Buying a dream home can be the most significant investment of your life. It comes with many expenses, not just the price of the house. You’ll also need to pay for things like inspections, closing costs, moving, and new furniture. Add to this the cost of moving and you can definitely feel the financial pinch. Consider this: The median price of a home in West Virginia is $155,773, and a standard 6% agent commission works out to a massive $9,346 (included in the home price).

Though buyers can do almost nothing about the listing price or the other costs involved, they can always negotiate a rebate to save thousands of dollars. Some traditional agents tell you that rebates are illegal, but that’s not the case.

While it is true that agents cannot pay unlicensed persons, this does not apply to the home buyer. The buyer can receive a rebate since they are part of the real estate transaction. The newer lot of agents have made rebates a part of their marketing strategy, so you have to look around and find the best deal for you. Let’s learn more.

1. Are Buyer Rebates legal in West Virginia?

Yes, buyer rebates are legal in West Virginia. The Department of Justice legalized rebates in the state following the antitrust investigation, stating that abolishing the regulation would increase competition among agents. This increased competition has induced agents to offer rebates to buyers, and saved them thousands of dollars.

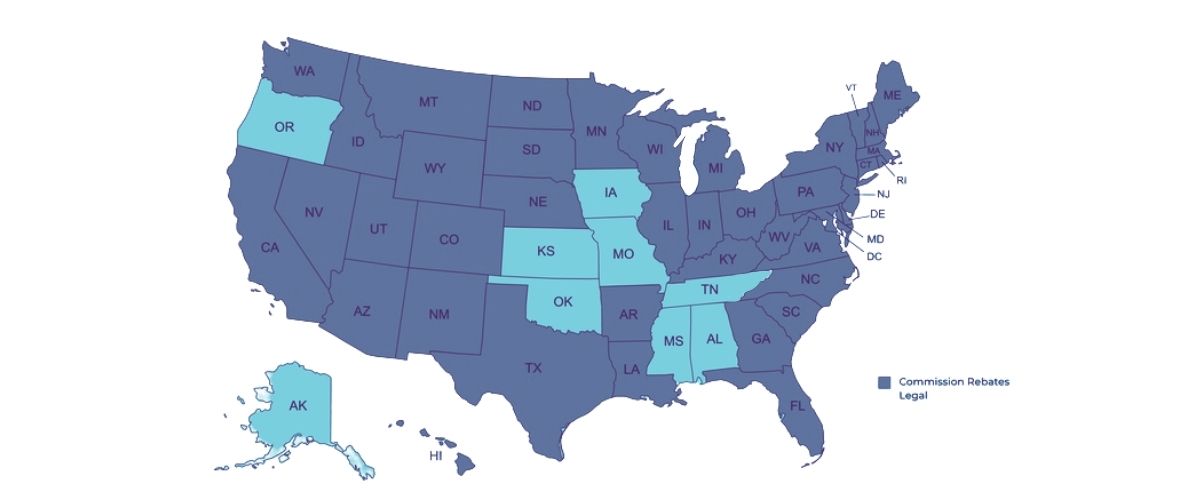

There are eight states where rebates are still illegal, namely Alaska, Kansas, Mississippi, Louisiana, Oklahoma, Oregon, Missouri, and Tennessee. In these states, agents cannot offer buyers a rebate to use their services. One more state, Iowa, only allows buyer rebates in the case of dual agency. When there is only one agent in the transaction, representing both the buyer and the seller, this is called dual agency.

In states that allow buyer rebates, they are highly regulated.

The Department of Justice (DOJ) approves of rebates because rebates can lower the prices for home buyers. The DOJ is trying to get it legalized in all U.S. states to ensure competition among realtors, which will directly benefit home buyers.

2. What is a buyer rebate?

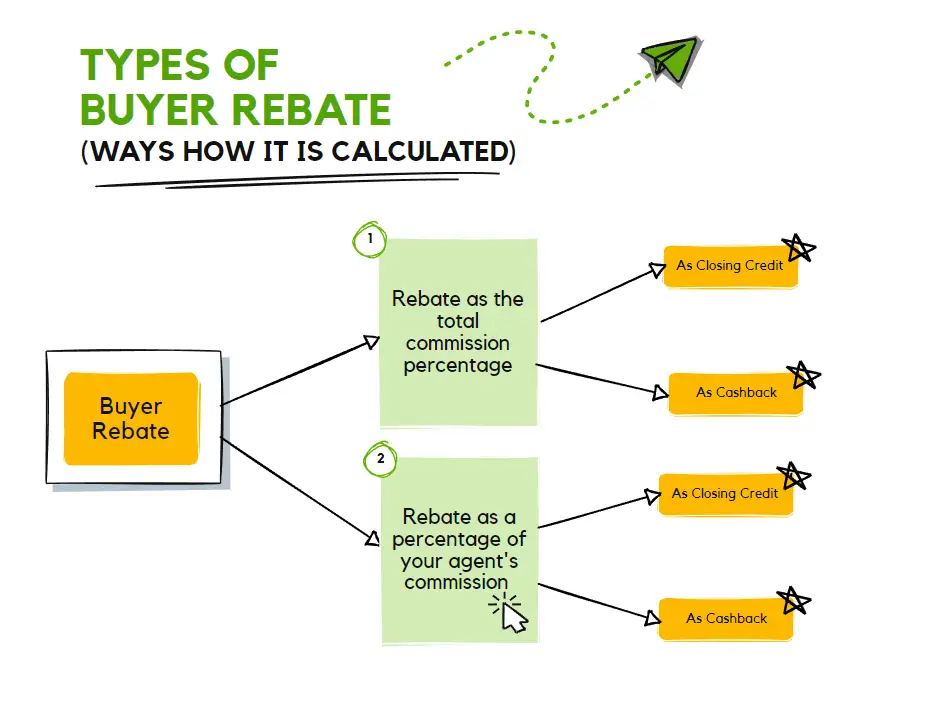

A buyer rebate is a refund given by the buyer’s agent to the buyer from the commission the agent receives at closing. It is a marketing strategy that enables real estate agents to attract buyers and close sales. Some agents offer a set amount regardless of the purchase price, while others provide a varying percentage on the home price. Buyers may receive up to half of their agent’s commission as a rebate, either in the form of closing credit or a cashback at closing.

2.1 From where does a buyer rebate come?

The buyer agent typically offers a portion of their commission as a rebate to the buyer. For example, suppose you buy a home for $300,000, and the seller pays a standard commission of 6% or $18,000, which is split equally between the two agents. Half the commission goes to the listing agent and half to the buyer agent, each getting $9,000. Your rebate comes from this $9000.

If the buyer agent offers a rebate of 1% of the home price to the buyer, it will work out to:

Home price X 1% = $300,000 X 1% = $3,000

2.2 Commission split between agents and brokers

The real estate commission is typically split further among agents and brokers. The real estate agents work for a broker or a brokerage firm, as they are not allowed to work independently. The agent and broker negotiate and fix their commission split. The commission split is usually 50/50, where the brokers and agents receive equal sums of money. However, the split can also be 60/40, 70/30, or 80/20, in which the real estate agent gets the larger share. The more experience an agent has the larger his portion of the commission.

Here’s an image that explains the commission split.

For example, in the above image, a homeowner sells a home for $350,000. The commission of 6% or $21,000 is split among the brokers and agents.

Total commission = Home price X commission percentage = $350,000 X 6% = $21,000

If the two agents and their respective brokers split the commission 60:40 (in favor of agents), the brokers will get

Each broker’s commission = (Total commission X brokers’ share) ➗2 = ($21,000 X 0.4) ➗2

= $4,200

Each agent will receive = Total commission X Agents’ share = ($21,000 X 0.6)➗2 = $6,300

To simplify, here are the brokers’ and agents’ commissions:

| Home Value | Commission Split | Agents’ Commission | Brokers’ Commission |

| $350,000 | 50/50 | $10,500 ($5,250 each) | $10,500 ($5,250 each) |

| $350,000 | 60/40 | $12,600 ($6,300 each) | $8,400 ($4,200 each) |

3. How much is the buyer rebate in West Virginia?

The median home value in West Virginia is $155,773, and the average commission in the state is 5.5%, which works out to $8,568.

Now rebate can be expressed as a percentage of the home price, or as a percentage of the buyer agent’s commission.

Let us see how much the rebate works out to in each case.

Case 1: You get rebate as a percentage of the final purchase price (say 1%)

Total Commission Amount = Commission Percentage X Median Home Price

= 5.5% X $155,773 =$8,568

If the commission is shared equally between the two agents,

Each agent’s commission =$8,568 ➗ 2 = $4,284

Since the buyer rebate is 1% of the home price, this works out to:

Buyer rebate amount = Buyer Rebate Percentage X Median Home Price

= 1% X $155,773 = $1,557

So at the time of closing, the buyer agent will receive $4,284 as his commission out of which he will give $1,557 to the buyer as rebate, and keep the remaining amount/

Case 2: You get rebate as a percentage of your agent’s commission

If the buyer rebate is 40% of the agent’s commission in the above case, this would be calculated as,

Buyer Agent’s commission X 40% = $4,284 x 40% = $1,713

So at the time of closing, the buyer agent will receive $4,284 as his commission out of which he will give $1,713 to the buyer as rebate, and keep the remaining amount.

Here is a helpful buyer rebate calculator provided by the Department of Justice

3.1 How buyer rebate varies depending on home price and rebate percentage

Let’s calculate the amount of buyer rebate when it amounts to 1%, 2%, and 3% of the home price.

| Home Price range | Buyer Rebate as % of home price | ||

| 1% | 2% | 3% | |

| $250,000 – $300,000 | $2,500 – $3,000 | $5,000 – $6,000 | $7,500 – $9,000 |

| $325,000 – $400,000 | $3,250 – $4,000 | $6,500 – $8000 | $9,750 – $12,000 |

| $425,000 – $500,000 | $4,250 – $5,000 | $8,500 – $10,000 | $12,750 – $15,000 |

3.2 Buyer rebate when calculated as a percentage of the agent’s commission in top 20 counties of West Virginia

Here is the list of median home prices in top 20 counties to live in in West Virginia and the amount of buyer rebate when calculated as a percentage of the agent’s commission:

| County | Median Home price* | Commission as 5.5% of home price | Buyer Agent’s 50% share | Buyer rebate as 50% of buyer agent’s commission | Buyer rebate as 2/3rd of buyer agent’s commission |

| Monongalia County | $285,000 | $15,675 | $7,838 | $3,918.75 | $5,225 |

| Ohio County | $130,000 | $7,150 | $3,575 | $1,787.50 | $2,383 |

| Putnam county | $210,000 | $11,550 | $5,775 | $2,887.50 | $3,850 |

| Jefferson County | $398,500 | $21,918 | $10,959 | $5,479.38 | $7,306 |

| Harrison County | $135,000 | $7,425 | $3,713 | $1,856.25 | $2,475 |

| Kanawha County | $143,500 | $7,893 | $3,946 | $1,973.13 | $2,631 |

| Cabell County | $159,000 | $8,745 | $4,373 | $2,186.25 | $2,915 |

| Wood County | $156,000 | $8,580 | $4,290 | $2,145.00 | $2,860 |

| Doddridge County | $117,300 | $6,452 | $3,226 | $1,612.88 | $2,151 |

| Marion County | $164,000 | $9,020 | $4,510 | $2,255.00 | $3,007 |

| Mercer County | $137,000 | $7,535 | $3,768 | $1,883.75 | $2,512 |

| Greenbrier County | $175,750 | $9,666 | $4,833 | $2,416.56 | $3,222 |

| Berkeley County | $294,900 | $16,220 | $8,110 | $4,054.88 | $5,407 |

| Jackson County | $156,500 | $8,608 | $4,304 | $2,151.88 | $2,869 |

| Raleigh County | $141,250 | $7,769 | $3,884 | $1,942.19 | $2,590 |

| Hancock County | $132,400 | $7,282 | $3,641 | $1,820.50 | $2,427 |

| Mineral County | $131,900 | $7,255 | $3,627 | $1,813.63 | $2,418 |

| Marshall County | $129,900 | $7,145 | $3,572 | $1,786.13 | $2,382 |

| Brooke County | $119,900 | $6,595 | $3,297 | $1,648.63 | $2,198 |

| Gilmer County | $170,300 | $9,367 | $4,683 | $2,341.63 | $3,122 |

4. Is the buyer rebate in the form of cashback?

Agents offer buyer rebates to stand out from their competitors and gain more customers. Rebates help buyers save thousands of dollars when they purchase a new home. Buyer rebates can be in the form of cashback or closing credit (non-cash) that agents offer to their buyers at closing. Both rebates will save you thousands, but there are certain limitations on how they can be used. The lender must approve a rebate in the form of closing credit. But it is safer to disclose cashback to the lender to avoid any issues.

Non-cash rebate or closing credit comes with numerous terms and conditions. It can only be used for closing costs such as mortgage points, escrows, and taxes, enabling buyers to bring less money at closing. On the other hand, cashback can be used however you want – you can use it for moving costs, buying new furniture, or just saving it for emergencies.

Often, rebates cannot be used for a down payment, but some lenders allow using rebates for a down payment. You need to check with your lender how to use your rebate and make the best out of it.

5. When will I receive my buyer rebate?

A buyer rebate is typically half of your buyer agent’s commission. When a buyer makes a home purchase, the home seller pays a pre-decided commission to the agents at closing. Once the agents split their commission in the pre-decided ratio, the buyer agent shares a portion of his commission with the buyer at the end of the real estate transaction.

6. Why do realtor agents offer buyer rebates?

Real estate agents give buyers rebates to stand out from competitors and attract more customers. Here are a few reasons agents offer rebates:

6.1 For customer loyalty

Buyers will be more interested in working with an agent who offers rebates. Rebate is a great incentive for buyers to stick around with one agent. A rebate makes them feel that the agent is thinking about the buyer’s benefit, which will increase customer loyalty.

6.2 To remain more competitive

These days, many companies offer rebates to home buyers. Agents have also started offering rebates to compete with such companies to avoid losing their business. Offering rebates gives an edge over the competition.

6.3 To make the transaction more affordable

Closing costs can be expensive, and this cost to the buyer is usually 3-5% of the home’s sale price. These closing costs are some additional expenses while purchasing a home. If the home value is $300,000, the closing cost can go up to $15,000, which is an added burden on the buyer. Rebate can be a great way to save some of these expenses and make the home more affordable. A buyer rebate can be used to pay for closing costs such as escrow fees, inspection costs, or even for buying mortgage points, among other things.

6.4 Marketing strategy to increase overall commission

Buyer rebate is a pure marketing strategy that agents offer to attract more customers. Though rebates reduce the commission earned on a single transaction, they help agents maintain and even increase their profitability by increasing their volume of business.

6.5 Rebates as a trade-off for fewer services

With the increase in internet usage, people can find all the listing information online. Buyers can search for their homes online and take virtual tours. They can shortlist a few properties they are interested in and do their drive-by of the property. Some brokerages offer rebates to these buyers where agents need not show multiple homes. Thus, showing services is compensated with a rebate to the home buyers.

7. Will availing of a rebate affect my mortgage in any way?

Yes, rebates affect your mortgage by reducing the cost basis of your home. The cost basis is used by the lender to calculate the LTV (Loan-to-Value) ratio, which is used to gauge your loan eligibility. Therefore you need to inform your lender before availing of a rebate so the lender can adjust the loan amount accordingly.

7.1 What is cost basis?

The cost basis of your home is the total amount you pay for your home. This would be the actual sales price, plus additional expenses during closing, minus a rebate which is a credit to the buyer.

A buyer rebate brings down the cost basis of your home since it cancels out some of the closing costs.

Here’s the calculation showing how rebate affects the cost basis.

Case 1 : Rebate 0

Cost Basis = Home price – Rebate

= $155,773 – 0 (No affect)

Case 2 : Rebate $6,380

Cost Basis = Home price – Rebate

= $155,773 – $1,713

= $154,060

7.2 What is LTV ratio?

Lenders will use the cost basis of your home to calculate the Loan-to-Value (LTV) ratio. You can calculate the LTV by dividing the loan amount by the cost basis of your home.

If your LTV changes (as in the case of a rebate), your lender will need to adjust your financing to keep the LTV ratio low. Usually, the lender tries to keep the LTV ratio at 0.8 or lower.

For example, the median home value in West Virginia is $155,773; if the buyer rebate is 2%, it means the buyer will receive $6,380 back at closing, and the LTV ratio turns out to be 0.816, which is too high.

The calculation shows the LTV ratio when there is no rebate and when the rebate is $6,380.

Case 1 : When rebate is 0

LTV = Mortgage Amount➗Cost Basis of home

= $124,618 ➗ $155,773

= 0.8 (Just right)

Case 2 : When rebate amount is $1,713

LTV = Mortgage Amount➗Cost Basis of home

= $124,618 ➗ $154,060

= 0.81 (too high)

Here’s the table depicting how rebate affects the cost basis of a home.

| Rebate | Appraised Value | Loan Amount | Cost Basis |

| $0 | $155,773 | $124,618 | $155,773 |

| $1,713 | $155,773 | $124,618 | $154,060 |

If your LTV ratio is high, you may need to purchase mortgage insurance to offset the risk especially when the down payment is less than 20% of the home price.

7.3 Disclosure of rebate is mandatory

If you don’t disclose your rebate amount, it can result in serious issues where your loan may be canceled, and there could be possible mortgage fraud charges.

Additionally, you must disclose the rebate to all parties in the transaction and list your refund on the HUD-1 settlement form, which covers all settlement expenses. Your agent can assist you with this.

8. Is the buyer rebate taxable?

8.1 The buyer rebate is not taxable.

According to IRS, a buyer rebate is an adjustment in the home’s overall purchase price, and hence is not a taxable income. The IRS considers a rebate as a discount on the home purchase price.

8.2 Does the buyer agent need to send a form 1099 to the buyer?

Since rebates are not taxable, they need not be reported on Form 1099-MISC. The broker should not send form 1099s to buyers.

8.3 What to do if I wrongly receive a 1099 form?

If any buyer receives a 1099 form that reports such payment, they should check with their broker and ask them to correct or withdraw it. Though such situations rarely occur, you can double-check with your accountant if you still face any issues.

8.4 How does rebate affect capital gain tax?

Rebates affect the future capital gain taxes through cost basis. When you sell your home, you have to pay a certain amount of tax on the increase in your property’s value since you purchased it. This is called capital gains tax. A lower cost basis can make it seem that your property gained more value than it did, increasing your taxes in the future.

8.5 It is best to consult a professional

In case you still have some queries regarding how rebates affect your capital gains, consult a professional in this regard since situations could defer from the ones stated above.

9. Will availing buyer rebate affect the services I receive from my agent?

Availing a rebate could affect the service quality you receive in some cases. The agent may simply cut down on some of the services offered to offset the lower income. But this need not be the case. Many brokerages are offering full service with rebates. You can find such brokerages and get a buyer rebate without compromising on any services.

10. How to negotiate buyer rebate

Negotiating buyer rebates is the only way a buyer can save money on their home purchase. Ultimately your negotiation skills will decide how much rebate you receive. The best time to negotiate a buyer rebate is before signing the agreement with an agent. Once the deal is signed, the agent will not negotiate further.

There are two ways to negotiate buyer rebates: the first is to negotiate yourself, and the second is to find a free service that already has agents who offer rebates. Let’s look at the negotiation options and how to get you started.

10.1 Negotiate yourself

10.1.1 Be willing to walk away

There is no reason why you should go ahead with a deal if you are not happy with the terms – whether it is the amount of rebate or the kind of services offered by the agent. If you are not convinced with the deal, do not hesitate to walk away.

10.1.2 Talk to multiple agents

There are many agents offering competitive services along with a rebate. You need to look around to find the agents who are willing to offer rebates and negotiate with them for the best deal. The best way is to talk to multiple agents and select the best.

10.1.3 Take friendly advice

Talk to those close to you and ask them if they have ever been in the same situation. Ask them how they found an agent or brokerage that offers a good rebate. They might be able to recommend a good agent.

10.1.4 Do your homework

With the growing usage of the internet, listing information is readily available. Find properties online that match your preference and shortlist the ones you can see yourself by visiting the property. If you reduce the agent’s work, they will be more willing to offer you a rebate.

10.2 Free service where agents compete

Some companies offer free agent-matching services. They have pre-selected local agents with whom they work. They have top agents competing to win your business by offering a rebate. You can easily read the agent’s reviews, talk to them on the phone or meet them. You can negotiate with multiple agents, interview them until you find the best deal, and only sign up with an agent that best suits your needs.

11. Where to find agents offering buyer rebates

Some agents advertise rebates for home buyers. You will need to research to find such agents who offer rebates. We have listed some of the services which help you find such agents, along with a few agents.

11.1 Clever Real Estate

Clever claims to offer the lowest commission rates and biggest average savings compared to any full-service real estate company in the US. Homebuyers who buy through them earn a cashback of up to 0.5% of the purchase price. If you buy a home worth $500,000, you will get $2,500 as a cash back rebate at closing.

Its agent-matching service is free for buyers with no obligation, so there’s no risk in signing up and exploring how it works. Their agent-matching process is fast and easy to use. Clever buyers qualify for cashback rewards which are more advantageous than closing credits. Clever Real Estate has a 4.9 average customer rating (out of 5) based on 1,630 reviews on Trustpilot.

11.2 Redfin

Redfin is a well-known real estate brokerage firm available in 80 U.S. markets. If you are an experienced buyer, Redfin is for you as it offers the largest rebates. However, if you are buying a home for the first time, you might feel more comfortable working with other brokerages like Clever or UpNest.

Redfin doesn’t have traditional agents but has in-house, salaried agents who handle 3x more customers than a traditional agent. Due to this, an agent might not be able to provide quality service as they provide less hands-on support.

Redfin’s average customer rating is 3.9 out of 5 on sites like Google, Yelp, and Zillow.

Redfin doesn’t advertise how much buyer rebate it offers; you need to check its website Redfin.com and see your area’s listings and price range.

11.3 UpNest

With UpNest, agents offer rebates of 0.5% of the home purchase price, and you get larger rebates if you buy a high-priced home. The rebate received at closing through UpNest is in the form of cashback refunds which has more advantages than closing credits. In addition to the rebate, they also offer a $150 Amazon gift card as a reward for using their services.

UpNest is also a free agent-matching service, but it has a different approach than other competitors like Clever. Instead of pre-negotiating low rates, agents use UpNest to compete for your business. This competition helps buyers to get the best savings.

UpNest is fast and easy to use and can match you with the top agents. Its user-friendly customer dashboard helps buyers research and compare agents easily. UpNest is suitable for buyers of all experience levels because they provide rebates without compromising on the full service of a traditional real estate agent.

Reviews of UpNest are generally positive, with a weighted average rating of 4.6 out of 5, based on 3,794 reviews on Google, Better Business Bureau, Facebook, and Shop. In addition, UpNest is accredited by the Better Business Bureau, where it has an A+ rating.

11.4 Realtor.com

Realtor.com is the National Association of Realtors’ official home search platform where buyers can get an idea about the real estate market. You can finetune your search by adding some filters for your city and other details to find a suitable home. The platform offers you an idea regarding the general asking price, what you can find within your budget, and neighborhood information.

Reviews suggest that you might face some challenges while getting in touch with an agent, as you must fill out many forms before connecting with anyone. You can negotiate a rebate when you get in touch with an agent.

Realtor also has a free app available on android with a 4.5 rating out of 5. It’s iOS app has a 4.7 rating out of 5. The apps come with many filters for your home search.

11.5 Homelight

HomeLight provides an agent-matching service to buyers by pairing you with a local agent in your area. Once you’ve signed up with HomeLight, you can explore their platform for free, and you’re not obligated to buy a home through them.

HomeLight has a fully automated agent-matching service that allows you to use their services at your convenience and not just during business hours. You need to fill out a form on their website about your agent requirement. HomeLight will direct you to their dashboard, where you can view all the agent matches. It automatically populates the agent matches based on the company’s algorithm. After a few minutes, HomeLight’s concierge reaches out to you via phone, email, and messaging in your HomeLight dashboard. Your agent matches also begin to call you after some time. You can negotiate a rebate when you get in touch with an agent.

Customers generally like HomeLight’s service, which has a rating of 4.7 out of 5 based on 1,012 reviews on Site Jabber.

11.6 Movoto

Movoto is an online real estate company that makes your home search easier. They have the top 5% agents with over three years of experience to serve you with your home buying process. Movoto has an extensive knowledge base to help you with all the information you require while buying a home. They also have a toll-free number to connect prospective buyers to real estate agents. According to reviews, customers feel Movoto has a user-friendly website with detailed information on different homes. You can negotiate a rebate when you get in touch with an agent.

Movoto has a 4 out of 5 rating on Yelp, based on seven customer reviews.

11.7 New Home Rebates

New Home Rebates offers 2% of the home purchase price as a rebate if you buy a new home through them. You get less rebate if you are looking to buy an existing home. New Home Rebates supports the do-it-yourself concept where buyers do the initial research to select a home. In exchange, New Home Rebates offers a rebate to buyers for their efforts in finding a home. It offers free service to buyers to find an agent they want to hire.

There is no obligation to register or use their team of agents. New Home Rebates also offers free home-finding tools to compare all homes that match your requirement. You can visit each home in person and, once decided, reach out to New Home Rebates. They will negotiate the best rates and provide you with all the possible discounts.

11.8 Discount Realtor

Discount Realtor offers 1/3rd of their commission as a rebate. However, this rebate is dependent upon different parameters such as the property’s purchase price, the seller’s commission, the total time an agent spent with the buyer, and local market conditions, to name a few. Discount Realtor has local, experienced, full-service agents from well-known brokerages such as RE/MAX, Keller Williams, Coldwell Banker, Century 21, HomeSmart, etc., who work with you and offer rebates. Customer reviews on their website say that Discount Realtor has excellent service and has helped them save a lot of money.

11.9 Estate Rebate

Estate Rebate offers up to 40% of the agent’s commission to buyers as a rebate at closing. Initially, they ask you to fill out a form to help them find the right agent for your needs. Based on your submission, they will share three rebate offer suggestions with you. You can compare these rebates and choose the one that best suits your requirements. Once you have selected an agent, you can contact Estate Rebate to connect you with the agent. Estate Rebate also has an agent monitoring process to ensure that you get top-notch service from your agent.

11.10 Rebate for Homebuyer

Rebate for Home Buyer offers up to 2% of the home price as buyer rebate at closing. However, the rebate can only cover certain closing costs such as escrow fees, inspection costs, transfer fees, etc. They are a group of people who have decades of experience in the real estate industry, helping buyers find their dream homes. Their website also offers local information such as schools, hospitals, etc., relevant links, and other local resources for the Charlotte area and surrounding communities.

Here’s a summary of the list of websites/agents mentioned above:

| Website/Firm name | Rebate offered | USP |

| Clever Real Estate | 0.5% of home price | Big savings at most price points. Top brand agents to choose from. |

| Redfin | 0.22% of home price | User-friendly website |

| UpNest | $150 + 0.3 to 0.75% of home price | User-friendly website |

| Discount Realtor | 1/3rd of agent’s commission | Local agents familiar with the market |

| Movoto | You can negotiate a rebate when you get in touch with an agent | User-friendly website |

| Realtor.com | You can negotiate a rebate when you connect with their agents. | Fast online service. Good for getting an idea of the market situation |

| HomeLight | You can negotiate a rebate when you get in touch with an agent | User-friendly website |

| Estate Rebate | Up to 40% of the agent’s commission | Local agents familiar with the market |

| Rebate for Home Buyer | Up to % of the home price | Local agents familiar with the market |

| New Homes Rebates | 1%-2% of home price | Specializes in new homes |

12. FAQs

12.1 Is buyer rebate really free? What’s the catch?

There is no catch if your agent offers you a buyer rebate for free. It’s the same as getting some loyalty points or cashback when you make a regular purchase at a shop. You can enjoy some savings in your pocket while investing huge money in your dream home.

12.2 Is there a limit on how much rebate you can avail of?

Rebate depends from agent to agent as some offer it as a percentage of the home purchase price while others offer a portion of their commission. It will also depend on the brokerage the agent works for. Irrespective of the rebate you receive, your lender dictates your final rebate amount and how you can use it. Therefore, it is vital to disclose the rebate to the lender.

12.3 Why don’t most companies offer buyer rebates?

Most real estate companies do few transactions in a year; hence it is not possible to offer a rebate as it would eat into their meager profits.

Buyer rebate is legal in West Virginia. Availing of a rebate is a great way to save thousands of dollars when purchasing a home here. Though many real estate agents offer rebates, it should not be the only criteria for hiring an agent.

Some agents don’t have a positive reputation in the market, and to overcome this situation, they will provide you with a rebate. Also, some agents give rebates to compensate for fewer services. So you must check beforehand what services they don’t offer in exchange for a rebate.

You need to analyze if you need partial or full-service assistance and find the rebate deal that suits your requirements. As a new home buyer, you should focus on getting complete services to close the deal smoothly rather than availing of fewer services for a rebate. However, if you are a seasoned buyer, you can handle some of the processes yourself. In that case, your chances of successfully negotiating a higher rebate are pretty bright.