Imagine this: You finally decide to sell your beautiful Illinois home and embark upon your next big adventure. You are looking forward to earning great profits based on the equity you built over time. But suddenly, you realize that one expense went unnoticed, waiting to take a massive bite from your profits- the realtor fee!

The Realtor fee is one of the most significant expenses you will have to deal with while selling your home. In Illinois, it can cost you an average of $31,000!

Now this fee is somewhat inevitable; you have to foot the bill for both agents, so even if you sell your home FSBO (For sale by owner), you will still have to pay the buyer’s agent!

But don’t start pulling your hair out just yet! With the right resources and help, you can reduce your commission and maximize your profits. And let us help you with it!

Here’s everything you need to know about the realtor fees in Illinois, how they work, why they exist, and most importantly, how you can turn this potential stumbling block into a stepping stone!

1. How does the realtor fee work?

When sellers in Illinois decide to put their homes on the market, the first step is often to hire a listing agent. Last year over 86% of sellers hired an agent to sell their homes.

Once these agents come on board, they become the seller’s go-to guides for the selling process. But before that, the seller and the listing agent negotiate – deciding the commission that will be given to both the listing and the buyer’s agents. This commission is then cleverly tucked into the price of the home, and voilà, the asking price is set!

For instance, if a home in Chicago is listed for $300,000 with a 6% commission, the commission cost is $18,000. The remainder, $282,000, is the seller’s potential earnings before deducting the closing costs. This $18,000 is shared between the listing and the buyer’s agent and is typically split evenly.

Once the commission is agreed upon and the parties ink the agreement, the listing agent swings into action. They list the property on the Multiple Listing Service (MLS) and other platforms, casting the net wide for potential buyers. The buyer’s agent, always on the hunt for the perfect property for their client, spots this listing and contacts the listing agent.

Let’s say a buyer’s agent in Springfield sees a house perfect for his client. They visit the home, negotiate the offer, and maybe even engage in a bit of back-and-forth of offer and counteroffer to seal the deal. If all the pieces fall into place, and the buyer pays the agreed price, both agents get their share of the commission.

Keep in mind that while the standard commission in Illinois is typically around 5-6%, this rate is negotiable and can vary depending on the agent and the specifics of the property.

2. How to Calculate Realtor Fee?

Calculating realtor fees, often called realtor commissions, is very simple, given you have all the necessary data ready.

The Realtor fee is typically a percentage of the home’s final selling price. Here’s what you need to know before calculating relator fees in Illinois.

- The Commission Percentage: As a seller, you will have this information handy. However, if you haven’t decided upon a commission yet, note that the commission in Illinois typically ranges between 5 and 6%. The commission varies from county to county, city to city and even neighborhood to neighborhood.

- Identify the Home’s Selling Price: The final price a buyer pays for your home. For example, let’s say your home sells for $300,000.

- Calculate the Total Commission: To calculate the total commission, multiply the home’s selling price by the commission rate. Assuming a 6% commission on a $300,000 home, the calculation would be $300,000 * 0.06 (6% expressed as a decimal) = $18,000.

- Divide the Total Commission: The total commission is usually split between the listing agent and the buyer’s agent. This is often a 50/50 split, but the exact division can vary based on what’s been agreed upon. If we continue with the above example, each agent would receive $9,000.

Let’s calculate the same for the average home price in the US and the average commission in the states.

The average US home price is $349,816, and the average commission is 5.37%.

Agents’ commission = Average home price x Average commission percentage

= $349,816 X 5.37%

= $18,785

Assuming that the buyer and listing agent share the commission equally, each gets half of the commission or $9,393.

2.1 How much does the realtor fee vary in Illinois?

The Realtor fee is not fixed and changes with location and deal. Realtor fees varies-not so drastically- across the state due to one of the below reasons:

- Market Conditions: The health of the local market can significantly affect how much you will pay in realtor fees. In a hot, competitive seller, agents may lower their fees to attract more business. Conversely, in a slower setting where homes spend more time on the market, agents may charge higher fees to compensate for the increased effort and time it may take to sell a property.

- Cost of Living: Higher cost of living often means higher realtor fees. And the logic behind this is simple. If the overhead cost for the realtors for office space, marketing, and transportation will be higher, they will charge you more to compensate for them.

- Competition: In areas with a high concentration of realtors, competition might drive fees down as agents seek to attract clients. Conversely, in areas with fewer realtors, fees might be higher.

The price of the home will also determine the realtor’s commission amount, as the fee is stated as a percentage of the home.

For example, let’s look at the commission for a range of houses in Illinois, where the average home price is $263,835. Let’s calculate this for varying rates of commission.

| Home Price Range | The Realtor fee is 5.5%of home price | The Realtor fee is 5.5%of home price | The Realtor fee is 5.5%of home price |

| $150,000 – $200,000 | $7,500 – $10,000 | $8,250 – $11,000 | $9,000 – $12,000 |

| $225,000 – $275,000 | $11,250 – $13,750 | $12,375 – $15,125 | $13,500 – $16,500 |

| $300,000 – $350,000 | $15,000 – $17,500 | $16,500 – $19,250 | $18,000 – $21,000 |

| $375,000 – $425,000 | $18,750 – $21.250 | $20,625 – $23,375 | $22,500 – $25,500 |

For homes priced at the lower end, from $150,000 – $200,000, the realtor fee could range from $7,500 to $12,000, whereas for high-priced homes, from $375,000 – $425,000, the commission could go up to 25,500.

2.2 What is the Average Realtor commission in Illinois?

The average home price and the average commission in Illinois are below the national average. The average home price in Illinois is $263,835, and the average commission is 5.24%.

Let’s calculate the total commission in this case.

Agent’s commission (Illinois) = Average home price X Average commission percentage

= $263,835 X 5.24%

= $13,825

If the buyer and listing agents share the commission equally, each gets $6,912.

Let’s take another example. Suppose you sell a home and pay the agents $30,000 in realtor commission. In case they have decided on dividing the commission in such a way that the listing agent received more (2.68%) and the buyer agent gets less based on the efforts, then the split will come out to be:

| Realtor fees in Illinois | % of sale price | Cost* |

| Listing fee | 2.68% | USD 804 |

| Buyer’s agent fee | 2.56% | USD 768 |

| Total | 5.24% | USD 30,000 |

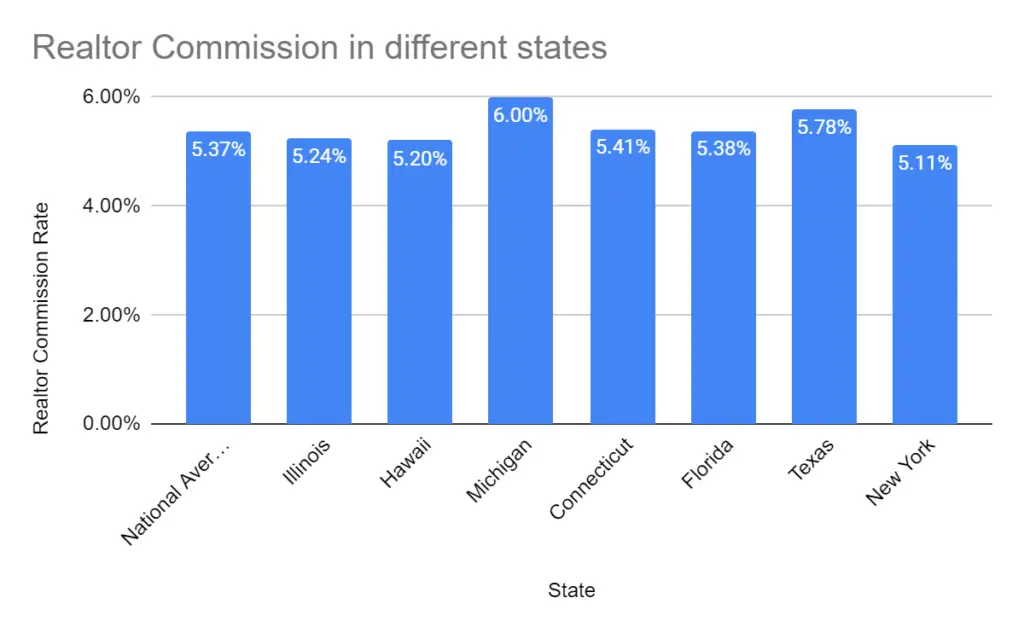

2.3 How does the commission rate in Illinois compare to that in other states?

Let’s compare the realtor commission in Illinois to the commission in other states.

| State | Realtor Commission Rate |

| Illinois | 5.24% |

| Hawaii | 5.20% |

| Michigan | 6.00% |

| Connecticut | 5.41% |

| Florida | 5.38% |

| Texas | 5.78% |

| New York | 5.11% |

| National Average | 5.37% |

From the data above, it is clear that selling a property in Illinois might be somewhat less costly in terms of realtor fees than in many other parts of the country.

However, it’s important to remember that while the commission rate is a significant part of the transaction cost, it’s not the only factor to consider when selling your home. Other factors, such as property taxes, closing costs, and market conditions, also play a crucial role in the overall cost and should be considered when planning a real estate transaction.

2.4 How much is the realtor fee in the different counties of Illinois?

Knowing realtor fees across different counties in Illinois can be a real game changer.

This knowledge also gives you a leg up in negotiations. By understanding the usual realtor fees, you’re in a stronger position to discuss commission rates. If you’re an investor selling properties, this is crucial to maximizing your returns. And let’s not forget being well-informed about all costs, including closing costs and home inspections, is key to a successful and profitable selling experience.

| County | Typical home price | Average realtor fee in Illinois (5.24%) |

| DuPage | $365,450 | $19,150 |

| McLean | $213,152 | $11,169 |

| Lake | $320,756 | $16,808 |

| Champaign | $187,842 | $9,843 |

| Cook | $316,055 | $16,561 |

| Sangamon | $163,414 | $8,563 |

| Will | $306,459 | $16,058 |

| Kane | $313,124 | $16,408 |

| Peoria | $127,921 | $6,703 |

| Kendall | $319,075 | $16,720 |

| St Clair | $155,818 | $8,165 |

| McHenry | $299,976 | $15,719 |

| Monroe | $232,440 | $12,180 |

| Madison | $166,244 | $8,711 |

| Woodford | $193,716 | $10,151 |

| Piatt | $173,151 | $9,073 |

| Jackson | $125,999 | $6,602 |

| Brown | $263,835 | $13,825 |

The average realtor fee in the above counties of Illinois ranges from around $6,602 to $16,720. Now, this is no small amount. Unsurprisingly, many home sellers look for ways to cut down on realtor commissions or do away with it.

Is this possible? The rest of the article will talk about how, if handled right, you can save thousands of dollars in commission.

3. How much is the realtor commission in case of a rental in Illinois?

In Illinois or elsewhere in the country, you can expect apartment brokers to direct you toward the structures offering the largest commissions. In some cases, the fee structure could depend on how many apartments a building has available for rent. In addition, some properties may have preferred brokers.

But, first, you need a benchmark to determine if you are being over-charged for commission. Here’s a broad idea of how much commission a realtor charges for a rental.

3.1 Commission as a month’s rent

A broker who shows you an apartment on the MLS is probably get paid half a month’s rent as commission. Although some pay a flat charge of less than a month’s rent, and some pay 125% or 150% of a month’s rent, most managed buildings pay brokers an entire month’s rent as their commission.

3.2 Commission as a percentage of annual rent

Besides a month’s rent, some agents charge a percentage of the annual rent as a commission. For example, if the annual rent is $12,000 and the commission is 10% of the yearly rent, this will work out to

Annual rent X 10% = $12,000 X 10% = $1,200

3.3 Lease renewal or extension

If the lease is to be renewed, there is usually a clause stating how much the agent will be paid.

3.4 Property management companies

Property management companies maintain the property for the landlord and even hunt for tenants and let out the property on behalf of the owner. They charge around 10-15% of the annual rent to manage the property, which the owner pays. The renter usually does not have to pay any commission in this case, as the property management company pays for this.

3.5 Rental listing companies

In some areas, realtor companies maintain a list of the properties being let out regularly and keep updating this list. Tenants can pay these companies a nominal amount to get this list and do their house-hunting on their own, and there is no commission in this case. Instead, these companies charge what the market can bear.

4. Realtor fee split between agents and brokers

Agents are not allowed to receive commissions directly from a buyer or seller. Only brokers are allowed to do this. Hence, the buyer and seller agents must work under their respective brokers, who are more experienced and have a higher license.

The broker accepts the commission, takes a share of it, and passes the rest to the agent. The ratio in which the broker and agent share the commission is termed the commission split.

For example, if the total commission is $30,000, and the two agents and their respective brokers share the fees equally, each with get

Total commission ➗ 4 = $30,000 ➗ 4 = $7,500

The more experienced the agent, the higher their share of the commission. For example, the below table shows how much commission goes to the agent and the broker for various splits in favor of the agent.

| Total commission | Split ratio | Buyer and Seller agents’ share | Buyer and Seller brokers’ share |

| $30,000 | 60:40 | $18,000 ($9,000 each) | $12,000 ($6,000 each) |

| $30,000 | 70:30 | $21,000 ($10,500 each) | $9,000 ($4,500 each) |

| $30,000 | 80:20 | $24,000 ($12,000 each) | $6,000 ($3,000 each) |

5. Who pays the realtor fee in Illinois?

As is standard across the country, the seller pays the realtor commission. The commission is baked into the price of the home. Once the buyer pays the home price, the seller pays the agent’s commission.

However, one can argue that technically the buyer pays the commission since the buyer pays the price of the home.

5.1 Who pays the commission in a rental deal?

The landlord usually pays the agent’s commission in a rental deal, like in most parts of the country. In places like Boston or New York City, however, it is normal for the tenant to pay the agent’s commission. In such markets, the owner will pay the commission if “OP” is mentioned in a rental ad. “No fee” ads also mean the landlord will pay the agent’s commission.

6. Is the realtor fee negotiable?

The Realtor fee is always negotiable and is never fixed. In fact, Article 16 of the NAR Code Of Ethics talks about negotiating commissions with their clients.

If an agent tells you it is fixed, do not work with that agent. As we have seen above, the realtor fee depends on many factors, including your negotiating skills.

6.1 How to negotiate a lower realtor commission

Remember that real estate agents are master negotiators, and you must have your guns fully loaded if you plan to engage with this lot. Here are some tips to help you tackle this difficult task.

If you want to present your case convincingly, you will need to talk about why it is in the agent’s favour to reduce the commission. If you make your case logically, few agents can refuse your offer.

6.1.1 Choosing the right agent

This is a vital factor in determining how successful you are in negotiating the commission. Choosing a newer agent rather than an experienced one may give you a better chance of paying a lower commission. New agents are looking for business and are usually out to prove themselves. Look for bright newcomers willing to push themselves, and you could have a winner.

6.2. Don’t break the camel’s back

Listen to what the agent offers, and then make a counteroffer just below the average realtor commission in your area. However, don’t make it so low that it is impossible to match up to. Instead, make it reasonable and list why you think it is the ideal commission in your case. For example, are the current market conditions in your favour, or is your home in perfect condition for a quick sale? It will not be difficult to convince the agent if you are convinced about it.

6.3. Don’t get bogged down by a refusal

If an agent refuses to negotiate the commission, there are plenty of fish in the sea. Many agents make it a point to take on more business by offering lower commissions. All you need to do is search for them.

6.4. Avoid dual agency even if the commission is low

If an agent offers you a lower commission and says they represent the buyer, you should avoid such deals. When a single agent represents the buyer and seller, this is called a dual agency.

Dual agency results in a conflict of interest. No agent can look after the best interests of both parties at the same time. This is one reason the dual agency has been banned in Alaska, Colorado, Florida, Kansas, Maryland, Texas, Wyoming, and Vermont.

In states where it is legal, it is mandatory for the agent to get written permission from both parties and to inform all the parties in the transaction, including the lender, about the situation.

6.5 Offer to reduce agent’s work

If you offer to take up some of the agent’s responsibilities, they will be more willing to reduce the commission.

For example, if you have plenty of time, you could offer to host an open house and handle all the questions from prospective buyers without the agent’s help. This will save considerable expense and time for the agent, making it possible to reduce the commission in the bargain.

6.6 Make your house attractive

If your home needs a paint job, offer to do this quickly, as it will help the agent pitch it better to buyers. Take the agent’s advice if they tell you to make minor changes to make the house more attractive. When they see that you are willing to close the deal quickly, the agent will be in a better mindset to negotiate the commission.

6.7 Offer a full buyer agent’s fee

While you negotiate to reduce the listing agent’s fee, offer to pay the full buyer agent’s fee. When buyer agents realize that you are offering the full fee, they will be more likely to show your home to their clients. In addition, since the listing agent knows this, they will be happier to reduce their commission because you will get a buyer quickly.

6.8 Sell and buy with the same agent

When selling a property, most people are also looking at buying a property with the proceeds. If this is your case, you can offer to route both deals through the same agent. This means more business for the agent, and you automatically become a ‘preferred customer.’ In addition, since they will be earning more through you, agents will be more willing to negotiate the commission.

6.9 Be willing to walk away

One of your most vital points here would be the willingness to walk away. If you are not convinced about the functioning of an agent or don’t like the terms being offered, be willing to walk away. Then, when the agent sees that you are ready to look at other options, they may stop acting tough and soften up enough to negotiate the commission with you.

7. How can you reduce the realtor’s commission without negotiation?

Sometimes, you may not have the time to negotiate with an agent or may not be so inclined. In such cases, too, you have plenty of options to reduce realtor commissions without much negotiation or negotiation.

The real estate market has been changing for some time now, especially given the reach of the internet and the possibility of sitting at home and browsing through a list of properties without even contacting an agent. Many companies use technology to leverage their business, benefitting both the agent and the seller in the process.

On the one hand, home prices are only going up while the commission percentage remains the same. But, on the other hand, this means the agent is being paid more for the same work. This seems unfair to most buyers and sellers.

7.1 Selling FSBO

Sellers who feel they are unnecessarily paying high commissions sometimes prefer to sell on their own rather than hire an agent. This is termed For Sale By Owner or FSBO. Of course, you still have to pay the buyer agent’s commission since the buyer will have his agent.

Here the owner performs all the duties of the listing agent, from doing all the paperwork to handling queries from prospective buyers and even listing the home in the right places. However, you need to have plenty of experience in home selling and should have a lot of time on your hands too. Otherwise, you could lose more than what you save in commissions – mistakes in real estate can be expensive. In addition, you need to do the paperwork thoroughly and ensure all legal aspects are covered. If you feel you need someone to handle only some elements of the deal, there is a solution for that as well in the form of Fee-for-service companies/agents.

7.1.1 Fee-for-service

Nowadays, some companies only charge you per service instead of the entire agent commission. For example, if you need an agent only to handle the paperwork, they will offer to do this at a fraction of what you would pay as a commission. Fee-for-service companies can help sellers save thousands of dollars in this way.

7.1.2 Flat-fee MLS listing service

The biggest challenge FSBO sellers face is listing their homes on the MLS, a database all agents access to the list and search for homes. This is because only agents have access to the MLS. However, some companies will list your home on the MLS for a nominal flat fee. In addition, websites like Zillow and Realtor.com will automatically list your home once you put it on the MLS.

7.2 Discount brokerage

A discount brokerage offers the complete services a traditional agent provides but at a much lower cost. They take on many clients and have a team of realtors handling the accounts. This makes it possible for them to earn commission based on many transactions.

Hence they can afford to take lower commission fees. However, considering they take on so many clients, their team’s efforts may be spread too thin, and you might have to compromise on the service quality. Some of them may even have new and inexperienced agents working for them. If this is fine, you can go ahead with a discount broker.

7.3 Hybrid home brokerage

Brokerages are creating unique models to charge lower commissions for quality services. One more model you can look at is the hybrid home brokerage. Like discount brokerages, these companies have a team managing the backend work, utterly separate from the agents dealing with you.

This way, they can give you more attention than a discount broker. With technology improving by leaps and bounds, these companies try to leverage tech to provide you with a better experience. Moreover, they charge half the commission of a traditional agent. They can afford to do this by streamlining the selling process, thus saving time and effort.

8. Can you do away with a realtor commission altogether?

One way you can do this is by selling FSBO and dealing directly with a buyer who does not have an agent. You can do away with both the buyer and listing agents’ commissions. Of course, you will find it very difficult to find a buyer without an agent. The best-case scenario when this can happen would be when the buyer and seller know each other personally and agree to each other’s terms. They can hire a single agent to do the paperwork and pay them a nominal charge. This is an ideal situation, which seldom occurs. However, if you find yourself in this lucky situation, you could save 5-6% of the home price.

There are other ways of not paying commission, but these could prove expensive as you might not get the going rate for your home. These selling methods only make sense when you are in a hurry and don’t mind getting 15%-40% below the market rate.

8.1. Cash buyers

If you dread the long, drawn-out process of selling, you could opt to sell your home quickly for cash. Be warned, though, that this will net you way below the market price. Yes, there is no commission, no excruciating search for buyers, and you don’t have to stress regarding showings, stagings, or cleaning the home whenever a buyer comes by.

Another advantage is that cash deals are more likely not to fall through because theory happens so quickly–unlike the normal process of selling to a buyer, which could take months.

These deals usually occur on an as-is basis—you need not worry about repairs or unreasonable demands from prospective buyers. If this works for you, there are cash buyers such as First Choice Home Buyers, Offerpad, Opendoor, RedfinNow, Sundae, and MarketPro Homebuyers, whom you can approach. Some even offer free, no-obligation cash offers, so there’s no harm in trying them out.

9. What services do the realtor fees cover in Illinois?

If you plan to negotiate with a real estate agent, you better know their business well. You will have to guard against the possibility of an agent accepting a lower commission but cutting down on services without your knowledge. For this reason, you need to know what services a full-service agent offers.

Here’s a list of services generally offered by a good seller agent.

Government Link

Buyer Agent’s Responsibilities

9.1 Online property shopping

If you hire an agent, you will not have to spend hours searching for the ideal home on the Internet. The agent will do that for you. Their expert eye will also detect homes in flood zones or any dangers you might overlook in a particular location. Homes come and go quickly on the market, so agents will constantly check the MLS database to which they have access.

9.2 Physically searching for homes

Not all properties will be listed online. There could be many good homes available in an area that are not listed online. Agents will drive around and check these homes for you, so you don’t have to waste your time searching.

9.3 Access to Agents’ network

Agents are also well-networked and will get information about homes through their contacts. Realtors have their gatherings where they exchange information on homes. This could be at the local cafe or weekly meetings they arrange for professional benefit. This helps them spread the word and get offline information of houses ready to market. If you are lucky, you can snag your dream home before it goes on the market.

9.4 Marketing your home

Although we don’t realize it, agents perform many activities once you hire them. For example, they will hire a good photographer to click excellent professional photographs of your home or hire a staging service to ensure it looks attractive to buyers. They will put out ads in magazines, newspapers, or in the form of fliers or put premium listings on promising websites. They spend all this from their pocket even before they charge you.

9.5 Making offers and counteroffers, agreements, and all necessary paperwork

Every time a prospective buyer makes you an offer, there has to be a counteroffer. This is written and managed by the agent. These offers are essential because they can save you thousands of dollars. The agent will negotiate the best possible price by evaluating each offer. Getting the right price can be time-consuming and involve a lot of back and forth between different buyers as there could be multiple offers simultaneously. Agents will also process the agreement and see that all paperwork is in order so the deal goes smoothly.

9.6 Presence at Inspections

Inspections can be time-consuming and could take a couple of hours. Even if you are not present, your agent will be there to ensure the inspector is informed about all the updates and modifications done to the home to ensure it is in good condition.

9.7 Taking care of minor issues

A good agent will ensure they don’t take too much of your time. They will also try to solve problems before they hamper the sale. For example, if some prospective buyers have any issues, they will try to solve them on their end before escalating them to you. This saves valuable time. In addition, an agent’s negotiating abilities will solve half your problems, often ensuring that the deal does not fall through.

9.8 Keeps the seller grounded

Sellers can often get emotional when selling a home-–some will demand a high price while others will refuse to negotiate. Agents advise on the best strategy and warn the seller if they pass up a good deal or are unnecessarily acting stubbornly.

10. Are realtor fees tax-deductible in Illinois?

Although you cannot deduct realtor fees the way you would deduct mortgage interest from your income, all selling costs directly tied to the sale can be subtracted from the sale price. This includes realtor commissions, escrow fees, legal fees, etc. The only criterion is that you should have stayed in the home for two of the last five years immediately before the sale.

Deducting these expenses from the sale price will reduce your capital gain and the consequent capital gain tax. Capital gain is the profit minus the purchase price from the sale price.

For example, if you spent $15,000 as realtor fees on a home sold for $300,000, and your purchase price was $100,000, your capital gain would be

Capital gain = Sale price – Purchase price – realtor fees

= $300,000 – $100,000 – $15,000

= $185,000

In other words, the IRS would consider your net selling price as

Selling price – realtor fees = $300,000 – $15,000 = $285,000

Incidentally, the IRS gives you a capital gain tax exemption of $250,000 if you file taxes as a single owner. You are exempt from $500,000 if you file tax jointly with your spouse.

11. FAQ

11.1 Can a real estate agent share the commission with the seller in Illinois?

Not all states allow agents to share the commission with the seller (or buyer). Illinois is one of the states where this is legal. The nine states where giving a part of the commission to the buyer or seller is illegal are Alabama, Alaska, Kansas, Louisiana, Mississippi, Missouri, Oklahoma, Oregon, and Tennessee. Iowa, too, has banned sharing commissions with the buyer or seller; however, the state allows this in the case of dual agency.

11.2 What if the buyer does not have an agent? What happens to the buyer agent’s commission?

The entire commission goes to the listing agent if the buyer doesn’t have an agent. This is because agreements between the seller and the listing agent only mention that a commission will be given to the listing agent. The listing agent will share the commission with a buyer agent if required. However, if there is no buyer’s agent, they are not required to share the commission.

According to the NAR (National Association of Realtors), 12% of buyers preferred not to hire a buyer agent in 2020. This usually happens when the property is transferred to a known buyer, maybe within the family or in a friend’s circle.

In these cases, the buyer can request the seller to reduce the price of the home. If the seller and listing agent agree, the buyer gains 2-3% of the home price.

12. Conclusion

While there are many ways to reduce realtor commissions, you must select the method that suits you best.

Blindly going for the FSBO route or refusing to pay the regular commission could prove detrimental to your deal. If going the FSBO route, make sure you know plenty about real estate transactions and have plenty of time on your hands. If you are merely negotiating the commission, ensure you don’t drive too hard a bargain—a realtor deserves a reward for their hard work.

Moreover, the agent might save you more than the commission because of their excellent negotiating abilities. Sometimes selecting the right agent might be more important than saving a few thousand in commission.