utility bills, and homeowner association fees. These financial adjustments ensure that both the buyer and the seller are responsible for their respective portions of these expenses during the time of the property transfer.

7.2.12 Dispute Resolution

Including a dispute resolution clause in the purchase agreement can be beneficial in case conflicts arise during or after the sale process. This clause should outline the preferred method of resolving disputes, such as mediation or arbitration, before resorting to formal legal proceedings.

A well-crafted dispute resolution clause promotes a more amicable and efficient resolution of conflicts.

7.2.13 Additional Terms and Conditions

Depending on the specific circumstances of the land sale, additional terms and conditions may need to be included in the purchase agreement. For instance, if the sale is contingent upon the buyer obtaining certain permits or approvals, these conditions should be clearly stated in the agreement. Addressing any unique aspects of the transaction helps ensure that all important aspects are covered.

7.2.14 Signatures and Execution

To be legally enforceable, the purchase agreement must be signed by both the buyer and the seller. Additionally, the agreement should include a clause specifying how the document may be executed and whether electronic signatures are accepted. Properly executed signatures ensure that all parties are bound by the terms of the agreement.

A purchase agreement is a critical component of a successful land sale, providing a legally binding contract that protects the interests of both buyers and sellers.

By including key components such as buyer and seller information, property details, pricing and financing terms, closing and possession dates, earnest money, deposit amounts, closing costs, and contract contingencies, the purchase agreement ensures clarity, transparency, and legal protection.

As a real estate agent or seller, taking the time to draft a comprehensive purchase agreement instills confidence and facilitates a smooth transaction, allowing both parties to proceed with the sale confidently.

8. Contract For Sale

When selling land, a crucial document that solidifies the agreement between the seller and the buyer is the contract for sale. The contract for sale serves as the legal foundation of the transaction, outlining the terms, conditions, and obligations of both parties involved.

- Legal Protection: The contract for sale offers legal protection for both the seller and the buyer. It clearly defines the terms and conditions of the sale, minimizing the potential for disputes or misunderstandings during the transaction.

- Establishing Clear Expectations: By outlining the rights and obligations of both parties, the contract for sale ensures that everyone involved understands their roles and responsibilities. This clarity helps foster a smooth and harmonious land sale process.

- Formalizing the Agreement: The contract for sale serves as a formal agreement between the seller and the buyer, providing a sense of security and confidence to both parties. It instills trust in the transaction and solidifies the commitment of both parties to proceed with the sale.

Comprehensive Documentation in a Contract for Sale:

- Seller’s Disclosure: A seller’s disclosure document provides comprehensive information about the property, including any known defects, past repairs, or environmental concerns. This document promotes transparency and helps buyers make informed decisions.

- Title Report: A title report confirms the ownership status of the property, identifying any liens, encumbrances, or legal issues that may affect the sale. It ensures that the buyer will receive clear and marketable title upon completion of the transaction.

- Purchase Agreement: The purchase agreement is the core document that outlines the terms and conditions of the sale. It includes key information such as the purchase price, financing details, contingencies, closing dates, and responsibilities of both parties.

- Deed: The deed is the legal instrument that transfers ownership of the land from the seller to the buyer. It includes a description of the property and must be properly executed and recorded to ensure a valid transfer of title.

- Financing Documentation: If the buyer is obtaining financing to purchase the land, additional documentation related to the loan, such as loan applications, pre-approval letters, and mortgage documents, will be required.

A well-crafted contract for sale is essential for a successful land transaction, providing legal protection, clarity, and formalizing the agreement between the seller and the buyer.

9. Deed

When selling land, one of the essential documents needed to transfer ownership from the seller to the buyer is a deed. A deed is a legal instrument that serves as evidence of ownership and conveys the title of the property.

9.1 The Significance of a Deed

A deed plays a vital role in the land sale process, serving several important purposes:

- Transferring Ownership: By executing the deed, the seller relinquishes their legal rights to the property, and the buyer becomes the new legal owner.

- Establishing Title: Having a deed that clearly identifies the buyer as the new owner helps ensure that there are no conflicting claims or disputes over the property’s ownership. A properly executed deed provides assurance to the buyer that they hold a clear and marketable ownership to the land, meaning they have the legal right to use, sell, or transfer the property.

- Legal Protection: This contract establishes the rights and obligations of both parties involved in the transaction, reducing the risk of misunderstandings or disagreements. If any disputes or challenges to the ownership arise in the future, the deed provides a clear record of the agreed-upon terms, offering a basis for resolving such issues through legal means if necessary.

9.2 Here is what a typical deed document includes:

9.2.1 Names and Addresses

The deed includes the full names and addresses of the person who is transferring the property (the grantor) and the person who is receiving the property (the grantee).

9.2.2 Property Description

The deed describes the property in detail, including its boundaries, lot numbers, and other identifying details. This description is important to ensure that there is no confusion about which property is being transferred.

9.2.3 Granting Clause

The granting clause is the heart of the deed. It is the statement by the grantor that they are transferring ownership of the property to the grantee. The granting clause typically includes phrases like “convey and warrant,” which indicate that the grantor is granting the property with certain warranties.

9.2.4 Consideration

The consideration is the amount or value of the property being transferred. It can be a monetary amount, or it can be something else of value, such as a car or a piece of furniture.

9.2.5 Signatures

The deed must be signed by both the grantor and the grantee. In some cases, the deed may also require the signatures of witnesses.

9.2.6 Notarization

In many states, a deed must be notarized to be valid. Notarization is a process that involves a notary public verifying the identities of the parties and witnessing the signing of the deed.

9.2.7 Legal Language

Deeds typically use legal language and terminology to ensure their validity and compliance with state laws.9.

9.2.8 Acknowledgment

The deed may include an acknowledgment section, where the grantor confirms their understanding and voluntary execution of the document.

Furthermore, a deed offers legal protection by providing notice to the public and other parties that the property has changed ownership. Once recorded in the appropriate public land records, the deed becomes part of the property’s chain of title, ensuring that anyone conducting a title search or examining the property’s history will be aware of the change in ownership.

9.3 Types of Deeds:

In Texas, three common types of deeds are used in land transactions:

9.3.1 General Warranty Deed

A general warranty deed provides the highest level of protection to the buyer. It guarantees that the seller holds clear title to the property and has the legal right to sell it. The seller also warrants the property against any past or present claims, ensuring that the buyer receives the property without any undisclosed issues.

9.3.2 Grant Deed

A grant deed is commonly used in Texas and provides certain warranties to the buyer. While it offers less protection than a general warranty deed, it guarantees that the seller has not transferred the property to anyone else and that the property is free from undisclosed encumbrances or claims arising during the seller’s ownership.

9.3.3 Quitclaim Deed

A quitclaim deed is often used in situations where the transfer of ownership does not involve a traditional sale, such as transferring property between family members or correcting title issues. Unlike general warranty and grant deeds, a quitclaim deed offers no warranties or guarantees regarding the title. It simply transfers whatever interest the seller has in the property to the buyer.

A quitclaim deed can play a significant role, especially when the transfer of ownership involves unique circumstances or when there is an existing relationship between the parties.

This type of deed is valuable for situations where traditional sale processes are not necessary, such as transferring property between family members or addressing specific title issues.

When selling land without a Realtor, a quitclaim deed offers a simple and straightforward way to convey the seller’s interest in the property to the buyer without any warranties or guarantees regarding the title.

While it may not provide the same level of protection as general warranty and grant deeds, a quitclaim deed can be an efficient solution when parties have a clear understanding of the transaction and trust the relationship between buyer and seller.

However, it is essential to ensure that the property’s title is free of any significant encumbrances or disputes before using a quitclaim deed to safeguard the interests of both parties involved in the land sale.

10. Closing statement

The closing statement is the final document you will need in your home purchase. It encompasses various important elements that ensure a smooth and successful transaction.

10.1 The Significance of a Closing Statement:

The closing statement serves several significant purposes, including:

- Documentation Review: The closing statement allows all parties involved, including the seller, buyer, and their respective representatives, to review and confirm that all required documentation is in order.

- Financial Accountability: The closing statement provides a clear schedule of payments, detailing the financial obligations of both the buyer and the seller. This ensures transparency and accountability in terms of payment deadlines and amounts.

- Insurance Verification: This document is crucial for protecting the interests of the buyer, seller, and any relevant lenders.

- Property Information: The closing statement may include the property’s topographical map, providing valuable information about the land’s features, boundaries, and surrounding areas. This assists in finalizing the sale and providing a comprehensive overview of the property.

10.2 Key Components of a Closing Statement

A comprehensive closing statement typically includes the following key components:

- Schedule of Payments: The closing statement outlines the financial obligations of both the buyer and the seller, including the purchase price, down payment, loan amount (if applicable), and any other relevant fees or expenses. It ensures that all parties are aware of their financial responsibilities.

- Property Insurance: The closing statement includes a copy of the property insurance policy. It is proof that the property is adequately insured. This protects the buyer, seller, and any lenders involved in the transaction.

- Topographical Map: In some cases, the closing statement may include a topographical map of the property. This map highlights the land’s physical features, boundaries, and nearby amenities, providing additional context and information.

The closing statement is a critical in finalizing a land sale. You need to ensure that all necessary documentations are reviewed, financial obligations are accounted for, and relevant property information is provided.

By including a schedule of payments, a copy of the property insurance, and, in some cases, a topographical map, the closing statement facilitates a smooth and transparent transaction

11. Other Relevant documents

In addition to the previously discussed documents, there are other relevant documents that play a crucial role in ensuring a clear title for a successful land sale. These documents address specific situations that may impact the ownership and transfer of the property. Here are a few instances where you’d need special documentations:

11.1 Inherited Land

If you want to sell inherited land, it is important to have proper documentation to establish the transfer of ownership. This may include a copy of the will, probate documents, or any other relevant legal documents that demonstrate the rightful inheritance of the property.

11.2 Dealing with Deceased Owners

In situations where one of the owners has passed away, it is essential to have documentation that addresses the transfer of their ownership interest. This may involve probate proceedings, death certificates, and legal documentation that confirms the transfer of the deceased owner’s interest to the surviving owner(s) or their designated heirs.

11.3 Divorced Owners

If one or both of the owners of the land are divorced, you will need documents that address the division of property rights. This may include a divorce decree or a property settlement agreement that clearly outlines the ownership rights and responsibilities of each party.

11.3 Proper Subdivision of land

If your Texas land was subdivided earlier, you will need documentation that demonstrates proper compliance with subdivision regulations.

You will also require necessary permits or approvals from relevant authorities to ensure that the property’s subdivision is legally valid and can be transferred with a clear title.

11.4 Property Held in Trust

In cases where the property is held in a trust, you will require the relevant trust documentation. So, keep documents like trust agreement or trustee’s certificate in handy.

This establishes the authority and legitimacy of the trust and confirms the ability of the trustee to sell the property.

Addressing specific situations that may impact the ownership and transfer of the property is essential in ensuring a clear title for a successful land sale. By obtaining the necessary documentation related to inherited land, deceased owners, divorced owners, easements and access, proper subdivision, and property held in trust, sellers can establish confidence and security for both buyers and themselves.

FAQs

1. Is there any difference between Deed and Title?

The terms “deed” and “title” are often used interchangeably in real estate discussions, leading to confusion regarding their meanings and functions. However, understanding the distinction between a deed and title is crucial when it comes to land ownership and transfer.

1.1 The Difference Between a Deed and Title

While a deed and title are related to land ownership, they represent different aspects of the property transfer process:

| Deed | Title | |

| Definition | A legal document used to transfer ownership of real property from one party to another. | The legal right of ownership or interest in a property. |

| Purpose | To convey and transfer ownership of the property from the seller (grantor) to the buyer (grantee). | To establish ownership rights and interests in a property. |

| Nature | It is a tangible, written, and executed document. | It is an intangible concept or legal right that exists regardless of a physical document. |

| Content | Includes the property description, names and addresses of the parties, granting clause, consideration, signatures, and notarization (if required). | The title includes information about current and historical ownership, liens, encumbrances, and any restrictions on the property. |

| Key Role | It facilitates the transfer of ownership and serves as evidence of the transaction. | It provides the legal basis for ownership and indicates who has the right to use and control the property. |

| Importance | It is vital for the valid and legal transfer of property ownership. | It is crucial for establishing and protecting property rights. |

| Transfer | Transfers ownership from one individual or entity to another. | It does not transfer ownership itself; instead, it confirms who currently holds ownership rights. |

| Physical Form | It is typically a physical, written document with signatures and notarization. | It may be represented by physical documentation or exist as an electronic record maintained in public records. |

| Existence | A deed exists when a property is bought, sold, or transferred between parties. | The title exists as long as someone has ownership rights or interests in the property. |

| Protection | It offers legal protection for the buyer by warranting the seller’s interest in the property. | It protects the owner’s rights by providing evidence of ownership and can be insured through title insurance. |

| Variation | Different types of deeds, such as general warranty deeds, special warranty deeds, and quitclaim deeds, offer varying levels of protection to the grantee. | Titles can be clear and marketable, indicating no issues, or clouded by liens or other encumbrances. |

A deed is the document that facilitates the transfer of ownership, while title represents the legal concept of ownership itself.

Selling land by owner in Texas is no different from selling FSBO in Texas, only with a few additional steps. We have explored the essential documentation required to navigate the process successfully. By understanding the various documents involved, both sellers and aspiring real estate professionals can approach land transactions with confidence and knowledge.

Selling land by owner in Texas requires careful attention to documentation, legal obligations, and the unique characteristics of the property being sold. By familiarizing yourself with the required documents and seeking professional guidance when necessary, you can navigate the process confidently and maximize the value of your land sale. Whether you are a seller, a real estate agent, or a potential buyer, understanding the documentation involved will ensure a successful and rewarding experience in the Texas land market.

Also Read: