Buying a home is everyone’s biggest dream. A lousy investment, and even before you know it, your dream turns into a living nightmare! Especially if you are looking to buy a condo.

Though the upscale lifestyle and reduced maintenance of a condo can be quite appealing to you, it’s important that you weigh both sides; there might be more cons than pros to condo living.

Let’s explore the biggest 15 cons of living in a condo!

Top reasons not to buy a condo

1. Condo HOAs Are the Worst!

When you buy a condo, you only own the interior of the property. The exterior – the walls, parking areas, and even the ceilings – are common properties, usually owned by the HOA.

When you purchase a condo within an HOA, you receive the CC&Rs (Covenants, Conditions, and Restrictions) and By-Laws, outlining all the rules you’re expected to follow.

At times, these rules can be quite restrictive, even bordering on BEING RIDICULOUS at best! (The internet is filled with such stories, and if you have some free time in hand, I suggest you read them they are hilarious :P.)

Take, for example, a 2023 incident in Florida where a homeowner faced $1,400 in HOA fines just for parking his white Ford FX4 off-road in front of his house (and his response to this is definitely worth reading about!). Additionally, some HOAs go as far as to restrict ‘solar drying’ – a fancy term for clothing to maintain the aesthetic of the condos :).

The HOA maintains and owns the common property. And, while it solves neighbor disputes so everyone can live peacefully if a bunch of power-drunk nitpickers manages the HOA, you can end up in a bad situation. They control:

- Common Area Maintenance

- Exterior Aesthetics

- Noise Regulations

- Pet Policies

- Parking Rules

- Trash Disposal

- Alterations to Units

- Rental Restrictions

- Insurance Requirements

- Use of Common Facilities

- Landscaping for Private Areas

- Holiday Decorations

- Window Coverings

- Dues and Assessments

Typically, doing so requires a majority vote from the homeowners, and in some cases, as much as 80% agreement is needed. And even if homeowners agree to disband the HOA, there are legal and logistical challenges to consider like reassigning the ownership and maintenance responsibilities of common areas, dealing with any outstanding debts or legal obligations of the HOA, and potential impacts on property values. So, if you are buying a condo with an HOA, chances are you’ll have to deal with them all your life or as long as you are there!

2. High HOA fees Might Drill a hole in your pocket

You thought the HOA rules were the only problem; HOA rates are even worse! HOA rates? They’re fees you pay to cover the maintenance of common areas in condos and to compensate those who manage the HOA. Given the upscale lifestyle of Condos, HOA rates can be quite high!

So while owning a condo means you have a pool, a world-class gym, security, and more. You also pay a hefty monthly fee to the Homeowners Association for its maintenance.

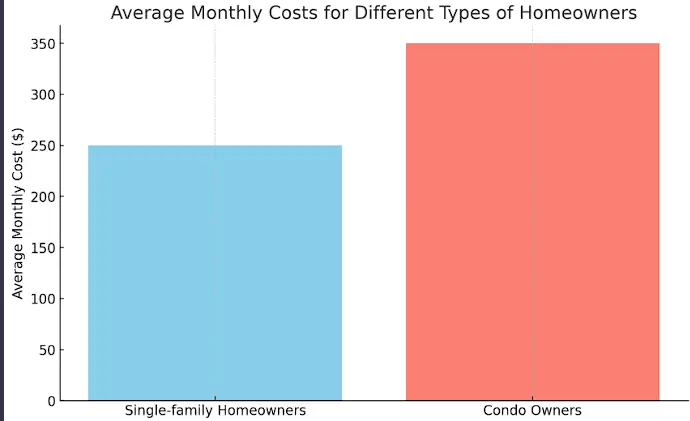

HOA fees for condos can cost you almost twice as much as in a single famil home :).

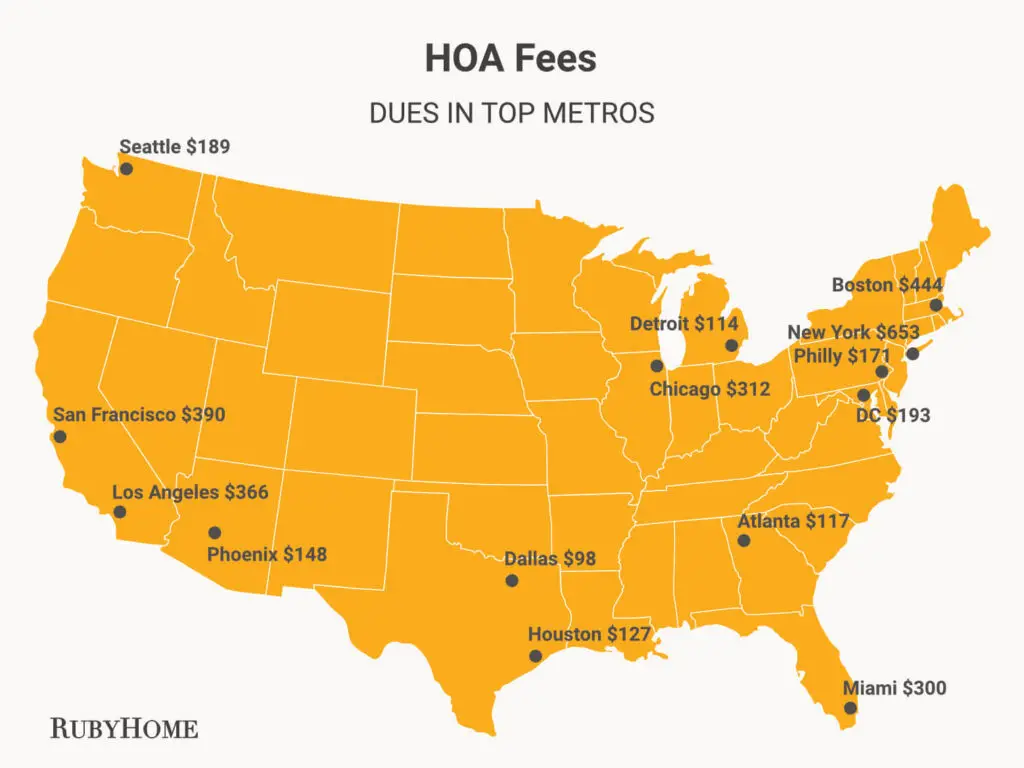

Just to give you an idea, here are the approximate monthly HOA fees in top metros.

On top of that, these fees also vary based on market conditions and can increase every few years.

For example, in 2022 alone, HOAs have increased annual fees by 3-5%. In addition, most HOAs had to increase this fee to 10-15% to keep up with the inflation. In addition to the fixed monthly HOA fee, you will be expected to shell out any future construction plans or beautification projects planned by your HOA. You might end up paying for a dog park even if you don’t own a pet.

The HOA Fees depend on two significant factors:

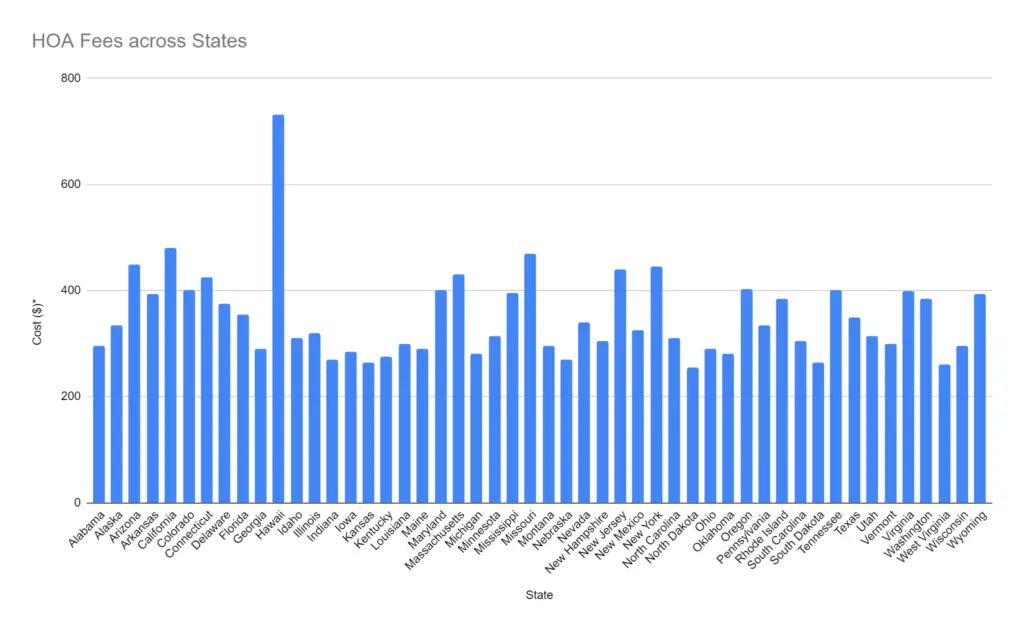

2.1 The City and State you are living in

The HOA fee will also vary according to your city and state. While you can pay an average of $653 in HOA fees for upscale places like New York, in Dallas, this may cost you around $98.

These numbers are according to the American Housing Survey- the most comprehensive national housing survey in the United States.

2.2.Quality of your condominium building, location, and size

The more amenities your condominium building has, the more HOA fees you pay! Upscale establishments with a gym, swimming pool, parking lot, etc., can charge anywhere between $500-$1000 as the monthly maintenance fee.

| 📖Also read: Buying Land in Texas |

3. It’s hard to get a loan for a condo

Unless you have enough cash to purchase a condo or a 20% deposit to secure a mortgage, you will need an FHA loan to purchase a condo.

The problem? You need to qualify some strict guidelines set by The Federal Housing Administration. You and the HOA of your chosen condominium must both qualify for an FHA loan.

To qualify:

- The HOA has to ensure that- no single owner should have more than 10% of the total units.

- A minimum of 50% occupancy should be completed, and most units should be ‘owner-occupied.

- A maximum of 49% of the units are investor-owned or rented out by the investor.

- Commercial spaces should be limited to less than 50% The property, including the common areas, must be “substantially complete.” That means all significant constructions must be completed before you can secure a loan. The condominium must be at an appropriate location.

- It should be close to a well-traveled road, railway station, airport, or military base.

- The property cannot fall under a bad or less-than-optimal location. For instance, it cannot be near a landfill.

- No restrictions on renting units or lenders’ right to foreclosure in case of non-payment of the loan.

- The FHA also takes into consideration the financial health of the HOA.

The FHA will review financial records to ensure that- A minimum of two years’ worth of funds are available in the reserve account of the HOA.

- A dedicated 10% of the total funds collected by the HOA goes into the reserve account.

- Only 15% of the residents (0ver 90 days) can be in debt to the HOA regarding monthly HOA maintenance fees, special assessment fees, and fines.

- It is much easier to secure a single-family home loan than a condo.

The Federal Housing Administration helps thousands of families buy their dream homes every year, yet they, too, have something against condos!

4. Bad neighbors

Bad neighbors can wreak havoc in your life. And you cannot choose your neighbors in a condominium community. You will have neighbors downstairs, upstairs, and even across your hall. You can hear them come up and go down the stairs.

You will listen to all their arguments and fights. Many condo owners and tenants have horror neighbor stories they have witnessed and lived through!

In 2018 an elderly California woman was arrested for shooting at her neighbor’s three kids with a shotgun. She was angry with them for being noisy! Fortunately, no one was hurt in the incident, and the woman was promptly arrested. In another incident, a Florida man chased his neighbor down with his tractor over a land dispute. His wife had to call 911 for rescue.

Source: 1

If you are an investor and have rented out your condo- it will become your responsibility to mitigate neighbor disputes. Bad neighbors can cause your tenants to leave early and unexpectedly.

This means more vacancies and a higher tenant turnover. If you are a condo renter, you should know that many landlords and HOAs are unhelpful or inconsiderate. In case of any neighbor disputes, you may have to intervene yourself. This can be both cumbersome and emotionally draining.

| 📖Also read: Buying a Non-Conforming Property |

5. Potentially Mismanaged Funds

The state government requires every condo community to create bylaws and articles of incorporation to run the condominium. The HOA is the governing body of condo owners who have volunteered or won by-elections.

If a group of investors owns the condo building, they can hire a property management company as the governing body. But where there is money, there is the risk of mismanagement. And unfortunately, many HOAs are run by corrupt or financially illiterate people. If you end up in a poorly managed HOA, get ready to pay hundreds of dollars in fines and infractions!

How an ill-managed HOA can cost you

5.1 Sudden Assessment Fees

According to a report by the Bellingham Herald, the Sudden Valley HOA tried to increase their monthly fees from $832 to $1237 to cover unexpected expenses. A well-planned HOA would have kept aside a minimum of 10% of HOA fees collected by each member in the reserve fund for emergency and long-term expenses.

If an HOA does not have enough funds in the reserve account, they can charge a ‘Special Assessment Fee’ to cover the sudden expenses. The special assessment fee is a one-time lumpsum amount expected from every member- this can run into thousands of dollars.

In some cases, the HOA can even force homeowners to sell their condos in case of defaults in payment.

5.2 Unqualified contractors

Nepotism exists even in an HOA. HOA members sometimes hire family and friends for repair or maintenance work around the condominium. They may be incompetent, but that doesn’t matter.

To cut costs, an ill-managed HOA may hire a company that offers the cheapest quotes, which can be dangerous as they will deliver poor-quality work. An uninformed HOA may hire contractors that charge excessive money for simple repairs. Ultimately you pay the price through high HOA fees and special assessment fees!

5.3 Ridiculous HOA fines

The HOA can control many aspects of ‘how you live’ in the condominium. HOAs around the USA have enforced some pretty bizarre laws. For example, a Florida HOA levied a $100 daily fine on a couple for putting up Christmas decorations early and even took legal action to enforce their ridiculous rule. In another incident, a Tennesse resident was forced by her HOA to remove the ‘For sale’ sign on her front yard because they had a no signs policy. She was forced to move the sign indoors where no one could see it.

5.4 The Reserve Fund

Every HOA must have two accounts – The reserve/emergency fund and the operating account. You may think that the hundreds of dollars in monthly HOA fees should cover both accounts- but an ill-managed HOA can charge sudden assessment fees to cover emergency expenses that you are legally required to pay!

The reserve fund should cover long-term expenses such as resurfacing the parking lot, fence and rooftop maintenance, or building a new garden. In addition, the reserve fund should be available during any emergency. But most of the time, the HOA members spend the reserve fund on unnecessary property updates and changes like a solar-powered bus stop for kids.

In case of a real emergency, such as a tree crashing into the roof, the HOA will be left scrambling to fund the repair. If the reserve fund has insufficient balance, the HOA will levy a ‘Special Assessment Fee’ on all members. According to a study by the Association Reserves, over 70% of HOAs are underfunded and ill-equipped to handle emergency expenses.

5.5 The Operating Account

The HOA operating or checking account is meant for regular and recurring expenses in a condominium. The HOA must take care of lawn mowing, pool maintenance, snow shoveling, and garden maintenance with the operating account. The HOA may charge you hundreds of dollars instead of such expenses but may not do even 50% of the promised work.

Living in a condo may look like you are in your favorite sitcom, but dealing with a tyrannical HOA is a nightmare. Before investing in a condo, ensure you know everything about the HOA, especially how they manage the monthly expenses.

| 📖Also read: What not to tell your agent when buying a house |

6. Lack of Privacy

When you live in a condo, you become part of a community. And there will be lots of people in that community.

The sweet grandma who smells like cookies, rowdy teenagers, nitpicking Karens, you never know who ends up living next door.

Noisy and nosy neighbors can become a menace. Cameras also surround many condominiums for security reasons.

But you always need to find out who is monitoring the feeds. You could end up in an intrusive atmosphere run by an ill-managed HOA. If you are looking for a quiet and peaceful residence, you may not be ready for the condo life.

7. Difficult in Selling

Reselling a condo can quickly become a nightmare for multiple reasons, and as a homeowner, you only have limited control over the selling process of your condo.

The financial limitations of your potential buyer, strict FHA rules, ill-managed HOA, and limited buyer interest can ruin your chance to recoup your money from a condo investment. Here are a few factors that will influence the sale of a condo-

7.1 Limited Market

First, living in a condo is not meant for everyone, drastically limiting your buyer market. Most families want a yard for their children and pets, so they prefer a stand-alone home. Many people want to avoid adjusting to neighbors living near them or following the strict HOA rules.

7.2 Unappealing HOA

Even if someone does fall in love with your home, the HOA can seem unappealing to the buyer for all the reasons we have mentioned above. Your HOA plays a significant role in your selling process. An underfunded and mismanaged HOA is offputting for most buyers as securing a loan against such properties is challenging.

Any pending litigations against the HOA will deter potential buyers as most lenders are not keen on financing such properties. If the community has too many renters, it becomes unappealing to potential buyers. Empty units: Empty condo units pose another problem for sellers. All units of a condominium are similar in size and design. If your HOA has many vacant units, those will sell first.

8. Some condos limit or prohibit renters

Before purchasing a condo for investment opportunities, it is best to learn about the rental policies of your condominium building.

Many HOAs create strict guidelines against renting to protect the integrity of the community. While this can conserve the look and feel of the condominium, it is terrible news for investors.

Some associations may even create bylaws that outright ban tenants in the condominium. Or allow only a certain number of units to be renter-occupied. Rental policies are not the only hurdle created by the HOA.

The strict and often intrusive rules of an HOA can be unappealing to a renter.

9. Slow appreciation

The appreciation on a condo is much slower and less than that of a single-family home. Most people prefer to invest in a single-family home instead of a condo. The lack of demand slows the rate of appreciation on condominium properties.

One of the most significant drawbacks of a condo is the lack of land ownership. This further lowers the market value for a condo. On top of all that, if your HOA does not maintain the property or has financial troubles, your property value will plummet further.

Having said that, in some regions, condos do appreciate

9.1 How Much Do Condos Appreciate per Year?

According to the National Association of Realtors (NAR), the median condo price in the US has increased by 22.9% in the last five years. It is predicted that the appreciation will slow down in 2023 and only increase by 5.5%.

Condo appreciation is based on several factors: location, condition, amenities, and overall market conditions. For example, the median condo price in San Francisco increased by 36.9% in the five years leading up to June 2023, while the median condo price in Detroit increased by 1.5% over the same period.

10. Overhead expenses

A condo is cheaper than a single-family home, but you must remember to factor in the monthly HOA fees, fines, and special assessments.

Monthly HOA fees can be between $100- $1000, depending on the location, amenities, and security provided at the condominium.

The more luxurious the condo, the higher your expenses. In addition to the HOA fees, emergency repairs and beautification projects are charged to the homeowners.

11. More financial obligation than single-family homes

When you own a single-family home, you decide on maintenance, repairs, and construction projects around your property.

But when you live in a condominium, the HOA makes all financial decisions on your behalf. You may incur unexpected and huge expenses when living in a condo.

The monthly HOA fees can skyrocket if your condominium has luxury amenities such as a clubhouse, tennis court, gym, etc. Always overestimate your budget when investing in a condo!

12. Parking Issues

By their very nature, Condo apartments are compact spaces in upscale buildings. This means there is limited parking for the residents.

Even if the condominium premises are enormous, the parking space between condos is limited. So if you want to host your family and friends in your home, you may have to ask them to come by Uber.

The lack of parking space and privacy limits your buyer pool when ready to resell your condo. Most people own a vehicle and want enough parking space near their homes for convenience and security.

There are condominium properties that offer ample parking space. But often, these properties are luxurious close-gated communities with high HOA rates.

13. No land ownership

When you invest in a condo, you do not invest in land. The plot on which the condominium complex stands belongs to all homeowners.

On the other hand, when you invest in a single-family home, you also become the sole owner of the land on which the house is built. ‘Land’ is a limited resource with an appreciating value and an excellent choice for future investment. Remember, it is land that appreciates and buildings that depreciate.

14. Ever-Increasing Condo Fees

The HOA can increase the monthly maintenance rates every few years to account for inflation. On top of that, the HOA can hit you with a substantial one-time payment, sometimes running into thousands of dollars in lieu of special assessment fees. Before investing in a condo, read all the HOA documents carefully.

If there are no restrictions on the ‘Fee increase percentage,’ the HOA may suddenly double or even triple the amount you owe them. If you fail to pay the HOA, they can even foreclose your property or make your life hell within the condominium.

Why Buying a Condo is a Bad Idea For Rentals?

Condo properties with excellent locations seem like attractive investment opportunities. It is within walking distance from upscale restaurants and grocery shops and has a world-class gym. What’s not to like?

Investment properties mean you need a down payment of 20%- 25% on the unit’s total cost. If you purchase a condo worth $200,000, you will need approximately $50,000 to secure a low-interest loan.

However, securing a loan with the FHA for a condo property is way more complex than just sorting out your down payment.

To profit from investment properties, you should:

- Get a minimum of 1% monthly rent. On a $200,000 condo, you should get $2000 monthly rent.

- Factor in the high HOA monthly fees, which can be between $500 and $1000, cutting your rent in half.

- In addition, you will also have to consider the rules of your HOA. The HOA controls the community rules, which means they can restrict your rental options (or ban tenants from the condominium) and even impact your ability to get a low-interest loan.

On top of that, any infringements committed by your renter will be your responsibility. If other homeowners in the condominium fail to pay the monthly rates, your HOA fees can increase. Fines and infractions with the HOA can lead to foreclosure, which means you lose all your investments.

Condos can be a great addition to your investment portfolio but require due diligence and asking for HOA documents upfront before investing. Some agents may try to avoid showing you the HOA docs before buying, which can lead to unpleasant surprises later. Make sure you know everything about the HOA and property before committing. Best of luck!

I am 60 years old. In a few years I will retire. A house is not an option at this time. HOA on my previous house was a pain but it kept the neighborhood clean. You did not mention that home insurance in some states is getting unaffordable and very few to consider.

Great point! Thank you so much for the feedback. Indeed HOAs take care of all maintenance services which would have painstaking otherwise. And I do not even want to get started on the surging home insurance premiums :). Will definitely add this point and revise.