When you’re buying or selling a home, especially in a vibrant state like California, it’s absolutely essential to have a real estate agent by your side.

The California market is fierce and always on the move, with lots of regulations to navigate. A real estate agent brings expertise and insider knowledge to the table. They know the ins and outs of the local market and have connections with industry pros. Whether you’re a buyer or seller, their guidance is invaluable in helping you find the perfect property, explore different neighborhoods, and effectively market your home. With their help, you’ll have a much better chance of a successful and hassle-free transaction in California’s diverse and bustling cities.

These agents charge a commission for their valuable assistance, which is typically paid at the closing of the sale. The role of a real estate agent is to bring buyers and sellers together, acting as the representative of either the buyer or the seller.

Real estate commissions are usually calculated as a percentage of the home’s sale price. The specific commission rate is negotiated between the seller and the listing agent and is factored into the overall price.

1. How much is the realtor fee in California?

Real estate agent commissions in California can vary, but traditionally they range from 5% to 6% of the home’s sale price. This commission is typically divided equally between the buyer’s agent and the seller’s agent, with each receiving a percentage. However, it’s important to note that commissions are negotiable, and the specific rate can depend on factors such as the property’s value, market conditions, and the agreement between the seller and the agent.

In recent years, there has been a rise in alternative commission structures, such as discounted rates or flat fees. Some agents may offer lower commission rates, especially for higher-priced properties. Additionally, in certain situations, agents may be open to negotiating their fees based on specific circumstances or services provided.

It’s crucial for buyers and sellers to discuss and negotiate commission rates with their chosen real estate agent. Rates may vary based on the agent’s experience, expertise, marketing strategies, and the level of service they provide.

It’s important to keep in mind that real estate practices and commission rates can evolve over time, so it’s recommended to consult with a local real estate professional or research up-to-date sources to get the most accurate and current information for your specific area in California.

In California, the average commission for realtors typically ranges from 4.91% to 5.14%. This means that if you were to sell an average house in California, which is worth around $728,134, you can expect to pay approximately $35,751 to $37,426 in realtor fees.

To give you a better idea, let’s break it down for different price points based on a commission rate of 4.91%:

- For a $500,000 house, the realtor commission would amount to around $24,550.

- For a $800,000 house, the realtor commission would be approximately $39,128.

- If you were selling a higher-priced property, say at $1,200,000, the realtor commission would come out to about $58,692.

It’s important to note that these calculations are based on the average commission rate and serve as estimates. Actual commission rates may vary depending on individual negotiations, market conditions, and the specific agreement with your realtor.

| Home Price | Realtor Fees as per 4.91% commission |

| $850,000 | $41,735 |

| $750,000 | $36,825 |

| $650,000 | $31,915 |

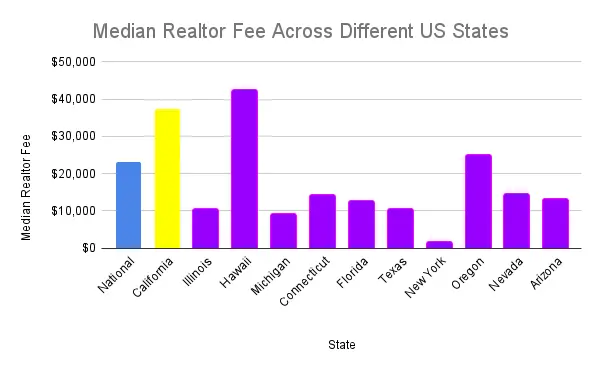

1.1 How does the realtor fee in California compare to realtor fees in other states?

| State | Commission Percentage | Median Home Price | Median Realtor Fee |

| National Average | 5.37% | $428,700 | $23,021 |

| California | 4.91% | $760,800 | $37,355 |

| Illinois | 5.24% | $202,100 | $10,590 |

| Hawaii | 4.99% | $848,926 | $42,361 |

| Michigan | 5.65% | $162,100 | $9,159 |

| Connecticut | 5.12% | $279,700 | $14,321 |

| Florida | 5.40% | $232,000 | $12,528 |

| Texas | 5.59% | $187,200 | $10,464 |

| New York | 4.97% | $32,500 | $1,615 |

| Oregon | 4.99% | $502,215 | $25,061 |

| Nevada | 5.02% | $290,200 | $14,568 |

| Arizona | 5.43% | $242,200 | $13,151 |

Compared to other states listed in the table, California has a relatively lower realtor fee percentage. However, it’s important to note that the median home price in California is significantly higher than in many other states, contributing to a higher median realtor fee.

In simpler terms, the realtor fee in California refers to the commission charged by real estate agents as a percentage of the property’s sale price. This fee compensates the real estate agent for their services in facilitating the sale of properties in California.

Please keep in mind that the information provided is for illustrative purposes only and may not reflect the exact or current realtor fees in California. To obtain accurate and up-to-date information, it’s advisable to consult local real estate professionals or research reliable sources specific to California’s real estate market.

In addition the realtor fee in California is approximately 62% higher than the national average. On average, sellers in California may potentially pay higher in realtor fees compared to the other parts in the nation when selling a property. However, it’s important to note that these are average figures, and actual fees can vary based on individual negotiations and market conditions.

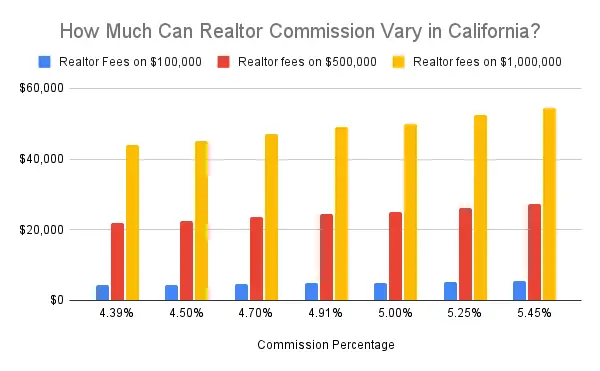

1.2 How much can Realtor commission vary in California?

Having said that, realtor commission can vary depending on the deal between the seller and the agent. In California, this could range between 4.39% to 5.45%. Let’s take a look at how much this could amount to in the below table.

| Commission Percentage | Realtor Fees on $100,000 | Realtor fees on $500,000 | Realtor fees on $1,000,000 |

| 4.39% | $4,390 | $21,950 | $43,900 |

| 4.50% | $4,500 | $22,500 | $45,000 |

| 4.70% | $4,700 | $23,500 | $47,000 |

| 4.91% | $4,910 | $24,550 | $49,100 |

| 5.00% | $5,000 | $25,000 | $50,000 |

| 5.25% | $5,250 | $26,250 | $52,500 |

| 5.45% | $5,450 | $27,250 | $54,500 |

1.3 How do realtor fees vary across different parts of California?

Realtor fee will vary within the different counties of California depending on the home price. Let’s look at the commission in the top 20 counties to live in California.

| County | Typical home price | Average realtor fee in California (4.91%) |

| San Mateo | $1,807,533 | $88,750 |

| Santa Clara | $1,761,401 | $86,485 |

| Alameda | $1,437,361 | $70,574 |

| Orange | $1,041,231 | $51,124 |

| Marin | $2,754,505 | $135,246 |

| Contra Costa | $994,183 | $48,814 |

| San Diego | $1,007,875 | $49,487 |

| Placer | $570,309 | $28,002 |

| Sacramento | $517,612 | $25,415 |

| Yolo | $623,735 | $30,625 |

| San Luis Obispo | $1,003,295 | $49,262 |

| Santa Cruz | $1,533,035 | $75,272 |

| Santa Barbara | $1,835,899 | $90,143 |

| Napa | $922,606 | $45,300 |

| Ventura | $890,621 | $43,729 |

| El Dorado | $681,176 | $33,446 |

| Sonoma | $1,050,061 | $51,558 |

| Los Angeles | $1,007,124 | $49,450 |

| Butte | $288,983 | $14,189 |

| Fresno | $374,930 | $18,409 |

The average realtor fee in the to 20 counties of California ranges from a low of $14,189 to a high of $135,246.

Considering that the realtor fee in California can go up to $135,000, it is only logical for some sellers to opt for ways to reduce this commission. The good news: it’s possible to reduce this commission drastically and save thousands of dollars. Let’s explore how one can save on realtor commissions in California.

2. How much is the realtor’s commission on rentals?

The typical rental commission is 5-15% of the annual rent. Rental commissions range from one-half to two months’ worth of rent, but commissions vary widely by market. You will be surprised to know that fees vary from $250 (where rental commissions are less popular) to four months’ worth of rent or more in other markets with fiercely competitive agent ecologies.

The agent collects the initial rent to cover the commission, after which the rent goes to the landlord. When renewing a lease, too, the agent needs to be paid a certain amount, as mentioned in the agreement.

Here are two cases where the tenant is not charged a commission.

2.1 Rental list companies

In some areas, companies maintain a list of properties being let out, and you can get this list by paying a nominal charge—no commission is levied. These lists are updated regularly.

2.2 Property management companies

Property management companies collect 10-15% from the landlord to manage, maintain and rent out homes. However, they don’t charge the tenant any commission and have their leasing staff.

3. How does the realtor commission work in California?

For selling a home, the seller hires a listing agent. They negotiate the commission and sign an agreement to the effect. The commission is included in the home price to be paid to the agents on closing.

The listing agent then looks for prospective clients by advertising the home on the MLS and other platforms, mentioning the buyer agent’s commission. The buyer pays the seller the home price if the deal goes through successfully. The seller then pays the listing agent the agreed-on commission.

The listing agent keeps a share and gives the buyer’s agent the advertised commission.

3.1 What is commission split?

Real estate agents cannot accept commissions directly from buyers or sellers and must work under a real estate broker (this could be an individual or a brokerage firm). These brokers are more experienced and have a higher license. They advise and guide agents. They accept the commission, take a share of it as fees, and pass on the rest to the agent in a pre-decided ratio — this ratio is termed a commission split.

The commission split differs from agent to agent, and depends on the brokerage policy. The commission is usually split equally. However, if the agent is inexperienced, they might get a lower share, while experienced agents may get a higher share of the commission. In some cases, agents are also given a bonus as an incentive for their hard work.

For example, a commission split of 50/50 means the broker and agent share the commission equally. However, if the agent is experienced, the split might be 60/40 or even higher in the agent’s favor. For example, the below image shows a 60/40 split for a home selling for $350,000, with a commission rate of 6%.

The total commission works out to $21,000. Since the two agents will get 60% of the commission, this works out to

Total commission X 60% = $21,000 X 60% = $12,600

If this is shared equally between the two agents, each gets $6,300.

The brokers will get 40% of the commission, which works out to

Total commission X 40% = $21,000 X 40% = $8,400

Each broker will get $4,200.

Let’s look at possible splits in the table below.

| Total commission | Split ratio | Buyer/Seller agents’ share | Buyer/Seller brokers’ share |

| $21,000 | 60:40 | $12,600 ($6,300 each) | $8,400 ($4,200 each) |

| $21,000 | 70:30 | $14,700 ($7,350 each) | $6,300 ($3,150 each) |

| $21,000 | 80:20 | $16,800 ($8,400 each) | $4,200 ($2,100 each) |

4. Can an agent split their commission with a buyer or seller in California?

California, and 39 other states, allow agents to share their commission with buyers and sellers. Sharing commission acts as an incentive for the buyer or seller to hire the agent. Another way to motivate buyers and sellers to hire agents is to reduce commissions. This is possible because commission rates are not set and can vary depending on how negotiated.

Nine states don’t allow agents to share their commissions with buyers and sellers. These are Alabama, Alaska, Kansas, Mississippi, Missouri, Louisiana, Oklahoma, Oregon, and Tennessee. Iowa prohibits sharing commission but allows it in the case of dual agency – when only one agent is involved in a transaction. New Jersey only allows agents to share commissions with homebuyers.

5. Who pays the realtor commission in California?

The seller pays the commission in California, as is the norm in the rest of the country. Homebuyers sometimes think it will be cheaper to forgo using realtors or agents. However, since the buyer is not obligated to pay any real estate commission, this is unnecessary. The seller’s and the buyer’s agent’s commission is included in the home price. Once the payment is received from the buyer, the seller pays the entire commission.

However, it can be argued that since the buyer pays the price of the home (which includes the commission), it is technically the buyer who pays the commission. Or you could say both the buyer and seller end up paying their respective agent’s commission.

5.1 Who pays the commission in case of a rental deal?

The landlord often foots the bill for the rental commission in most cases. The commission is frequently divided between a seller’s agent representing the owner and a buyer’s agent locating the tenant. In other situations, the landlord will serve as the seller’s agent and merely pay the buyer’s agent a commission.

Renters occasionally foot the bill for the commission in some markets, like Boston and New York City. In these cities, you may come across the words ‘OP’ or ‘No fees’ mentioned in the ad. In both cases, this means the ‘Owner Pays’ the commission, and the tenant does not have to do so.

6. Are real estate commissions negotiable in California?

If an agent or broker tells you realtor fees are not negotiable, opt for another agent. Realtor fees are always negotiable. Even the government encourages competition between agents because this saves thousands for buyers and sellers. However, your capacity for negotiating is influenced by several variables, including your property, local demand, the agent’s association with their firm, and more.

6.1 Should you negotiate realtor commission in California?

It would help if you negotiated a realtor commission in a state like California, where home prices are already high and constantly rising. Even a little saving in percentage terms can mean thousands of dollars here. For example, when the average home price is around $800,000, even a 1% savings means $8,000 in your pocket.

6.2 How to negotiate realtor commission in California

Negotiating with agents can be difficult. Agents are professional negotiators who will soon get the better of you if you are unprepared. Always keep all the data and information ready before you start negotiations. Here are a few suggestions to keep in mind before you enter into serious talks with agents.

6.2.1 Negotiation should be mutually beneficial

Remember that to gain some, you have to lose some. So when asking for a discount, make sure you also offer something to the agent. For example, you could reduce the agent’s workload by offering to do some of the tasks yourself. You can suggest that you don’t need the agent to be present during showings. Agents will be more open to charging a lower commission if you save their time and effort. Adding value to the partnership will benefit both parties rather than just asking for a discount.

6.2.2 What’s the commission rate in your area?

Unless you know the average commission rate in your area, you may not be able to negotiate well. For example, if the average commission rate in your area is 6% and you ask the agent to charge a 4% commission, you will have difficulty convincing them. However, you can use this information as a starting point for your discussions to ensure that both parties keep their demands fair.

6.2.3 What’s your negotiating leverage?

How easy is it to sell your home? Is your home a premium property? Is the demand for homes high in your area? How much precisely will your agent earn from the deal? These questions need to be answered to understand your negotiating leverage.

The stronger your position, the better you will be able to negotiate a lower rate. If your home is relatively easy to sell, for example, the agent won’t have to spend much time on the deal and will be willing to charge you a lower rate.

6.2.4 A new paint job or a few repairs

Talk to the agent and ask them what will make it easier to sell your home. For example, a new point job, a few minor repairs, cleaning the carpet, or some new landscaping might give the house a whole new look.

Buyers are always impressed by homes that are attractive and ready to move in rather than homes that require a lot of work. Since the agent can see that you are willing to make selling the house easier, they will be more inclined to reduce the commission.

In addition, you can spend money on a pre-listing examination to go one step further. This will make any unforeseen problems that can bog down or extend negotiations more apparent.

6.2.5 Talk to multiple agents

Talking to multiple agents will ensure you get the best possible deal. If you speak to only one agent, you are at their mercy. But you have options when you speak to multiple agents, even if one rejects your offer. While some agents are rigid and won’t negotiate, there are plenty of agents willing to negotiate to gain your business. In addition, more and more agents are getting creative and offering mutually beneficial deals where you pay a lower commission, and they end up spending less time on the deal.

6.2.6 Reduce the agent’s overall cost

Did you know that agents spend money from their pockets when signing an agreement with the seller? They hire the services of a professional photographer to click great pictures of your home or may even hire a copywriter to write an attractive description of your home. They spend money to drive you around to meet buyers or for meetings.

You could try to reduce some expenses by asking the agent to keep costs to a minimum. For example, there is no need for expensive lunches or expensive cars while arranging meetings. When the agent realizes you are saving them money, they will be more willing to charge you a lower commission.

6.2.7 Don’t reduce the buyer’s agent fee

Sellers need to realize is that they should not lower the buyer agent’s fee. When a buyer agent is looking for homes, they are more likely to ignore homes where they are getting a low commission.

So offering a low commission to the buyer agent means your house will not sell quickly. Always provide the full commission to the buyer agent. This will ensure that you get many offers. Your listing agent knows this, and, expecting a quicker sale, will agree to a lower commission when you ask for it.

6.2.8. New agents are more motivated

While established agents may not agree to lower commissions, new agents are usually more open to accepting lower fees. This is because new agents are trying to get a foothold in the industry and are looking to increase their experience rather than earn high commissions.

The newer lot will be enthusiastic and out to prove themselves. However, often new agents have to work with brokerages that don’t allow them to reduce the commission. Of course, working with experienced agents has its benefits.

6.2.9. Multiple transactions with the same agent

Usually, home sellers plan to buy a home immediately after a home sale. In this case, you could offer to route both transactions through the same agent. This means more business for the agent, so they will treat you like a preferred customer. Which means charging you a lower commission in the bargain. If you don’t have multiple transactions, you could offer to spread the word and give the agent referrals to your friends and family in case they plan to buy or sell a home shortly.

6.2.10. Dual agency

Dual agency is where a single agent acts as the listing agent and the buyer’s agent. For example, if you know the buyer well and are convinced there will be no problems, you could ask the same agent to act as the buyer and listing agent. This way, they earn a double commission, and you can ask them to charge you a lower fee in the bargain.

Though it will work in the above case, a dual agency has disadvantages. In most cases, it has an inherent conflict of interest—the same agent cannot work for the interests of both the buyer and seller. The seller needs the highest price, while the buyer wants to pay the lowest price. That is the reason it is banned in several states. Even in states where it is allowed, there are strict rules. The agent must take approvals from both parties in writing and inform all the parties in the transaction, including the lender about the situation.

Dual agency is legal in California but is banned in Alaska, Colorado, Florida, Kansas, Maryland, Oklahoma, Texas, and Vermont.

6.2.11. Just walk away if you are not satisfied

If you don’t like a deal, you should always be prepared to walk away from it. No hard and fast rules state that you have to close a deal you don’t like. However, suppose the agent does not adhere to the agreed-upon terms or refuses to reduce the commission after promising. In that case, you should walk away since it could lead to more compromises. After all, any negotiation should culminate in some benefit to both parties.

If the agent understands that you are willing to walk away from the deal, they will be more likely to agree to a lower commission to keep you happy.

7. Can you reduce realtor commission without negotiating in California?

While negotiating realtor commissions can be pretty difficult, since agents are master negotiators, some sellers may not want to negotiate. This could be either because of a lack of time or because you dislike negotiating. Still, there is no need to lose heart. You can still reduce the commission without negotiating or with minimal negotiation.

Let’s take a look at some of these options.

7.1 Agent-matching services

Services such as Clever Real Estate offer to match you up with multiple agents. Select the one best suiting your needs. Clever also pre-negotiates a lower commission with their agents so that you don’t have to spend time negotiating. What’s more, these services are free, and there is no obligation to hire their agent if you are unhappy with them. The agents you get to choose from are top-rated local agents from top brokerages who will offer full service. If you are unhappy with the list of agents provided by Clever, you can ask for a different list at no cost.

7.2 Discount real estate brokers

Discount real estate brokers try to offer you economies of scale. They have a team of in-house agents who take on multiple offers, thus reducing their expenses and increasing their overall transactions. This allows them to charge you a much lower commission than traditional agents.

However, in some cases, they may have inexperienced agents. And since they are taking on more deals, you may have to compromise on the quality of services. Some of these companies are more effective than others, so choose carefully

7.3 For Sale by Owner (FSBO)

One way to completely do away with the seller agent’s commission is not to hire one. If you have time and are quite familiar with selling homes, you could opt to be your own agent.

This will save you the listing agent’s commission. However, you still have to pay the buyer agent’s commission. Unless, of course, you come across a buyer who doesn’t have an agent at all. If both of you are agreeable, you could just hire an agent to do the paperwork at a nominal fee, and save on both the commissions.

7.4 Flat-fee MLS company

A seller who does not hire an agent will find it difficult to list the home on the local MLS (Multiple Listing Service). This is a database listing all the homes being sold through agents. Unfortunately, only agents have access to the MLS so that FSBO sellers will be disadvantaged. However, there is a solution.

There are flat-fee MLS companies that will agree to list your home on the MLS for a nominal charge. Remember that that is the only service they will offer; the rest is up to you.

Once listed on the MLS, other major websites like Zillow and Realtor will automatically pick up your listing and showcase it on their platform.

7.5 Fee for service agents/companies

If you’re not looking for a full-time agent and only require them for a particular service, there are agents and companies that will charge you only for that service, rather than the entire commission. In the case of FSBO, this works well, as you may only want to hand over the paperwork to the agent. These agents/companies can save the seller thousands of dollars.

7.6 Sell your home for cash

If you simply don’t have the time or inclination to wait for months for a deal to happen and are in a hurry, you still have options. Some companies will buy your home for cash. They usually buy the property in an ‘as-is’ condition, so you don’t have to do up the place or make repairs. They will assess the home and make you an offer in days. This is a good option for a distressed sale, where you do not have the money to pay the mortgage nor have the resources to do up the place to make it good enough to go on the market. This could help if you have to move to another state because of a new job or a divorce. Here you don’t have to worry about negotiations or buyers backing out at the last moment.

The downside is that these companies may offer only 50-60% of the house’s market value, so you can opt for their services only if in dire need.

7.7 iBuyers

iBuyers are similar to cash buyers or investors. The difference is that they leverage technology to buy and sell homes quickly. They connect buyers looking for a good deal and sellers looking for quick buyers. are companies that leverage technology to make fast-all cash offers on homes, often sight unseen.

They have strict criteria for homes, but if you qualify, you can expect to close the deal at your pace–you could do this in a week or take up to three months, depending on your schedule.

The downside is that these iBuyers charge a hefty 5-15% for their services. The advantage is that they may not make a low offer like cash buyers or investors and will at least give you a fair market value for your property.

8. What services are covered in the realtor fees in California?

When negotiating with an agent for a lower commission, you need to be aware of all the services offered by a traditional agent.

Otherwise, you risk being short-changed because the agent could simply reduce the services provided to compensate for the lower commission.

Agents can get away with this because very few home sellers know what services are offered by full-service realtors. Therefore, understand these services before you begin negotiating. Here is a list that will help you.

8.1 Pricing the home

This is perhaps one of the essential services provided by an agent. They are skilled at gauging how much a home will sell because they are constantly in the market. Agents will look at similar homes and how much they have sold for recently. They will look at the amenities available and the home’s condition and then decide how much to price the home correctly, and you get a reasonable price too. If you price the house too high, buyers will not look at it, which will delay the whole process. If you underprice the house, you could lose thousands. Hence, it is critical to price the house just right, and your agent will do that for you.

8.2 Marketing your property

Once the price is decided, agents will shoot some good pictures and give a good description before posting the ad on the local MLS or other websites and social media. Agents know how to reach buyers quickly, which is a great advantage. Good photographs/videos and a great description will go a long way in attracting buyers.

Also, reaching the right and relevant platforms, whether it is websites, magazines, or newspapers, is what agents are good at. They will ensure that you get the best reach through their efforts.

8.3. Updating the seller with the latest developments

The seller is usually busy with work, and the agent will update them on the status of the sale. For example, the agent will answer all these questions: how many prospective buyers like the property, how soon is the property expected to be sold, or is there something that can make the house more attractive. Even when there are no buyers, the agent will keep the seller updated. The seller can quickly make any changes in pricing or strategy.

8.4. Screening buyers

Prospective buyers see many homes before they finalize one. Also, some people are not serious about buying and can waste the seller’s time. The agent screens all such offers and sifts through them to find genuine buyers.

Checking the buyer’s background, whether they are pre-approved for a mortgage? What is their income? Can they afford the home?—the agent will ensure they get all the answers before accepting an offer and coming to you for approval.

8.5. Negotiating the highest price

Good agents will generally not accept the first offer that comes their way. Instead, they will sound the market and try to get you the best offer possible. The gift of negotiation is a vital skill in agents who are in the business because they are good at it.

They will negotiate the best possible terms before they present you with the offer. Offers that are way below your expectations and not worth considering may not reach you at all, thanks to the screening process. In addition, the agent will warn you about buyers who do not have pre-approval for a loan, as the buying process will take much longer in such cases.

8.6. Attending the home inspection and appraisal

Agents will attend the home inspection to understand what is the feedback from the inspector. They will pass on this information to the seller so that if there is anything worth rectifying or repairing the seller can do it to enhance the home’s value.

Similarly, attending home’s appraisal will ensure that the agent provides the correct information to the appraiser— whether it is about any repairs or any additions which have enhanced its features.

8.7 Closing the deal and ensuring things go smoothly

There are a lot of problems that can arise while selling a home. Some paperwork may be pending, or you may be unable to attend some crucial meetings with buyers. In such cases, the agent will ensure all paperwork and legalities are taken care of. They will participate in the meetings on your behalf to ensure that there are no loose ends and things go smoothly.

9. Are realtor fees tax-deductible in California?

The IRS looks at commissions as an expense related to selling a home. Hence you can deduct commissions from the home price when you mention the sale price to the IRS. Real estate commissions are not capital gains tax-deductible and cannot be deducted the way you deduct your mortgage interest.

However, you can subtract them directly from the home price for tax purposes. For example, if the home sells for $800,000 and pay a commission of $48,000, your sale price would be

Adjusted sale price = Home price – Commission = $800,000 – 48,000 = $7,52,000.

If you purchased the home for $700,000, then your capital gain on sale would be

Capital gain = Adjusted sale price – Purchase price = $752,000 – $700,000 = $52,000

Hence you would be taxed on $52,000 rather than $100,000.

Incidentally, the IRS allows a capital gain tax exemption of $250,000 if you file tax as a single person, and a tax exemption of $500,000 if you file taxes with your spouse. The only stipulation for availing of the above deduction and exemption is that you should have been living in the house for at least two of the five years immediately preceding the sale.

10. FAQ

10.1 What happens to the commission if the buyer does not have an agent?

The entire commission goes to the listing agent if the buyer does not have an agent. This is because the seller agrees to give the whole commission to the listing agent when signing the agreement.

The seller agent will then share it with the buyer’s agent as they see fit. Since that amount is earmarked for commissions only, and since there is no buyer agent, the entire commission goes to the listing agent. The seller is bound to give that amount irrespective of whether there is a buyer agent.

In such a situation, the buyer could request the seller and the listing agent to reduce the home price since the buyer agent need not be paid in this case.

If the seller and listing agent agree, this could benefit the buyer and make it a lucrative deal. The seller remains unaffected in either case since they would have to pay the entire commission all the same.

Conclusion

Negotiating realtor commissions is crucial, especially in a high-priced market such as California. Today agents are coming up with innovative ways to benefit their clients and themselves. For example, agents try to reduce the commission and take on more clients. This keeps clients happy, and agents can make more money.

However, don’t make a lower commission the sole criteria for selecting an agent. It is more important to ensure that the agent will get the job done and that you can work with them.

Just signing on because of a lower commission could land you in a soup if the agent is not good enough to sell your home quickly at the highest price. So think carefully before you sign on the dotted line.