Are you planning to sell a house in New Jersey and feeling overwhelmed by the potential costs, especially those sneaky realtor fees? You’re not alone. After all, realtor commissions alone can eat up about 6% of your home’s selling price. Add in expenses like prepping your house for sale – think painting, window washing, carpet cleaning, repairs, and staging – and you might feel your budget tightening.

But hold on, what if we told you there’s a way out of this expense labyrinth? What if we told you that you don’t necessarily have to shoulder the entire realtor fee, and sometimes, you may not need to pay any commission at all? Surprising, right?

Before you start celebrating, let’s understand the ins and outs of realtor commissions and uncover the secret to drastically cutting down the commission sellers pay to agents. So, are you ready to join us on this journey to savings?

What is a realtor fee or commission?

A realtor fee, often called a commission, is a payment made to a real estate agent for the services they provide in facilitating the sale or purchase of a property. This fee is typically calculated as a percentage of the property’s sale price.

When selling or buying a house, sellers and buyers take the assistance of agents or realtors to help them with the complex buying and selling process.

As the case may be, these agents hunt for buyers, and take care of all the paperwork, legal requirements, negotiations, and showings, and generally advise their clients on the best way to go about things.

They ensure the smooth transfer of the property from the seller to the buyer. These agents charge their client’s a realtor fee or commission for their services.

How does the realtor commission work in New Jersey?

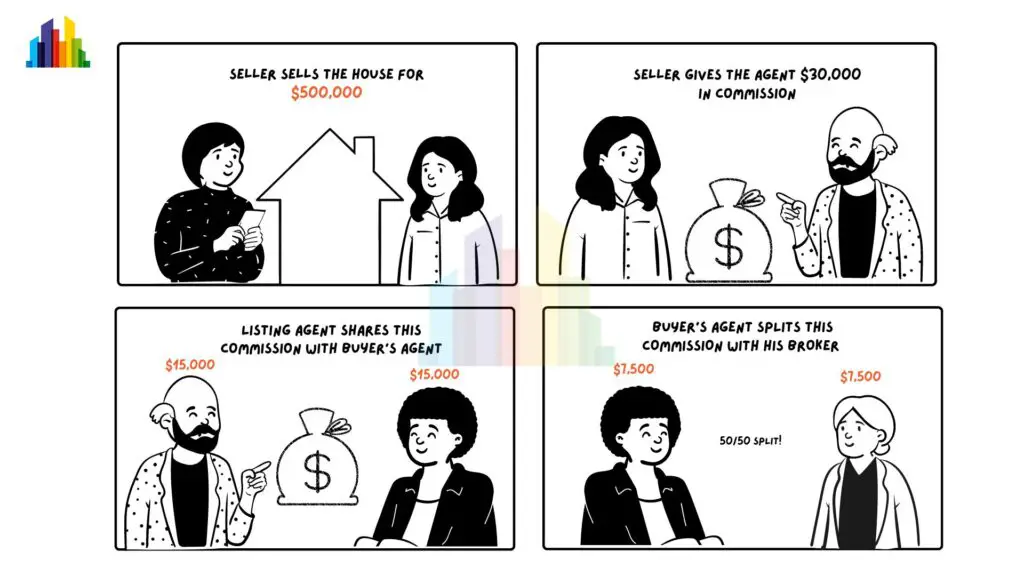

When someone decides to sell a house, they hire a listing agent. The seller and the listing agent negotiate the commission. The commission is a percentage of the home price and is paid at closing.

Once determined, the commission is included in the home price. This commission consists of the listing agent’s and buyer agent’s commissions.

Once the deal is finalized and the buyer pays the price of the home, the seller pays the commission to the listing agent. The listing agent then pays the buyer’s agent’s commission.

What are commission splits?

In New Jersey, as in the rest of the country, real estate agents cannot receive commissions directly from the buyer or seller. Instead, they must work under a broker with a higher license to accept commissions.

In addition, the agent’s broker advises and guides the estate agents, sometimes providing them with the infrastructure needed. For these services, the broker charges the agent a percentage of the commission. This sharing ratio is called the commission split.

The buyer and seller agents will have their individual brokers for a transaction. The commission split can be whatever has been decided between the agent and their broker. For example, splits could be 50/50, 60/40, 70/30, or even 80/20. The split goes in the agent’s favour as they gain more experience. While a new agent might start with a 50/50 split with their broker, an experienced agent might have an 80/20 split in their favour.

Let’s take an example of a $500,000 home. A 6% commission works out to $30,000.

Commission = Home price X Commission rate

= $500,000 X 6%

= $30,000

If this commission is split equally between the agents and their brokers, each will get $7,500.

Each agent/broker’s commission = Total commission ➗ 4

= $30,000 ➗ 4

= $7,500

Let’s look at how the commission split works out for different split ratios.

| Total commission | Split | Buyer/Seller agent’s share | Buyer/Seller broker’s share |

| $30,000 | 50:50 | $15,000 ($7,500 each) | $15,000 ($7,500 each) |

| $30,000 | 60:40 | $18,000 ($9,000 each) | $12,000 ($6,000 each) |

| $30,000 | 70:30 | $21,000 ($10,500 each) | $9,000 ($4,500 each) |

| $30,000 | 80:20 | $24,000 ($12,000 each) | $6,000 ($3,000 each) |

To keep matters simple, however, in this article, we will talk about the buyer and seller agents, who are the two most involved with their clients.

4. How much is the realtor fee in the US?

The average US home price is $354,165, and the average commission is 5.37%. So the commission works out to $19,119.

Commission = Home price X Commission rate

= $354,165 X 5.37%

= $19,019

If this commission is split equally between the agents (we will ignore the broker split, for now, to keep things simpler), each will get $8,008.

Each agent’s commission = Total commission ➗ 2

= $19,019 ➗ 2

= $8,008

For the latest average US home price, click here.

For the latest average US real estate commission, click here.

4.1 How much is the realtor commission in New Jersey

The realtor fee in New Jersey is currently around 5.13%. The average New Jersey home price is approximately $467,384. So the commission works out to $23,977.

Commission = Home price X Commission rate

= $467,384 X 5.13%

= $23,977

If this commission is split equally between the agents, each will get $11,685.

Each agent’s commission = Total commission ➗ 2

= $23,977 ➗ 2

= $11,685

4.1.1 How much does the commission vary in New Jersey?

Since the commission is a percentage of the home price, it will vary depending on how high or low the home prices fluctuate within New Jersey. So let’s look at what the commission amounts to for a range of home prices and commission rates in New Jersey.

| Home price range | 4.5% Realtor fee | 5.13% Realtor fee | 6% Realtor fee |

| $375,000 to $425,000 | $16,875 – $19,125 | $19,238 – $21,803 | $22,500 – $25,500 |

| $450,000 to $500,000 | $20,250 – $22,500 | $23,085 – $25,650 | $27,000 – $30,000 |

| $525,000 to $575,000 | $23,625 – $25,875 | $26,933 – $29,498 | $31,500 – $34,500 |

| $600,000 to $650,000 | $27,000 – $29,250 | $30,780 – $33,345 | $36,000 – $39,000 |

| $675,000 to $725,000 | $30,375 – $32,625 | $34,628 – $37,193 | $40,500 – $43,500 |

4.1.2 How much does the commission vary in the counties of New Jersey?

The commission will vary in the counties of New Jersey depending on the home price in each county and the location in the county.

Typical home prices in the top 20 counties of New Jersey range from a high of $632,072 in Cape May to a low of $281,872 in Camden.

For different commission rates, let’s look at the commission amount in these 20 counties in New Jersey.

| County | Typical Home Price | Commission as 4.5% of home price | Commission as 5.13% of home price | Commission as 5.5% of home price | Commission as 6% of home price |

| Somerset | $544,191 | $24,489 | $27,917 | $29,931 | $32,651 |

| Morris | $564,582 | $25,406 | $28,963 | $31,052 | $33,875 |

| Bergen | $621,747 | $27,979 | $31,896 | $34,196 | $37,305 |

| Middlesex | $456,139 | $20,526 | $23,400 | $25,088 | $27,368 |

| Mercer | $355,937 | $16,017 | $18,260 | $19,577 | $21,356 |

| Hunterdon | $520,552 | $23,425 | $26,704 | $28,630 | $31,233 |

| Monmouth | $630,223 | $28,360 | $32,330 | $34,662 | $37,813 |

| Burlington | $339,513 | $15,278 | $17,417 | $18,673 | $20,371 |

| Hudson | $580,803 | $26,136 | $29,795 | $31,944 | $34,848 |

| Union | $512,130 | $23,046 | $26,272 | $28,167 | $30,728 |

| Camden | $281,872 | $12,684 | $14,460 | $15,503 | $16,912 |

| Gloucester | $309,137 | $13,911 | $15,859 | $17,003 | $18,548 |

| Cape May | $632,072 | $28,443 | $32,425 | $34,764 | $37,924 |

| Sussex | $359,037 | $16,157 | $18,419 | $19,747 | $21,542 |

| Atlantic | $312,257 | $14,052 | $16,019 | $17,174 | $18,735 |

| Warren | $348,649 | $15,689 | $17,886 | $19,176 | $20,919 |

| Essex | $558,141 | $25,116 | $28,633 | $30,698 | $33,488 |

| Ocean | $463,598 | $20,862 | $23,783 | $25,498 | $27,816 |

| Passaic | $477,256 | $21,477 | $24,483 | $26,249 | $28,635 |

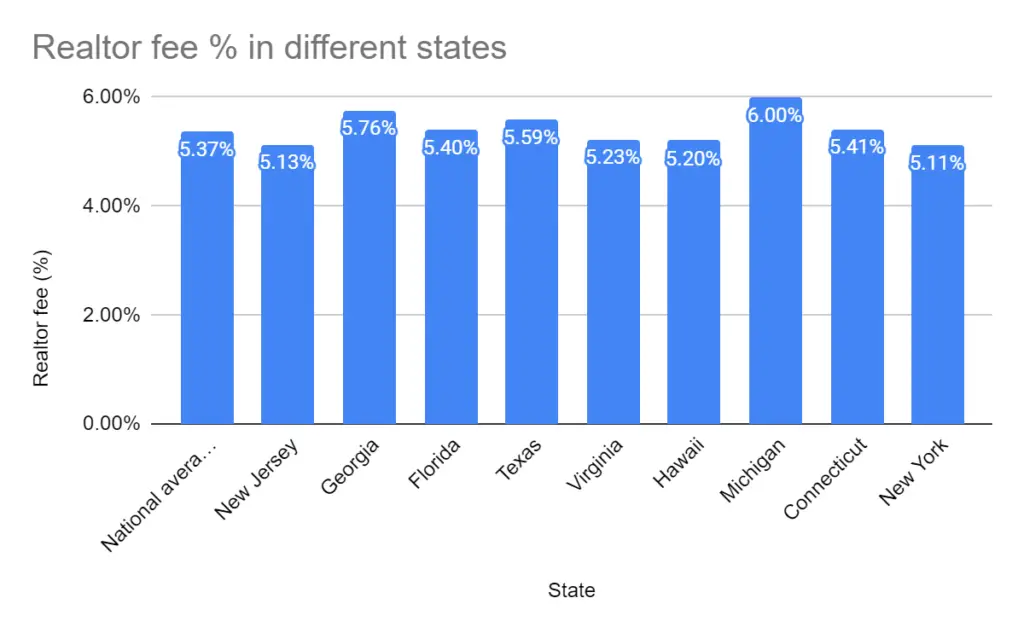

4.2 How does the realty fee in New Jersey compare to other states?

Realtor commissions will vary from state to state within the US, depending on the state of the real estate market in that location. Let’s compare the realtor commission rate in New Jersey to some other states.

| State | Realtor fee (%) |

| National Average | 5.37% |

| New Jersey | 5.13% |

| Georgia | 5.76% |

| Florida | 5.40% |

| Texas | 5.59% |

| Virginia | 5.23% |

| Hawaii | 5.20% |

| Michigan | 6.00% |

| Connecticut | 5.41% |

| New York | 5.11% |

5. Who pays the realtor fee in New Jersey?

Just as in the rest of the US, the seller pays the commission in New Jersey. This is because the home price includes the commission and can only be paid to the agents once the buyer pays the money.

Since the buyer pays the home price, which includes the commission, it can be said that technically it is the buyer who pays the commission. The seller only receives the balance of the home price after deducting the commission.

5.1 Who pays the commission on the rental deal in New Jersey?

Unlike in most of the US, New Jersey is one of the few states where the tenant pays the realtor fee in case of a rental. Connecticut, Massachusetts, and New York are some other states where this is the norm.

If the rental ad specifies such terms as “OP” or “No Fee,” the landlord will pay the realtor commission. OP stands for owner pays. In these cases, the renter does not have to pay the agent. This is usually the practice in states where the tenant pays the realtor fee.

Remember that this fee will be shared by the landlord’s agent and your agent (this may not be equally divided), so you would be required to bring two checks to pay the commission.

Make sure you know how much to pay each of them before you sign the rental contract, as these things must be sorted out first to avoid confusion and misunderstandings.

6. Is the realtor fee tax-deductible?

The realtor fee is not tax-deductible the way you deduct mortgage interest. However, the IRS treats commission as an expense related to the sale.

Therefore, it allows you to remove it from the home price while calculating your profit or capital gain. This will bring down your capital gain tax.

In other words, the IRS considers the sale basis as your selling price rather than the actual price at which the home is sold.

The sale basis is calculated as the home price minus all related expenses such as realtor fees, legal costs, escrow fees, etc. The seller will have to pay a capital gain tax on the profit after deducting all these expenses.

For example, let’s take two scenarios.

Case 1

Suppose you sell a house for $500,000, and there is no realtor commission. If the house was purchased for $400,000, your profit on the sale is $100,000. Since there is no realtor commission, your sale basis will equal the home price.

Sale basis = Home selling price – Realtor fee

= $500,000 – $0

= $500,000

Capital gain = Sale basis – Purchase price

= $500,000 – $400,000

= $100,000

The seller will have to pay a capital gain tax on a profit of $100,000.

Case 2

In the above example, if the seller paid a realtor fee of 6%, this would amount to $30,000, as calculated earlier at the beginning of the article.

Sale basis = Home selling price – Realtor fee

= $500,000 – $30,000

= $470,000

Capital gain = Sale basis – Purchase price

= $470,000 – $400,000

= $70,000

The seller will have to pay a capital gain tax on a lower profit of $70,000, effectively bringing down the tax amount.

6.1 Tax exemption of $250,000 to $500,000

The IRS allows a tax exemption of $250,000 if you file taxes as a single person. However, if you are married and file your tax returns with your spouse, you get a tax exemption of $500,000.

The only criterion for availing of the above exemption is that the house should have been your primary residence, and you should have stayed for at least two of the five years immediately preceding the sale.

6.2 Is the realtor fee tax-deductible in the case of rental property?

If the landlord pays the commission, the IRS lets them write off the commission in the year they pay them, mainly because these are short leases. However, in the case of a sale of a rental property, the seller can deduct the commission from the sale price, as mentioned earlier.

6.3 Commission on commercial property

Commission on commercial property is treated differently. Because of the long-term nature of such leases, the IRS lets you deduct the commission over a more extended period. For example, if the lease is for four years and you have paid a commission of $40,000, it lets you write off $10,000 yearly.

7. Should you negotiate the realtor fee in New Jersey?

Yes, you should always negotiate the realtor fee. The realtor fee is not fixed and varies from deal to deal. Suppose you save 1% of the home price in terms of commission on a house selling for $500,000. This means a saving of $5,000, which is not a small amount.

The New Jersey housing market is hot, with prices rising quickly. Over the last year, prices have increased by over 15%, and properties don’t remain on the market for long. So it’s a seller’s market where listing agents don’t have to overwork themselves to sell your house.

This means they will be expecting you to negotiate the commission. Only those not aware that you can negotiate commission will be caught unawares and pay the full commission.

8. When to negotiate realtor commissions in New Jersey

Some situations make it easy for the seller to negotiate realtor commissions. If you know these, you can quickly capitalize on them and get the best deal from your agent.

Let’s look at some of these situations.

8.1 When you are selling a high-priced property

If you are selling a high-priced property, for example, a $1M house, you should undoubtedly negotiate for a lower commission.

This is because even a 5% commission on a $1M house works out to $50,000, which is a considerable sum. Agents usually spend the same amount of time and effort on the deal, irrespective of how the property is priced. Since they already earn a hefty sum, they will more likely agree to a lower commission to gain your business.

Another thing to remember is that selling a premium property like yours will be a feather in the cap for any agent.

It increases the chances of them getting more high-priced properties in the future since they will add them to their resume. Therefore, they will indirectly add to their future earnings by selling your property. You can point this out to them while negotiating.

8.2 When the agent is new

Agents just beginning their careers are more likely to reduce the commission than experienced agents. This is because new agents are looking for a break where they can prove themselves. Therefore, the more deals they have on their resume, the higher they earn.

However, getting those initial deals can be challenging. In such a situation, you can promise to give a new agent your business if they will reduce the commission to your expectations. Chances are, they will agree.

8.3 In the case of a dual agency

If your listing agent is also the buyer’s agent, the agent already earns a double commission. This is called a dual agency.

In this situation, the agent is more likely to agree to a lower commission because of the higher income they earn from a single deal. However, sellers avoid dual agency because a single agent cannot act in the interests of both the buyer and the seller. The buyer needs the lowest price, and the seller the highest price.

There is an inherent conflict of interest here. This is why the dual agency is banned in a few states: Wyoming, Alaska, Vermont, Colorado, Florida, Maryland, Texas, and Kansas. In states where it is not illegal, such as New Jersey, dual agency is strictly monitored, requiring the agent to take written approval from the buyer and the seller. The agent must also disclose the dual agency to all the parties in the transaction, including the lender.

A dual agency generally works well when there is little chance of a dispute and when the agent does not have to work in the interest of any single party. For example, if you are selling the home to someone within the family or a close friend. In such cases, the price is usually already agreed upon by both parties, and the transaction will mostly be concluded amicably. The agent is merely needed to facilitate the trade—to ensure that all paperwork and legalities are correctly done.

8.4 In a seller’s market

A seller’s market is when the seller has the upper hand. This happens when there are plenty of buyers, and you will likely get multiple offers on the house. New Jersey, by all standards, is a seller’s market. In other words, half the agent’s work is already done since they don’t have to go hunting for a buyer by spending on advertising and promoting the house. Since this cuts down the agent’s costs and efforts, they will likely agree to charge you a lower commission.

8.5 When you already have a buyer

If you already have a buyer in place and only need the agent to facilitate the deal, you can negotiate hard for a drastic cut in the commission. The agent merely does the paperwork and legalities to ensure a smooth house transfer. This is, again, literally half the work of a traditional agent. You can point this out (though it will hardly be required) to the agent and ask them to reduce the commission.

8.6 When you do not require complete services

You can negotiate for a lower commission if you do not require the complete services an agent offers. For example, if you can meet prospective buyers and show them the house on your own, this will save the time and effort of the agent. They will be willing to pass this saving on to you as a reduced commission.

8.7 When you have a ‘sale-ready’ house

It is a significant advantage if you have already done up the house to make it ready for buyers. For example, you may have recently painted the home, mowed the lawn, cleaned the windows, or even made minor repairs so that the house is ready to be shown to buyers.

Some of this is usually done by the agent, and since you have already done it, it will save considerable cost for the agent. In addition, all agents like to see a home that is ready for prospective buyers to see. In such a case, you can negotiate a lower commission.

9. How to negotiate a lower commission in New Jersey

It’s good to know when to negotiate when the chips are in your favor. However, knowing how to negotiate when they are not is essential.

Here are some tips to get the upper hand. Be sure to read this section and keep these points in mind because real estate agents are expert negotiators and can quickly turn the tables if you are unprepared.

9.1 Listen to the agent’s advice

A real estate agent will ask you for details about your property and advise you on how to sell it quickly. For example, they might advise you to give it new paint or make some minor repairs to make it look attractive to buyers.

Agreeing to the agent’s advice will work in your favor because the agent will understand that you are willing to go out of your way to ensure a quick sale. And a quick sale means less time and effort spent on the deal for the agent. Hence they will be willing to consider your request for a lower commission.

9.2 Talk to multiple agents

If the agent understands that you are only talking to them, they will be less willing to make concessions since you don’t have much choice. So talk to multiple agents.

You will not only learn more about the state of the market when you talk to them, but you will also be able to negotiate by telling them that you will accept an offer from the first agent who offers you a lower commission.

Once they give you proposals, you can always select the one that best suits your purpose.

9.3 Never reduce the buyer agent’s fee

Many sellers try to reduce the buyer agent’s fee, but this is a big mistake. Buyer agents look at how much commission they will earn if they shortlist your home to show to buyers. If they see that you are not paying much, they may completely ignore your property, and you will either be left with a house that is not selling or will take a long time to sell. The seller agent knows this and may refuse to reduce their commission if you do this. Therefore, always pay the full buyer agent’s commission. You should only try and reduce the listing agent’s commission as far as possible.

9.4 Be willing to walk away

If you are unhappy with how negotiations are going, make it quite clear to the agent that you are willing to stop talks and walk away from the deal. No agent wants to lose a prospective customer, and if they have the capacity, they will try to keep you happy by reducing the commission as much as possible. After that, it is up to you whether to accept the deal or try your luck with another agent.

9.5 Do your research

It would help if you did some thorough research before you begin negotiations:

- Understand the market well, and find out the average commission in your area.

- Find out how many similar houses have sold on the market recently and how much they have sold for.

- Find out how quickly homes are selling.

All these answers will help you decide how much you can negotiate with the agent. You need to check how much leverage you have before you engage with agents.

10. How to reduce the commission without much negotiation

You can consider other options if you don’t want to negotiate or simply don’t have the time to haggle with agents. These are also workable solutions that will reduce the commission and ensure the house is sold quickly.

10.1 Selling FSBO

FSBO means For Sale by Owner. Here the owner does not hire a listing agent but decides to sell the house independently. This means saving on the entire listing agent’s commission.

You will still have to pay the buyer agent’s commission, though. Although this can mean saving a considerable amount of money, it also means that you will have to put in time and effort to ensure that the deal goes through smoothly. You will have to perform all the services of an agent.

This means staging the house, listing and promoting it on suitable media, meeting and showing the home to prospective buyers, negotiating, vetting the buyers’ proposals, drawing up the contract, etc. You need to be an experienced home seller to understand the complex process and have plenty of time on your hands.

If you are selling a house for the first time, you should avoid going via FSBO. When selling a home, a mistake can be costly, and you might lose much more than what you were supposed to pay the listing agent.

10.1.1 Flat-fee MLS service

Only agents, brokers, and realtors have access to the Multiple Listing Service (MLS) they use to list and search for houses on sale. Once listed on the MLS, you can rest assured that all the agents, brokers, and realtors can see the terms of the offer for sale.

There are hundreds of local MLS databases across the country, each updated with the latest houses for sale in a particular area. In addition, websites like Realtor.com, which is NAR’s (National Association of Realtors) own website, Zillow, and Trulia pull data from the local MLS and showcase it on their platforms.

This ensures a broader reach. If your house is not listed on the MLS, you are cut off from a significant source of promotion. This is usually one of the reasons sellers need to hire the services of an agent.

For those selling FSBO, however, flat-fee MLS services are a blessing. Flat-fee MLS services will put your house on the MLS by charging you a nominal fee of around $299-$399. Mostly, that is the only service these MLS services will provide.

If you’re worried that agents may ignore your listing because a flat-fee MLS service is involved, you need not worry. Agents need the best deal for their buyer clients, and if they ignore such listings, they will quickly lose clients and credibility. Just ensure you have not cut down on the buyer agent’s commission. You will have to mention this in the ad when selling FSBO. If buyer agents see that you are offering very little commission, they may ignore your listing. You must offer a minimum of 2.5-3% commission to a buyer agent—make sure you research the going rate in your area. Be liberal, as it increases the chances of buyer agents shortlisting your house to show to their clients.

Some of the top flat-fee MLS services in New Jersey include NJ Real Estate Boutique, Flat Fee Group, Realmart Realty, Houzeo, and Flat Fee Realty. Their charges range from $200-1,000, and some even offer a money-back guarantee. All of the above offer unlimited listing updates, except for Houzeo.

10.1.3 Fee-for-service

Sellers using the FSBO route may want to outsource some of the services of a traditional agent. For example, they may wish to help set up a yard sign or need a professional photographer to click photographs, or they may want an agent to make the contract or handle all the paperwork.

Some agents and brokerages offer fee-for-service options where they offer services on an a la carte basis. They will offer all the services a traditional agent provides, and you can pick and choose which of these services you want—they will only charge you for the services you need. Some MLS services also have this option so that you can check their service rates with them.

Fee-for-service companies can save sellers thousands of dollars in commission since they can do everything a traditional agent does. Moreover, the seller is still in charge of the whole process and can take help only when needed.

10.2 Selling to Investors

Investors are buyers who are looking for a good deal. They look for opportunities where they can buy at almost 50 to 60% below the market price to make a killing. If the seller cannot pay the EMI, is in no condition to do up the house and put it on the market, or is simply in a hurry to sell the home. For example, they may want to shift location quickly because a fantastic job opportunity can’t wait for 2-3 months for the whole sale process.

These investors are willing to buy the home at a much lower price than the market value and take care of the entire selling process. In addition, they will pay you quickly so you can take your plans forward without waiting too long.

10.3 Agent matching services

Today, some companies use technology to connect you with agents for free. Services such as Clever Real Estate and UpNest select and sign up with a vast network of agents. So when you’re selling a home and want to connect with a top agent near you, you must register on one of these websites.

They will not charge you a single penny, and you will be immediately connected to some of the top agents in your area. This is faster than setting off on your own to connect with agents and then selecting the top agent.

Some of these services pre-negotiate a lower commission, so you don’t have to waste time haggling for the same. In addition, all their customers automatically get a certain discount on the commission on signing up. Once you sign up and provide the details required, they will give you a list of agents you can talk to. If you are unhappy with this list, you can ask for another list. And if you are still unsatisfied, you can walk away without paying any fee. There is no obligation to sign their agents.

10.4 Discount brokers

Discount brokers offer you all the services of a traditional agent or broker at a much lower price. For example, some may charge you 1.5% of the home price as the listing fee. You will also have to pay the buyer agent’s commission. This still means a significant saving in commission.

Discount brokers earn money by taking on many clients at the same time. They have a team of agents who manage these clients. The idea is to reduce the cost of operations by making the whole selling process more efficient, increase the volume of transactions and reduce the charge to the client by passing on the saving. This is an overall win-win situation.

However, because discount brokers take on so many clients, their agents are spread thin, and you may not get the best quality of services. This would make sense if you are familiar with the selling process and can make up for the quality with your experience. Therefore, sign up with a discount broker only if you are confident of getting the best services.

Examples of discount brokers include Redfin, Houwzer, and Clever. Redfin offers a 1.5% listing fee and reduces this to 1% if you buy a home through their agent. Houwzer charges a flat $5,000 for listing. And Clever charges $3,000 for a listing or 1% of the home price if it sells for over $350,000.

10.5 IBuyers

iBuyers use technology to make a quick offer on your home. For example, they will estimate the price of the house and make you an offer. If you agree to the proposal, they will take care of the marketing and sale of the home.

The advantage is that they will make an all-cash offer, and you don’t have to get involved in the selling process. In addition, this kind of business shields you from the complex home-selling process. Many sellers don’t have the time or the inclination to go through the whole process, usually spread over a few months.

Each iBuyers has its own set of rules by which they operate. However, most of them offer a reasonable price for the home, and they usually prefer homes in good condition.

They aim to make minor repairs if needed and sell it to the next buyer quickly. iBuyers mostly earn money by charging the seller a 5% fee on the home price. You can decide when you want to move, and the iBuyer will accordingly pace out the sale.

11. What services does Realtor fee include?

To negotiate a lower commission, you need to know the services a full-service real estate agent provides. This is so that you don’t get cheated with the agent reducing the benefits to compensate for the lower commission they are charging you. You need to be able to insist on full service in addition to a lower discount. For this, let’s get familiar with the services of an agent.

11.1 Preparing the house for sale

Before the other tasks, preparing the house for sale is essential. Prospective buyers like to see a home they can move into with minimum work. Your house loses value if the buyer feels they must do a lot of work before moving in.

They are ok to pay a higher price for homes that are spick and span and which are ready to move in. So your agent can suggest what can be done to prepare the house. An agent usually has contacts with handly men, painters, etc., and they negotiate the best rates. Check the piping, fireplace, drainage, roof, etc., for any repairs needed. A good agent will help you get in touch with professionals who will get all these jobs done and also ensure that you get $2 for every $1 spent on such work when you sell the house. The idea is that you should get an excellent return on investment. Otherwise, they may ask you to leave things as they are if it involves too much expense.

In a seller’s market like New Jersey, houses usually sell quickly. But ensuring that you have prepared the place for selling will make it quicker.

11.2 Staging the House

The agent may advise the hiring of a professional stager. By decluttering the home, these stagers will make the house look spacious and appealing to prospective buyers. For example, if there’s too much furniture, they might advise only keeping the bare minimum so the buyer can feel there is plenty of space.

You will be surprised how these small changes will make the house look different from a buyer’s point of view. Staging may not cost you much but will add to the value of your home. For example, if you are selling a million-dollar home, spending a few thousand to make it look appealing will make sense if you get a much higher price.

11.3 Hiring a professional photographer/copywriter

Getting the best possible pictures of the house is crucial because these will give buyers a first impression. These photos will draw in the buyers. So an agent may hire a professional photographer to click the best possible photographs. The agent will get some websites to do a 3D scan of the house so that buyers looking at it online from their homes can even get a feel of the place. An aerial video using drones will also give buyers a different feel since this is not generally done.

These photographs and videos must be accompanied by some great copy that will beautifully bring out the features. Copywriters are the best people to do this. Your agent may hire a copywriter to write a good description of your house and probably even bring out features that are not visible in the photographs. For example, mention how the sun shines directly into your home, which is east-facing, or how the surrounding area truly complements your house.

There are many ways to present your house, and it is up to you how far you want to go in this case. Your agent will advise you on this to get the best return on the money spent.

11.4 Price the house just right

The agent will look at houses nearby and what is the going rate. Then, they will compare the features of your home with those that have been sold recently. Then, they will look at what prices they have sold.

Finally, they will analyze your house’s ideal price in a comparative market analysis. They will also speak to their colleagues in the business to get a feel of how much a buyer will pay. All this research is done in the background, possibly without you being aware. However, this is one of the crucial services provided by any agent.

Getting the price right is essential because if your house is overpriced, few agents will shortlist it, and if it is underpriced, it could mean a considerable loss of thousands to you. The agent will balance all these things while arriving at the final price.

11.5 Marketing the house

After this, it’s time to market your house. The agent will list it on the local MLS so that buyer agents can see the details. The agent may also advertise in the local newspapers and magazines, make flyers to distribute in the right circles, and place a yard sign saying “For Sale”.

Agents know the best places to advertise to reach prospective buyers quickly. If required, the agent will also suggest holding an open house so people can walk in and see the house for themselves before making a decision.

These open houses are an excellent way for the agent to network with prospective buyers and give instant feedback on what attracts clients and what can be done to improve your chances of selling the house quickly. For example, you may have missed out on some repairs, or buyers may not like the placement of too much furniture, and you can get this changed quickly.

11.6 Scheduling and supervising home showings

Sellers are usually busy and cannot meet every prospective buyer. Therefore, the agent’s job is to meet them and show them the house. The agent will schedule such showings and make sure they are present during them to answer any questions the prospective buyers have regarding the house, such as when significant renovations were done or are there any issues with the piping, etc. The agent will also update the seller on the feedback from such showings if it helps improve the house.

11.7 Paperwork and Contract

The agent will put all the paperwork in place. They will keep abreast of all the local and state laws and keep all the required reports ready. Drawing up the final contract is something they do regularly, so they will ensure that all the clauses and fail-safes are in place to ensure that your interests are taken care of. Many contingencies can crop up in a house deal, and agents are aware of things that can go wrong and will help you be prepared for such events. For example, suppose the prospective buyer needs to confirm the actual area of the house. In that case, the agent will ensure that the inspection papers, previous agreements, etc., are ready and shown for verification purposes.

11.8 Vetting buyers and offers

Agents will also review any offers made by prospective buyers and evaluate them to check which ones are the best. For example, they will check if the buyer has the means to pay for the house, so that there are problems after the contract is signed. Offers not up to the mark will be rejected if they are not worth spending your time over. In this way, agents will also save you valuable time and effort.

11.9 Negotiation

Once you finalize offers, you will need to get into the negotiation. The agent will ensure that they conduct the initial talks, and you only need to step in to close the deal at the best possible price. For example, if you have stated that you will not accept anything below the asking price, the agent will reject all offers below that level.

The agent may ask the prospective buyers to come up with better offers. They will also advise you about which is the best offer to accept. For example, if the prospective buyer offering you the highest price has questionable sources of income, they might advise you to go with another reliable offer.

If further negotiation is possible, the agent will ensure you understand this too. For example, the client may have loved the house so much that they are willing to go the extra mile to secure the property. The agent may convince them to pay the buyer agent’s commission on their own to ensure a quick deal. This means you will save a good deal of money.

11.10 Closing the deal

Once the deal is finalized, the agent will ensure that they are present for the final signing of the contract. Then, they will schedule the meeting and ensure all the final paperwork is done correctly, with the parties’ signatures in the relevant documents. Finally, they will communicate all the terms and conditions regarding the last payment and the keys’ handover to the buyer.

12. FAQs

12.1 How much is the rental commission in New Jersey?

The rental commission could vary from deal to deal, depending on what has been agreed between the parties. Let’s look at some of the standard methods of paying rental commissions.

12.1.1 One month’s rent

This is probably the most popular method. Agents ask the tenant to pay one month’s rent as their commission. So if the monthly rent is $1,000, the agent collects this amount when signing the contract. Also, this amount will probably be shared with the tenant’s agent, so remember to bring along two checks at the time of signing.

12.1.2 A percentage of the yearly rent

Instead of a month’s rent, agents sometimes charge a percentage of the yearly rent. For example, if the monthly rent is $1,000, the annual rent will be $12,000. If the agent charges 10% of the yearly rent as commission, this will work out to $1,200.

Agent’s commission = Annual rent X 10%

= $12,000 X 10%

= $1,200

12.1.3 Extended lease agreement

If the landlord and the tenant want to renew the lease agreement at the end of the term, the contract may have a clause stating the commission to be paid to the agent while renewing/extending the lease. However, if there is no such clause in the agreement, the landlord and tenant can decide to go ahead without any commission if both are agreeable.

12.1.4 Property management companies

Sometimes landlords prefer not to handle the maintenance and leasing out of the property. In such cases, they hand over the property to a property management company. These companies will take care of minor repairs and maintenance, ensure the house is in good condition, and even look out for tenants. They usually charge the landlord a fixed percentage of the yearly rent for their services. In this case, the tenant usually does not pay any commission unless the landlord insists on such payment. This is because the New Jersey market works differently, and usually, the tenant pays the commission here.

12.2 What happens to the commission if the buyer does not have an agent?

The entire commission goes to the listing agent if the buyer does not have an agent. That is why most buyers are advised to hire a buyer’s agent. Buyer’s agents offer to work for the buyer for free, and many buyers believe them. Although this is not technically true since their commission has already been included in the home price, and the buyer will pay the home price.

If the buyer does not have an agent and insists on a lower price, the seller and the listing agent can decide how to proceed. If both agree to reduce the home price by how much would have been paid to the buyer’s agent, it will be a win-win situation for all. The listing agent will get the usual commission in this case and not a double commission.

Another alternative is that the buyer can ask the listing agent to act as a dual agent. Meaning the listing agent will be representing both the buyer and the seller. In this case, the listing agent can agree to rebate a portion or entire buyer agent’s commission to the buyer. This finally works for all parties concerned too.

12.3 What is BAC?

BAC stands for Buyer Agent’s Commission. The buyer agent’s commission is decided at the outset. The listing agent advertises the home on the MLS, mentioning how much commission will be given to the buyer agent. This becomes binding if the deal goes through. The listing agent will be paid on closing and will, in turn, pay the BAC as agreed.

12.4 Why are agent commissions so high in New Jersey?

When agents take on a client, they are committing their resources even when they will be paid only at closing. This means spending on meetings with prospective buyers, preparing the home to make it presentable to clients, making flyers, or advertising in newspapers, magazines, and websites.

Today agents also spend on drone photography or hiring good photographers and copywriters, etc., to make a good ad for the home. Some of them even make glossy brochures. All this costs money. The seller only wants to best so that the property is sold quickly at the highest price. Hence, agents charge a high commission.

Secondly, the internet has changed the way agents work. It has considerably reduced the time and effort put into a deal by these agents. Technology has diminished paperwork (email instead of physical mail) and reduced efforts through computerized accounting.

It has also made it possible for buyers to sit at home and browse through properties online, thus narrowing down the search for homes. However, since the commission is expressed as a percentage of the home, and home prices have only gone up, the commission too has gone up. That is why it makes sense to negotiate with agents to bring down the commission.

Home selling is a complex process and cannot be taken lightly. That is why sellers prefer to hire a listing agent to help make the transaction go smoothly. If you are experienced and have sold many houses, you can consider going the FSBO route; otherwise, new sellers should stick to a full-service agent.

Even while selling FSBO, if one goes by the statistics, according to NAR, only 7% of US homes were sold via FSBO. This is understandable because the average sale price of an FSBO home was much lower at $260,000. Compare this to the average home price of an agent-assisted sale which stood at $318,000. That’s a huge difference of $58,000 in favor of hiring an agent. Getting $58,000 higher makes the commission paid to an agent look like small change.

The situation you are in will decide which option you should consider. For example, if you don’t have the time to engage in a 3-month transaction, you could consider selling to an iBuyer and closing the deal quickly. In this case, the commission does not matter—the transaction’s speed is a priority.

Whatever the case, the decision to reduce the commission is up to you now that this article has placed multiple options before you. So weigh your options carefully and take the plunge.