Buying a home is one of the most significant investments you will ever make.

The average home price has been increasing rapidly nationwide. According to St. Louis Federal Reserve, the median home sale price in the U.S. just crossed $400,000 for the first time.

According to Zillow, the typical home price in Connecticut is $350,897, which has risen more than 15% over the last year.

In addition to the home price, home buyers also have to pay additional costs such as closing costs, moving costs, mortgage, down payment, etc., which can put tremendous pressure on their wallets. So much so that many buyers back out of deals because they can’t cover all the costs.

But wait, here’s a well-kept secret. Buyers can significantly save money or reduce their closing costs when buying a home. How? Ever heard of home buyer rebates? We won’t be surprised if you haven’t. Many home buyers are unaware that they can negotiate rebates from their agents and save thousands of dollars on their home purchases.

What is a home buyer rebate?

Many sellers and buyers consider the standard 6% agent commission too high. To tide over this negative sentiment, real estate agents have devised an attractive strategy that we also know as buyer rebate.

Many real estate agents refund a portion of their commission to homebuyers as an incentive for working with them. This amount is termed a buyer rebate. Buyers also know it by the name of commission rebate or commission refund.

Such rebates can come in different forms; they are commonly offered as closing credits, but some agents/brokers also offer rebates as cashback at closing.

1.1. Buyer rebate as closing credits

Rebates as closing credits can be used to cover specific costs such as origination fees, appraisal fees, attorney fees, prepaid interest, escrow fees, inspection costs, loan application fees, buying discount points, etc.

Sometimes this rebate is also offered for much-needed home repairs.

Closing credit has limitations on how it can be used and needs to be approved by the lender. The buyer needs to be clear about how closing credit can be used and ensure the terms are written by the seller and the listing agent.

Source: 1

1.2 Homebuyer cashback

Cashback rebates are cash incentives that buyer agents provide to their clients at closing. The amount you receive as cashback can be used in any way you want. You could use it to buy new furniture, to cover moving costs, or to save up for emergencies.

While cashback rebates do not require approval, disclosing them to your lender is always safer.

2. How does a buyer rebate work?

The money for the home buyer rebate comes from the buyer agent’s fee. The seller typically pays a total of 6% on the final selling price as a commission to both agents. The commission is later shared between the two agents in a pre-decided ratio. The buyer agent then gives a part of the commission (say 1% of the home price) to the buyer as promised.

Here is an illustration that will help you better understand how buyer rebate works.

When a buyer purchases a home worth $300,000, the seller needs to pay a commission (of, say, 6%) to his listing broker and buyer broker for selling the home.

Total commission = Home price X 6% = $300,000 X 6% = $18,000

Suppose this total commission of $18,000 is shared equally between the listing broker and buyer broker. In this case, each will receive:

Buyer agent’s commission = Total commission ➗2 = $18,000 ➗2 = $9,000

Now if the buyer agent has promised to pay the buyer a rebate of 1% on the home price, this works out to:

Rebate = Home price X 1% = $300,000 X 1% = $3,000

So the buyer agent will pay the buyer a rebate of $3,000. The buyer agent will still be left with $6,000 ($9,000 – $ 3000) after giving the rebate.

Buyer rebate is often expressed as a percentage of the home price or a percentage of the buyer agent’s commission. Let’s take a look at both of these situations.

2.1 Home rebate as a percentage of home price

When a buyer rebate is offered as a percentage of the home price, the rebate will vary depending on the price of the home.

Here is a look at buyer rebates for a range of home prices.

Let’s calculate the amount of buyer rebate when it amounts to 0.5%, 1%, 1.5%, and 2% for a range of home prices.

| Home Price range | Buyer Rebate as % of home price | |||

| 0.5% | 1% | 1.5% | 2% | |

| $250,000 – $3,00,000 | $1,250 – $1,500 | $2,500 – $3,000 | $3,750 – $4,500 | $5,000 – $6,000 |

| $325,000 – $3,75,000 | $1,625 – $1,875 | $3,250 – $3,750 | $4,875 – $5,625 | $6,500 – $7,500 |

| $400,000 – $450,000 | $2,000 – $2,250 | $4,000 – $4,500 | $6,000 – $6,750 | $8,000 – $9,000 |

2.2 Home Rebate as a percentage of the buyer agent’s commission

Let’s look at buyer rebate when it is calculated as a percentage of the buyer agent’s commission.

For this, let’s look at home prices and rebates in the different counties in Connecticut.

Remember that though the average home price in Connecticut is $350,897, according to Zillow, the home price varies considerably in different counties in the state.

| County | Median Home Price* | Commission as 5.41% of home price | Buyer Agent’s 50% share | Buyer rebate as 30% of buyer agent’s commission | Buyer rebate as 50% of buyer agent’s commission |

| Fairfield | $ 717,042 | $ 38,792 | $ 19,396 | $ 5,819 | $ 9,698 |

| Hartford | $ 159,139 | $ 8,609 | $ 4,305 | $ 1,291 | $ 2,152 |

| Middlesex | $ 387,225 | $ 20,949 | $ 10,474 | $ 3,142 | $ 5,237 |

| Tolland | $ 313,097 | $ 16,939 | $ 8,469 | $ 2,541 | $ 4,235 |

| New London | $ 243,369 | $ 13,166 | $ 6,583 | $ 1,975 | $ 3,292 |

| New Haven | $ 265,418 | $ 14,359 | $ 7,180 | $ 2,154 | $ 3,590 |

| Litchfield | $ 425,288 | $ 23,008 | $ 11,504 | $ 3,451 | $ 5,752 |

| Windham | $ 282,329 | $ 15,274 | $ 7,637 | $ 2,291 | $ 3,818 |

3. Are rebates legal in Connecticut?

Yes, buyer rebates are legal in Connecticut.

While agents across the state might say that commission rebates are illegal, it is not true. DOJ and many other legal institutions, in fact, promote buyer rebates.

If your agent is telling you otherwise, do not do that, yes, it is illegal to pay someone who is not licensed in Connecticut, but that does not apply to the property buyer.

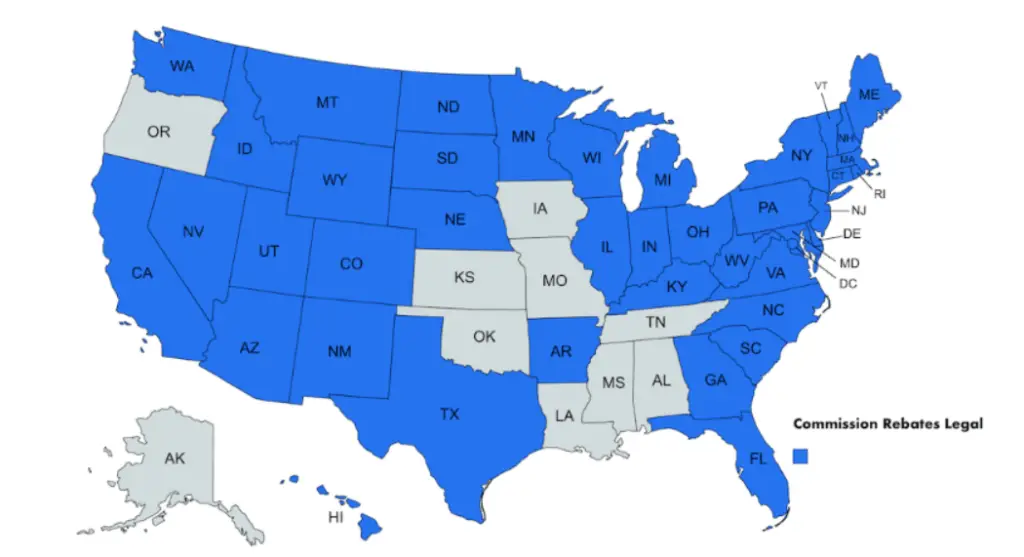

Here’s a map showing where Commission rebates are legal in the US

Source: Yoreevo.com

4. Should I contact the listing agent directly to get my rebate?

If the buyer contacts the listing agent directly, the listing agent will also assume the role of an agent and pocket both the buyer and seller agent’s commissions.

In such a case, there is a good chance that the buyer won’t be able to get a rebate.

That is why it is better to hire a separate buyer agent, who will then rebate a part of the commission back to you at closing.

If the buyer still wants to see a property without the buyer agent, then it is necessary to inform the listing agent that the buyer already has an agent. This must be communicated to the listing agent in advance.

5. Why do agents and brokers offer home buyer rebates?

Buyer agents offer rebates to prospective buyers to attract and gain more customers. These agents provide cash refunds or closing credit to persuade buyers to use their service. Here are a few other reasons for agents to offer rebates:

5.1 Rebates help agents earn more

Agents offer rebates to attract more customers. This results in a higher volume of transactions. The ensuing revenue more than makes up for the lower commission per deal. This is a win-win situation for the buyer and the buyer agent.

5.2 To reward buyers for their efforts

With the introduction of websites like Zillow and Realtor.com, many homebuyers can do their home search themselves, taking up some of the agents’ responsibilities. Some sites even offer virtual walkthroughs of homes. In this way, agents can simultaneously use their free time to work with more buyers. So they don’t mind refunding some of their commission to buyers for their efforts.

5.3 Rebates incentivize buyer loyalty

Four in ten people feel that real estate commission is very high. To overcome this negative sentiment, buyer agents offer rebates to reward their buyers and build loyalty with them. This also helps agents build a reputation in the market. Their happy customers also help them by spreading the word.

5.4 Rebates can prevent a transaction from falling through

Many hurdles occur during the negotiation process between the buyer and the seller or the buyer and the buyer agent. Many buyers consider backing out at this stage. But a buyer may overlook minor inconveniences and stay in the deal because of the high rebate offered.

5.5 To make homes more affordable to buyers

Many times, buyers tend to back out of deals because additional costs, such as closing credits, moving costs, etc., turn out to be too high, and they overshoot their budget. In such a case, a rebate helps lower these costs to make the home more affordable.

5.6 To beat the competition

The realtor industry in the US is crowded. There are far too many agents vying for the same business pie. In such a situation, agents who offer rebates tend to stand out in the crowd. A buyer is more likely to work with an agent who is offering an upfront rebate as compared to an agent who is not.

5.7 Home may be challenging to sell

Homes in some localities could be challenging to sell, and in such a situation, it may be necessary to offer an incentive to home buyers. So to attract buyers, agents tend to compete with each other through rebates.

5.8 As a trade-off for services

Experienced home buyers already know the entire home-buying process and are willing to take on some of the agent’s work. In such a situation, agents save on time, expenses, and effort, offering the buyer a rebate as a reward. This is a tradeoff for the fewer services they have to render to these buyers.

5.9 Savings Due to technology improvements

Today, technology enables real estate agents to work efficiently. An email has cut down paperwork, and the internet has many websites where buyers can go and look for homes. All this has saved the agent a lot of time and effort, whereas the commission rate has remained almost the same. Hence, agents don’t mind passing on some of these savings to their clients as an incentive to hire them.

6. Are buyer rebates negotiable?

Buyer rebates are not fixed. The U.S. Department of Justice wants home buyers to understand that buyer rebates are always negotiable. The government encourages competition among agents because this can save the buyer loads of money. The DOJ even have a Buyer Rebate Calculator to show buyers how much they can save with rebates. However, it is not always easy to negotiate – more so in a market with high demand for homes.

7. How to negotiate a commission rebate

There are two ways to make sure you get a commission rebate. One way is to talk directly with your agent and ask for or negotiate a rebate. The other way is to use services like Clever Real Estate, which has pre-negotiated rebates with agents – so you don’t have to negotiate.

7.1 Simply ask for a rebate

The simple ways are always the best. If you already have a good agent in mind who is not offering a rebate, the best thing to do is ask the agent for a rebate. Since it’s a common practice to offer rebates today, the agent may simply agree to do the same.

7.2 Offer something in exchange

Of course, to gain something, you may also have to go the extra mile. For example, you could offer to do the initial online home search to narrow down properties that interest you. Or you could probably agree to visit homes on your own until you find a suitable option. This will reduce the agent’s work considerably, making them more willing to negotiate a rebate.

7.3 Talk to multiple agents

If your agent is unresponsive to initial requests, you can talk to multiple agents to introduce some competition. Making agents compete is the best way to get them to offer you a rebate. You can go with whoever offers you the best deal in terms of services and a rebate.

7.4 If the home is finalized

If you have finalized a property, there is very little for the agent to do except give your offer to the seller and close the deal. The agent will not only have less work but also save considerable time, effort, and expense (showing multiple properties). The agent will be more open to negotiating in such a situation.

7.5 Talk about the rebate before you sign up with an agent

While finalizing your agent, negotiate for the best rates before you sign on. You are more likely to get reasonable rates if you negotiate hard enough. Once you sign the agreement, renegotiating a rebate will be difficult.

7.6 Pre-approved by a reputed lender

In a seller’s market, homeowners will only talk to you if they believe you are a serious buyer. Getting pre-approved by a reputable lender is one way to show them that you mean business and are willing to close the deal quickly. If you are not pre-approved and like a property, it may not be on the market by the time you get yourself approved by a lender. So it is always prudent to be prepared with a pre-approval letter. This will put you in a better position to negotiate a rebate.

7.2 Use a service that pre-negotiates rebates

There are many companies out there that pre-negotiate rebates with local agents. Once you sign up, they offer an upfront rebate if you work with one of their agents. There is minimal negotiation from your side, as most of this is done by the company. Also, these companies offer you a choice of agents. They offer agent-matching services for free, with no obligation to use them once you sign up.

8. On what does negotiating a rebate depend?

Negotiating a rebate in Connecticut is simple and depends on two main factors – your situation and the market situation.

Some situations will make it easy for you to negotiate. You need to research and check if these conditions apply to you. Again, doing your homework will make it easier to negotiate a good rebate since you know the market situation.

Here are a few examples of such situations.

8.1 Your situation

8.1.1 High-value home

If you are buying a high-value home that can offer a high commission amount to your agent – the agent will be more open to offering you a rebate.

8.1.2 Multiple Transactions/Dual Agency

If you have more than one property to sell or buy, you can promise the agent that you will use their services for multiple transactions. In such a case, the agent will agree to a rebate to get your business.

8.1.3 Personal rapport

If you have a personal rapport with the agent, they will be more willing to discuss a rebate with you.

8.1.4 Dual Agency

If only one agent represents both the buyer and the seller, the agent will be more open to offering a rebate because of the double commission being earned by them.

8.1.5 When working with a new agent

When working with an agent just starting a career, they are more eager to get your business. In such a case, they are more open to offering you a rebate to compete with more established agents.

8.1.6 When a full-service agent is not required

If you need only a few services from the agent, ask only for the required services, which will increase your chances of getting a higher buyer rebate. If the agent is saving on time, cost, and effort because of having to provide fewer services, they will not mind passing this saving on to the buyer.

8.2 The housing market situation

8.2.1 Buyer’s market

In a buyer’s market, there are plenty of homes for sale but few buyers. So the buyer is in a better position to negotiate since agents are desperate to close deals. In this situation, you can insist that you only work with an agent offering a rebate.

8.2.2 Homes not selling quickly

When homes are not selling quickly, the agent will have to spend more time promoting and hunting for a buyer. To close the deal quickly, the agent may agree to a rebate in such a situation.

8.2.3 When home values are rising

When home values are increasing, it may be challenging to find buyers. In such a situation, agents usually offer rebates to make the home more affordable for clients.

9. How to find an agent who will offer a rebate in Connecticut?

In Connecticut, you can approach an agent already offering a rebate. You can find them advertising in local newspapers or online. Or you can work with agent-matching services like Clever and UpNest, which offer pre-negotiated rebates and connect you with multiple agents in your locality. To help you, here is a list of local agents and some agent-matching services that can connect you with local agents offering a rebate. A Google search will get you more of the latest offers on the market. So do you research before you select your buyer agent?

9.1 Clever Real Estate

Clever Real Estate gives homebuyers a 0.5 percent rebate on the home price of the property at closing. It provides agent-matching services in addition to offering a cashback incentive. Through the firm, you can connect with full-service agents from reputable brokerages, such as RE/MAX and Century 21. It also provides you with a list of agents, and you can pick and choose the one that suits you best.

It is free to use and comes with no commitments once you sign up, just like any other agent-matching service. Based on 1,512 reviews, Clever Real Estate has a Trustpilot customer rating of 4.9 out of 5.

9.2 Redfin

Redfin provides low-cost brokerage services to people looking to purchase a house. They provide all the essential services that a conventional agent does for less money. However, customer testimonials indicate that you may have to sacrifice the service quality in exchange for a lower commission.

Redfin doesn’t advertise the rebate amount it offers to customers and claims that this varies depending on the situation. As a result, you must ask your agent if you are eligible for a rebate. Redfin claims that the typical buyer saves $1,750 when buying a home. Based on 416 reviews on Consumer Affairs, Yelp, and Google, Redfin has received an overall rating of 3.9 out of 5.

9.3 UpNest

The agent-matching service UpNest has a distinctive business structure. Home buyers can communicate with the best real estate agents vying for your business. Since agents will compete to give you the best deal, you won’t need to negotiate much.

UpNest provides home buyers a cashback incentive equal to 0.5 percent of the home’s price, or often 20-30% of the agent’s commission. You can earn up to a $1,336 average commission rebate offered by agents in Connecticut. UpNest offers a $150 Amazon gift card as an extra. As per customer reviews, there may be occasional trouble communicating with the company’s customer service agents. Based on 3,794 customer reviews on Google, the Better Business Bureau, Google, Facebook, and Shopper Approved, UpNest has a weighted average customer rating of 4.6 out of 5.

9.4 Prevu

A discount brokerage, Prevu has qualified agents who can assist you in purchasing a home. Prevu stands apart from most brokerages since it provides significant rebates for buyers compared to standard industry rates.

You can be eligible for a rebate of up to 2 % of the purchase price when you buy a house through a Prevu agent. However, those cost savings come with significant compromises: a small pool of available agents, hefty minimum fees, and a lack of personal attention during the transaction. You can opt for Prevu if you’re purchasing a more expensive house or if you already have one or more specific homes in mind that you plan to purchase. Ensure the home qualifies for Prevu’s rebate by reading their terms and conditions in your location before signing up.

9.5 Realty By Design

With Realty by Design, buyers can earn up to 50% of their agent’s commission as a rebate. They offer a sliding-scale program called Buyer Rebates CT. The rebate is based on how many properties they show you before you buy a house – the rebate reduces as the showings increase.

It’s best to work with them if you’ve already found the house you want to buy. Remember, though, that not every Realty by Design agent chooses to participate in the buyer rebate program. So make sure you ask whether you qualify for the rebate before signing up with the agent.

Agents either charge a one-time non-refundable retainer or a non-refundable per-showing fee. The company’s buyer services are full-fledged even when you obtain a rebate.

9.6 Rebate Agents

You don’t have to use a discount real estate company for a rebate. Rebate Agents connects you with agents at no cost. These agents have a prearranged agreement with Rebate Agents and hence offer you full service and 20% of the real estate agent’s commission as a rebate. There is also no cost or obligation to work with their agent on signing up. The Rebate Agents Network puts the buyer in touch with well-known national and local real estate agents willing to offer you a rebate. Make sure you qualify for a rebate before signing up with an agent from this network, as they don’t offer a rebate on every deal.

9.7 Bella Realty

When you plan to buy a home with Bella Realty, you get full service and can save thousands from the real estate agent commission rebate. They offer a rebate in the form of cashback at closing. The firm does not mention the exact rebate offered, which could vary from deal to deal. The owner Lori Marco is a full-time accomplished broker with sixteen years of experience. She is a member of the Greater Fairfield County Multiple Listing Service, the Connecticut Statewide Multiple Listing Service, the Valley Board of Realtors, the National Association of Realtors, and the Connecticut Board of Realtors. She offers her services in both Fairfield County and New Haven County.

9.8 Discount Realtors

Discount-Realtor claims to have pioneered the concept of discount/rebate in 1999. Brokers associated with Discount-Realtor have an agreement to share a portion of their commission with buyers they represent. When you buy a home through the Discount-Realtor network, you get up to 1/3rd of the agent’s commission as a rebate at closing. The brokerage claims that the actual rebate will depend on various factors like the home’s purchase price, the amount of seller commission, the time the agent spends with you, local market conditions, competition, etc. So make sure to find out how much you are eligible for before committing to them.

9.9 Affiliated Broker Network

Agents working with the Affiliated Broker Network expect you to do your homework before working with them. So you need to narrow your home search by visiting property websites like Realtor.com, Zillow, Trulia, etc., before approaching them. They also encourage you to drive by our selected properties so that you can finalize quickly. Once buyers find their dream home, they can reach out to Affiliate Broker Network for a rebate. Buyers can receive a rebate of up to 50% of their agent’s commission at closing.

9.10 New Homes Rebate

New Home Rebates is a local firm focused on East Hartford, Connecticut, where buyers can register for free and find an agent to help them with the home purchase. As the name suggests, they specialize in new homes. New Home Rebates can help you find the home, negotiate the price, and offer a rebate of up to 2% of the home as cashback at closing. Registering with them is free, and there is no obligation to buy a home through them. They claim that their average client saves up to $20,000 and that they can get the builder to pay for all their closing costs. The 2% rebate they offer is in addition to any special promotions, free options, discounts, upgrades, or any other incentives they can negotiate for the buyer.

Here’s a bird’s eye view of the above list.

List of websites/agents offering rebates:

| Website/Firm name | Rebate Offered | Significant savings at most price points. Top brand agents to choose from. |

| Clever Real Estate | 0.5% of home price | $150 + 0.3 to 0.75% of home price |

| Redfin | 0.22% of home price | User-friendly website |

| UpNest | Agents of full service | User-friendly website |

| Prevu | Up to 2% of the home price | Higher rebates than the competition |

| Realty by Design | Up to 50% of the agent’s commission | Best to work with if you have already finalized the home |

| Rebate Agents | Up to 20% of the agent’s commission | Agents off full service |

| Bella Realty | Varies with the deal | Full-service agent |

| Discount-Realtor | Up to ⅓ rd of the agent’s commission | Has a network of agents |

| Affiliated Broker Network | Up to 50% of the agent’s commission | Has a network of agents |

| New Home Rebates | Up to 2% of the home price | Specializes in new homes |

12. Is the buyer rebate taxable? Do you need a 1099?

No, according to IRS, a rebate paid to a property buyer after closing is an adjustment in the home price and, therefore, not a taxable income. A home buyer rebate effectively lowers the home’s cost basis and is treated as a discount. Since buyer rebate is not an income and is not taxable, it need not be reported on Form 1099-MISC, which is used to declare miscellaneous income. If your agent sends you the form, you should ask them to withdraw it.

12.1 How does buyer rebate affect capital gains tax?

Since the rebate affects the cost basis, it has an impact on capital gains tax as well. The cost basis comes down when you take advantage of a refund. So your property may appear to have gained more in value over time than it did if your cost basis is low. You will have to pay capital gains tax on your home’s growth in value when you sell it. So you will pay a more significant tax when you eventually sell the house. However, the increase in tax due to the rebate will be nominal.

13. Do I need to disclose a buyer rebate?

Yes, it is necessary to disclose the buyer’s rebate. All parties involved in the transaction, including your lender, must be informed of the rebate. The refund would impact the cost basis and loan-to-value (LTV) ratio, which the lender uses to determine whether the buyer is eligible for a loan.

If you receive the rebate as a closing credit, you must include a disclosure on your HUD-1 settlement form, which covers all settlement costs. The name of the person granting the rebate, typically your real estate agent, must be included on lines 204–209.

Your loan will be canceled if you don’t tell your lender about the rebate. In the worst instance, you can even be accused of mortgage fraud. Furthermore, not all lenders accept cash rebates. Therefore, even if you receive the refund as cashback, it is still preferable to declare it.

13.1 What is the cost basis?

The cost Basis is the total cost of your house – the price of the home plus other costs like inspection fees, escrow charges, purchasing mortgage points, etc. This sum is reduced by the rebate, a credit given to the buyer. The lender uses the cost basis to determine the LTV ratio.

For instance, if the cost of the property is $350,000, and you spend an additional $10,000 on related costs, and the rebate is $5,000,

Cost Basis = Home Price + Related Expenses – Rebate = $350,000 + $10,000 – $5,000 = $355,000

13.2 What is the LTV ratio, and how is it affected by rebate?

The loan amount divided by the cost basis gives the LTV ratio. It reveals how much of the home price needs to be financed. Usually, your lender will maintain the ratio at 0.80 or less.

Rebate impacts the loan-to-value ratio since it raises the ratio by reducing the cost basis of your home. This is why you need to reveal the rebate to your lender because the lender will change your finances based on it.

For example, if your cost basis is $200,000 and you are seeking a loan of $180,000, your LTV ratio is 0.90. This means the loan covers 90% of the total cost.

LTV ratio = Mortgage ➗ Cost basis = $180,000 ➗ $200,000 = 0.90.

In this case, the lender will try to lower the LTV ratio by reducing the loan amount; otherwise, you will need to purchase mortgage insurance to help offset the financial risk.

LTV can also be viewed in terms of your deposit. A 20% down payment indicates that you borrow 80% of the home’s worth. Your LTV ratio is 0.80 as a result. One of the critical figures a lender considers when determining whether to accept you for a home refinance is LTV.

14. Will availing of a rebate affect the services received from the buyer agent?

Some agents may reduce some of their services without your knowledge to offset the reduced earnings when offering you a rebate.

To ensure this does not happen, read on to find out the services a full-service agent provides.

14.1 What services do traditional full-service buyer agents offer?

Full-service real estate agents offer the following services:

- Reviewing contracts that might include providing advice on home inspections or other contractual terms.

- Suggesting other services professionals such as exterminators and inspectors.

- Negotiate with potential home sellers for the best price.

- Locating and showing potential properties.

- Helping to inspect and evaluate properties.

- Providing relevant information about a community, such as relative property values, most recent selling prices, and property taxes.

- Explaining financing alternatives.

- Creating a buyer-focused competitive market study of the property

- Advising the buyer on the fair price to submit to the seller.

- Disclosing any material facts about the home if the agent has such knowledge

- Putting contract contingencies in place to protect the buyer.

- Informing what prices local purchasers are willing to pay for real estate.

- Keeping information confidential if would weaken your bargaining position.

- Helping draft an offer with the buyer’s best interests in mind.

- Assisting in the negotiation of offers, counteroffers, and acceptance.

- Assisting with closing the real estate transaction and handling paperwork.

15. Conclusion

Rebates are growing in popularity among agents and buyers in states where it is legal and can save you thousands when purchasing a new home. A tax-free rebate as cashback or closing credit can make your home purchase easy and less expensive. Cashback is always preferable over closing credit because of the advantages explained in the article. However, if availing of closing credits, always inform your lender of the same. Although a rebate is not taxable, it does affect the cost basis and LTV ratio, which is crucial for the lender when calculating your eligibility for a loan. Finally, don’t make rebates the sole criteria for selecting an agent – it is more important to ensure you find an agent who best suits your needs.